In the current global market landscape, cooling inflation and robust bank earnings have propelled U.S. stocks higher, with value stocks outperforming growth shares significantly. As central banks around the world cautiously navigate interest rate adjustments, investors are increasingly drawn to dividend stocks for their potential to provide steady income amidst economic uncertainties. A good dividend stock typically offers a reliable yield and demonstrates financial stability, making it an attractive option in today's fluctuating markets.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.11% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.32% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.38% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.47% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

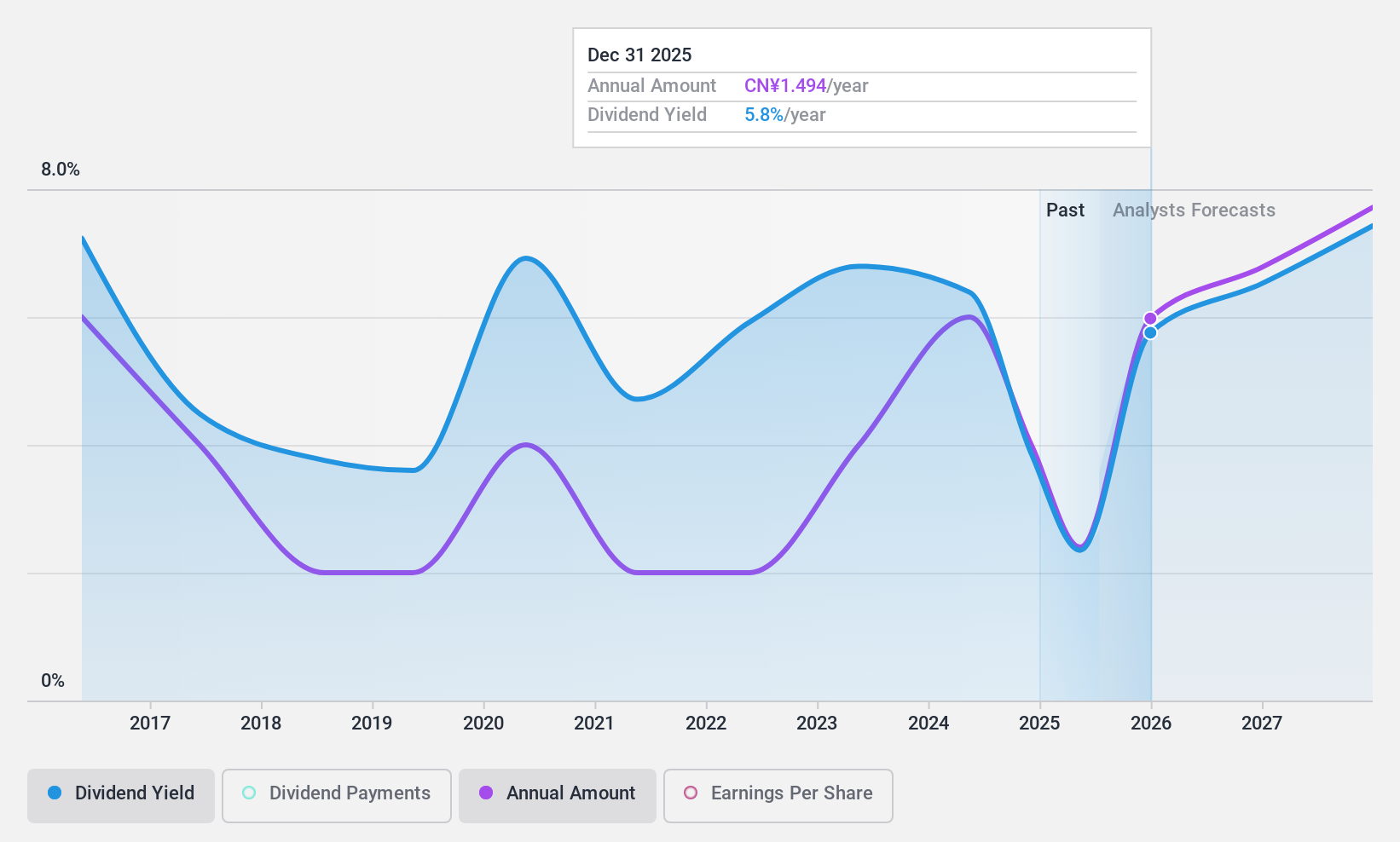

Yutong BusLtd (SHSE:600066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Yutong Bus Co., Ltd. manufactures and sells buses and related products both in China and internationally, with a market cap of CN¥61.41 billion.

Operations: Yutong Bus Co., Ltd. generates revenue through the manufacture and sale of buses and related products both domestically in China and on an international scale.

Dividend Yield: 3.6%

Yutong Bus Ltd. offers a dividend yield of 3.6%, placing it among the top 25% of dividend payers in China, but its dividends are not well covered by earnings, with a high payout ratio of 137.4%. Despite this, the dividends are supported by cash flows with a cash payout ratio of 61.8%. Historically volatile, Yutong's dividends have grown over the past decade amidst substantial earnings growth and recent revenue increases to ¥24.07 billion for nine months ending September 2024.

- Delve into the full analysis dividend report here for a deeper understanding of Yutong BusLtd.

- Upon reviewing our latest valuation report, Yutong BusLtd's share price might be too pessimistic.

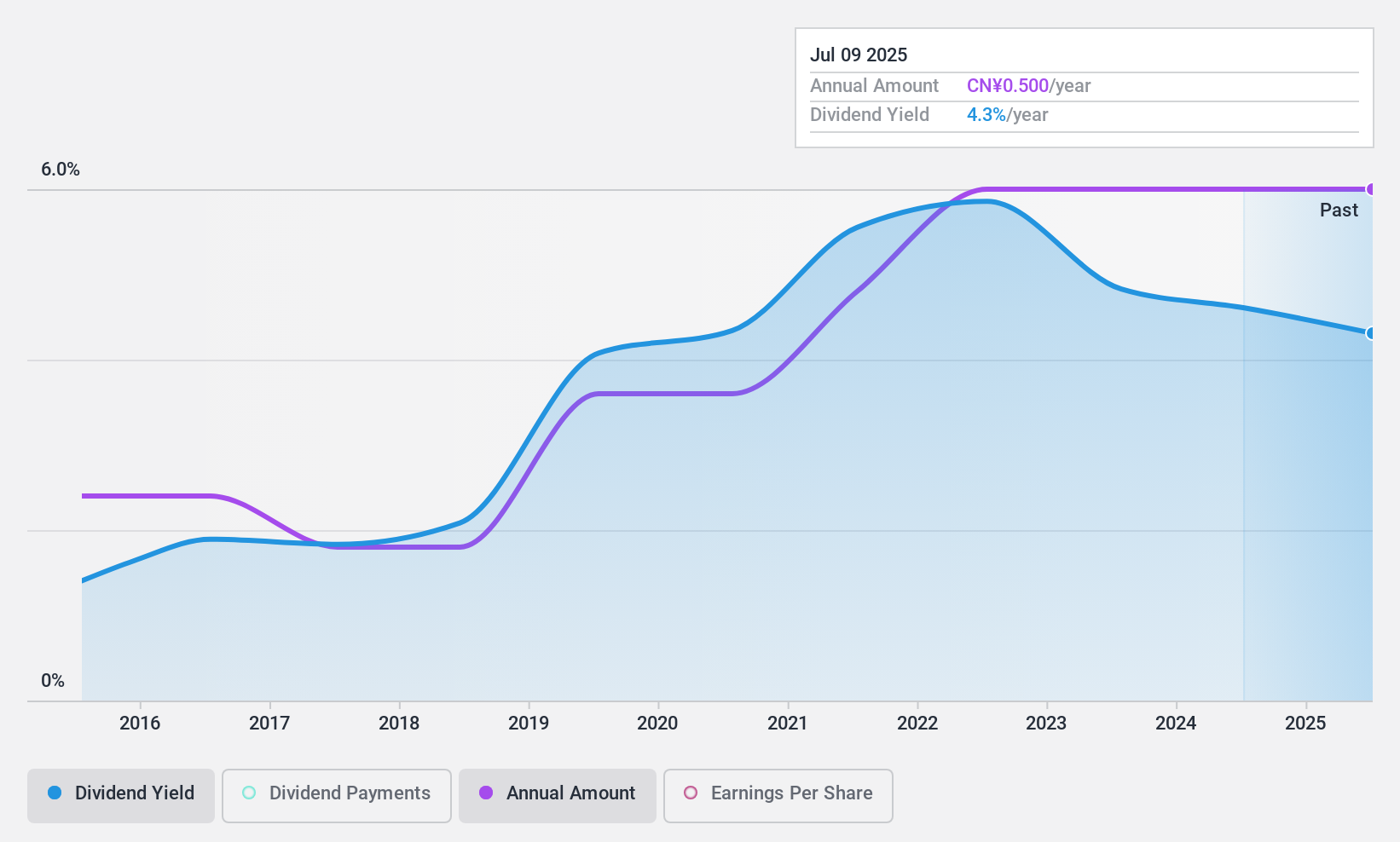

Jiangsu Phoenix Publishing & Media (SHSE:601928)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jiangsu Phoenix Publishing & Media Corporation Limited is involved in the editing, publishing, and distribution of books, newspapers, electronic publications, and audio-visual products in China with a market cap of CN¥27.03 billion.

Operations: Jiangsu Phoenix Publishing & Media Corporation Limited generates revenue through its core activities of editing, publishing, and distributing a variety of media products including books, newspapers, electronic publications, and audio-visual items within China.

Dividend Yield: 4.7%

Jiangsu Phoenix Publishing & Media offers a dividend yield of 4.71%, ranking in the top 25% of Chinese dividend payers, yet its dividends are not well covered by free cash flows, with a high cash payout ratio of 153.1%. Despite a reasonable earnings payout ratio of 50.5%, dividends have been historically volatile and unreliable over the past decade. The company reported CNY 9.56 billion in revenue for the first nine months of 2024, with declining net income year-on-year to CNY 1.34 billion.

- Navigate through the intricacies of Jiangsu Phoenix Publishing & Media with our comprehensive dividend report here.

- Our comprehensive valuation report raises the possibility that Jiangsu Phoenix Publishing & Media is priced lower than what may be justified by its financials.

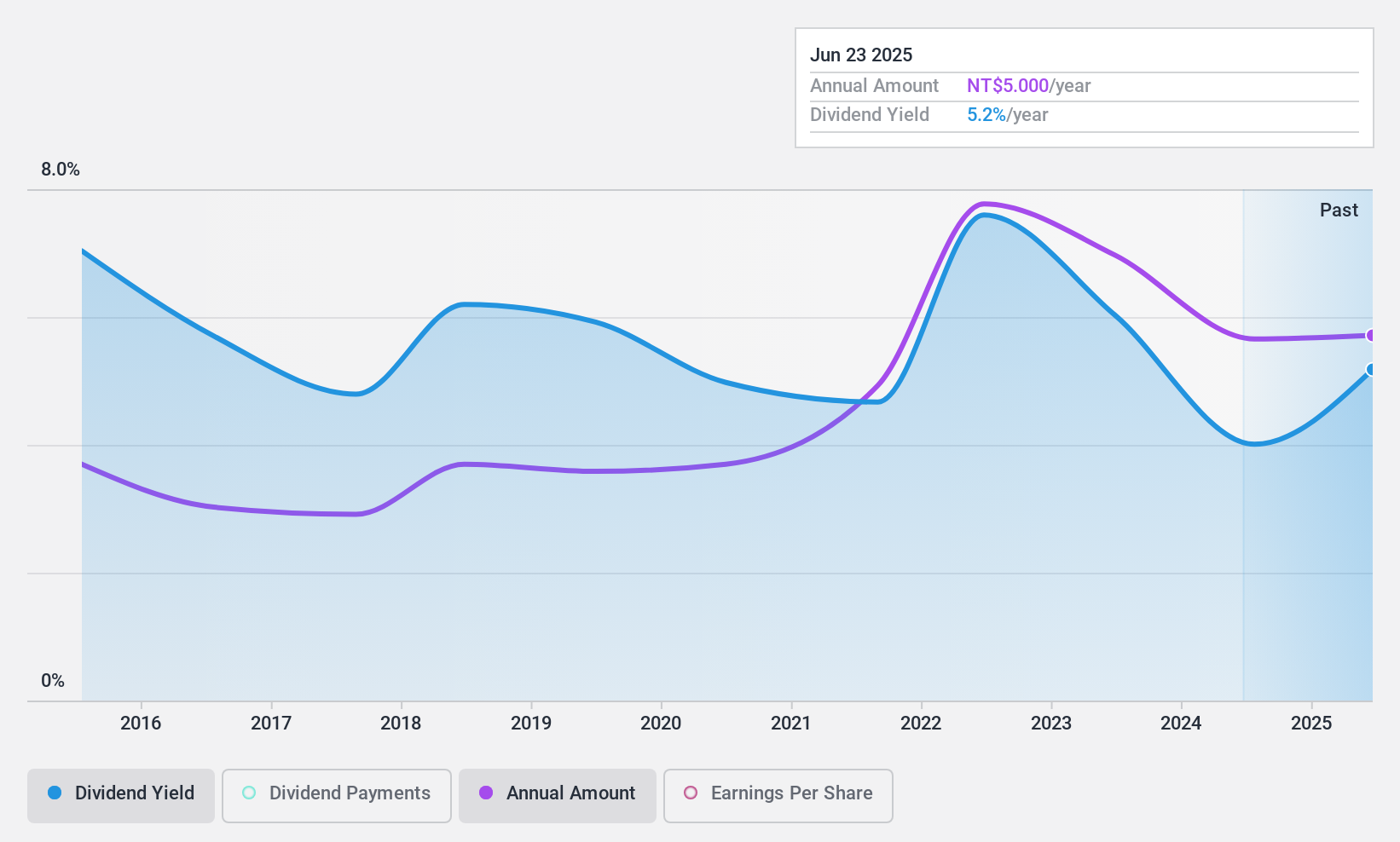

Wah Lee Industrial (TWSE:3010)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Wah Lee Industrial Corporation operates in Taiwan, focusing on manufacturing materials, engineering and functional plastics, semiconductor process materials, and printed circuit boards with a market cap of NT$29.84 billion.

Operations: Wah Lee Industrial Corporation's revenue segments include NT$45.19 billion from the company, NT$13.60 billion from China Hong Kong, and NT$15.02 billion from Shanghai Yikang.

Dividend Yield: 4.3%

Wah Lee Industrial's dividend yield of 4.3% is stable and has grown over the past decade, supported by a reasonable payout ratio of 57%. However, the high cash payout ratio of 453.9% indicates dividends are not well covered by free cash flows. Despite this, earnings have consistently increased at 6.7% annually over five years. The company's price-to-earnings ratio of 13.9x suggests it may be undervalued compared to the broader Taiwanese market average of 20.3x.

- Unlock comprehensive insights into our analysis of Wah Lee Industrial stock in this dividend report.

- Our valuation report here indicates Wah Lee Industrial may be overvalued.

Key Takeaways

- Get an in-depth perspective on all 1981 Top Dividend Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600066

Yutong BusLtd

Engages in the manufacture and sale of bus and related products in China and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives