As global markets experience a resurgence, driven by easing core U.S. inflation and robust bank earnings, investors are increasingly looking towards small-cap stocks for opportunities amidst the broader market's upward momentum. In this climate of cautious optimism, identifying promising stocks often involves seeking companies with strong fundamentals and growth potential that may not yet be fully recognized by the market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Jinzi HamLtd (SZSE:002515)

Simply Wall St Value Rating: ★★★★★★

Overview: Jinzi Ham Co., Ltd. focuses on the research, development, production, and sale of fermented meat products both in China and internationally, with a market capitalization of CN¥5.44 billion.

Operations: Jinzi Ham generates revenue primarily from the sale of fermented meat products. The company's financial performance can be analyzed through its net profit margin, which reflects its ability to convert sales into actual profit after all expenses.

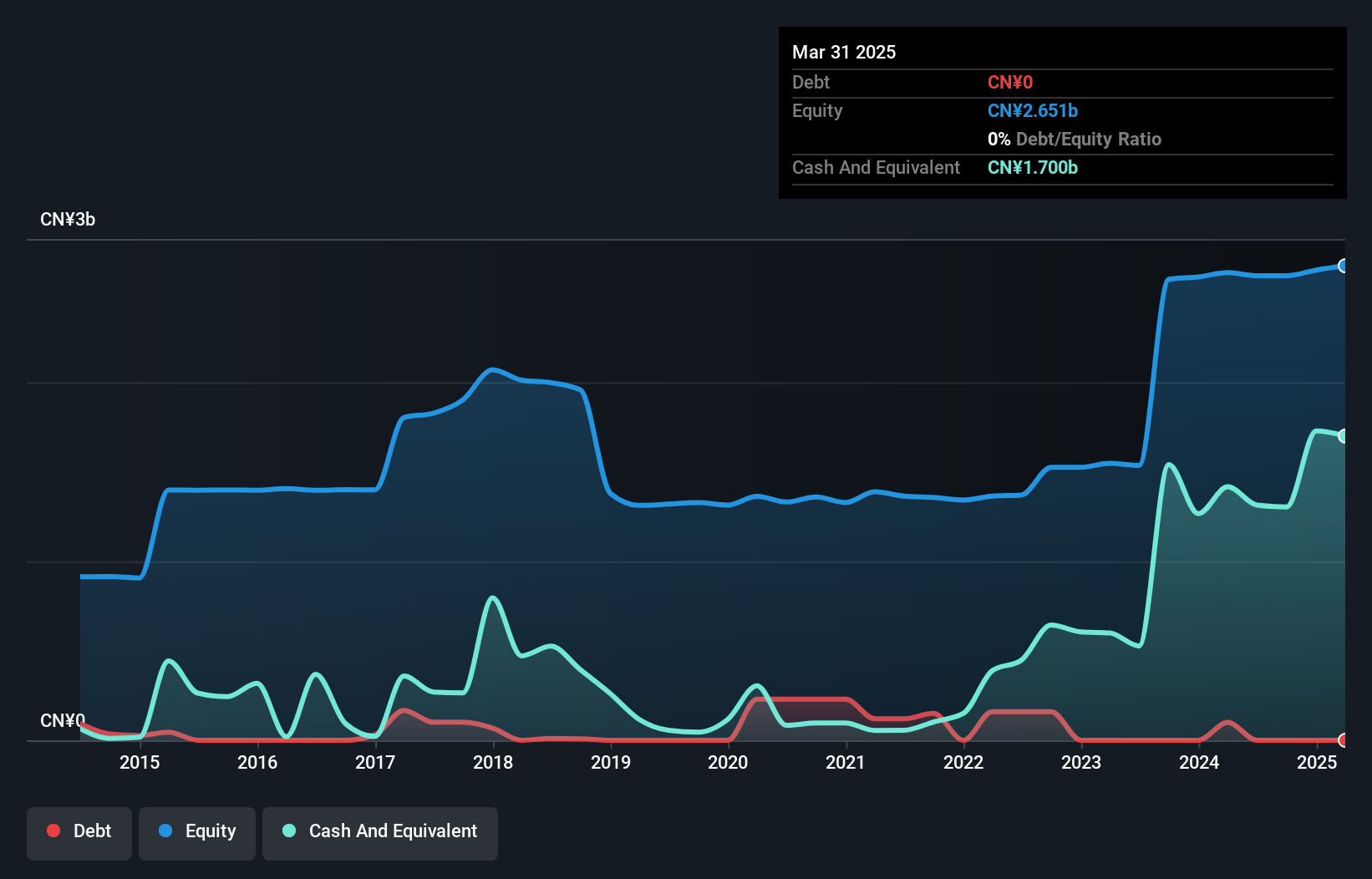

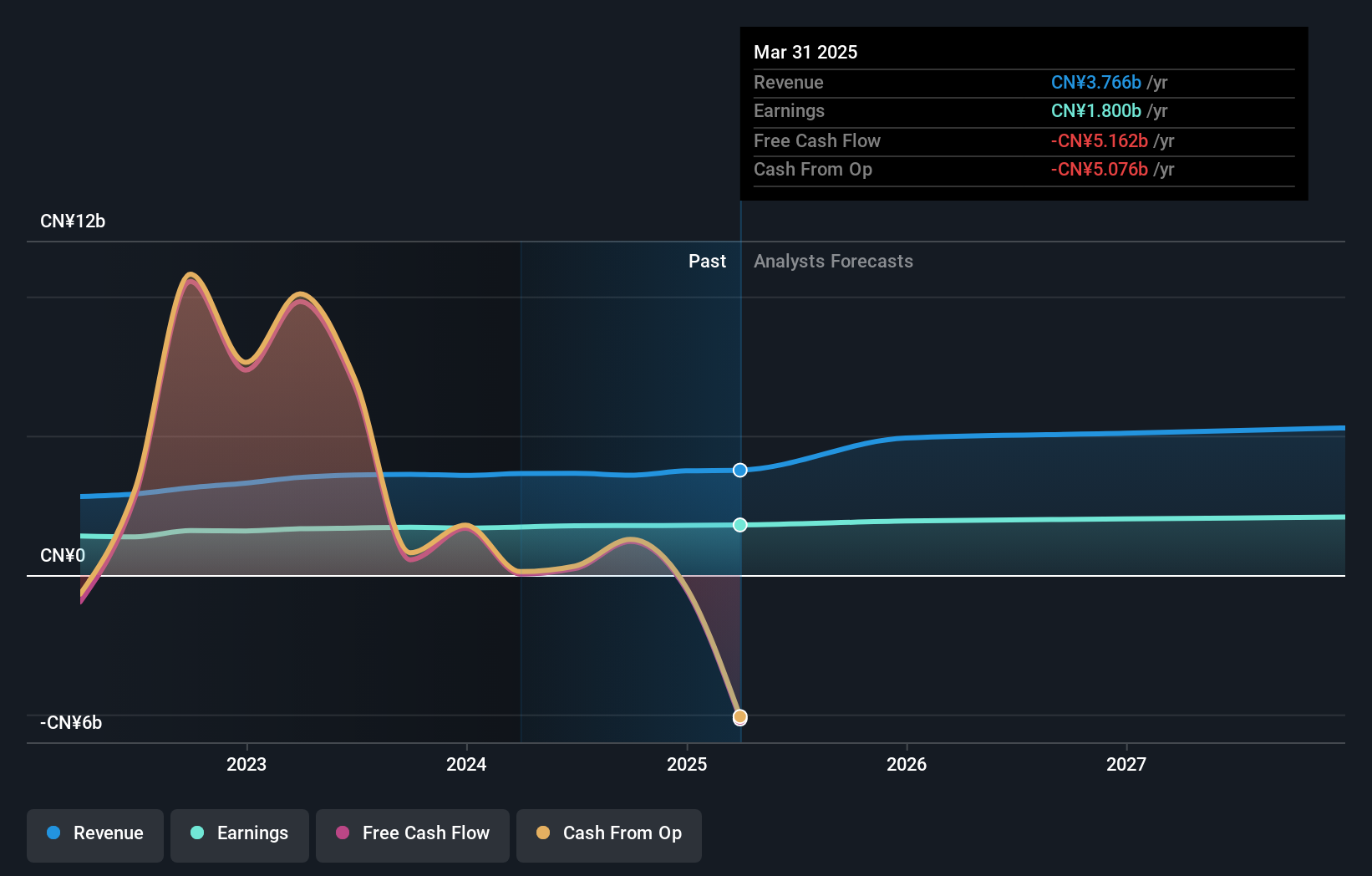

Jinzi Ham Ltd. showcases a compelling profile with earnings growth of 79.8% over the past year, outpacing the food industry which saw a -5.8% change. The company is debt-free, eliminating concerns about interest coverage and showcasing prudent financial management over five years without any debt burden. Despite a decline in earnings by 6.6% annually over five years, recent results show sales at CNY 258 million and net income of CNY 29 million for the nine months ending September 2024, reflecting resilience in challenging times. With high-quality past earnings and positive free cash flow, Jinzi Ham seems poised for stability amidst market fluctuations.

- Dive into the specifics of Jinzi HamLtd here with our thorough health report.

Review our historical performance report to gain insights into Jinzi HamLtd's's past performance.

Jiangsu Zhangjiagang Rural Commercial Bank (SZSE:002839)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhangjiagang Rural Commercial Bank Co., Ltd offers a range of banking products and services in China, with a market capitalization of CN¥10.32 billion.

Operations: The bank generates revenue primarily from interest income and fee-based services. Its cost structure includes interest expenses and operational costs, impacting its profitability metrics. The net profit margin has shown variability, reflecting changes in operational efficiency and market conditions.

Zhangjiagang Bank, with assets totaling CN¥215.9 billion and equity of CN¥18.3 billion, stands out for its robust financial health. The bank's total deposits are CN¥170.2 billion against loans of CN¥131.6 billion, indicating a solid funding base primarily from customer deposits, which account for 86% of liabilities—considered low-risk funding sources. It has an impressive bad loan allowance at 424% of non-performing loans, which are just 1% of total loans, suggesting prudent risk management practices. Despite a modest net interest margin of 2%, earnings grew by 3.7%, slightly outpacing the industry average growth rate last year.

Treasure FactoryLTD (TSE:3093)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Treasure Factory Co., LTD., along with its subsidiaries, operates reuse stores in Japan and has a market cap of ¥39.58 billion.

Operations: Treasure Factory generates revenue primarily through its network of reuse stores in Japan. The company's gross profit margin was 58% last year, reflecting its ability to manage costs effectively relative to sales.

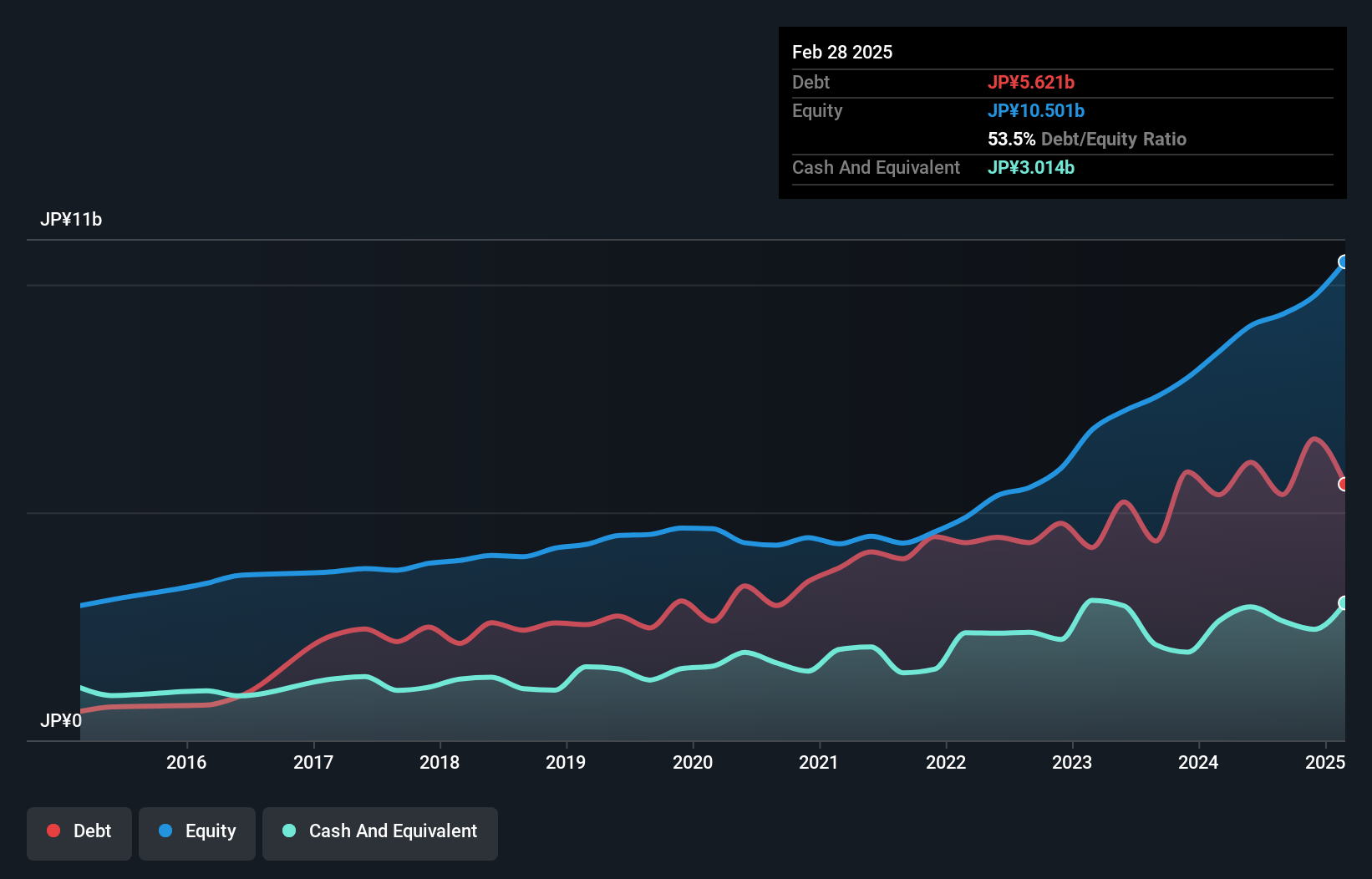

Treasure Factory showcases a mix of strengths and challenges, reflecting its character as a promising player in the industry. The company reported impressive sales growth for November 2024, with existing stores achieving 109.9% compared to last year and all stores at 121.6%. Despite this success, it carries a high net debt to equity ratio of 42.9%, indicating financial leverage concerns. However, its interest payments are comfortably covered by EBIT at an impressive 167 times coverage, suggesting robust operational efficiency. With earnings growing by 27% over the past year and forecasts suggesting nearly 10% annual growth, Treasure Factory seems poised for continued expansion in the retail sector.

Next Steps

- Get an in-depth perspective on all 4640 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002515

Jinzi HamLtd

Engages in the research and development, production, and sale of fermented meat products in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives