- China

- /

- Auto Components

- /

- SZSE:300893

Market Participants Recognise Zhejiang Songyuan Automotive Safety Systems Co.,Ltd.'s (SZSE:300893) Earnings Pushing Shares 32% Higher

Zhejiang Songyuan Automotive Safety Systems Co.,Ltd. (SZSE:300893) shareholders would be excited to see that the share price has had a great month, posting a 32% gain and recovering from prior weakness. Taking a wider view, although not as strong as the last month, the full year gain of 18% is also fairly reasonable.

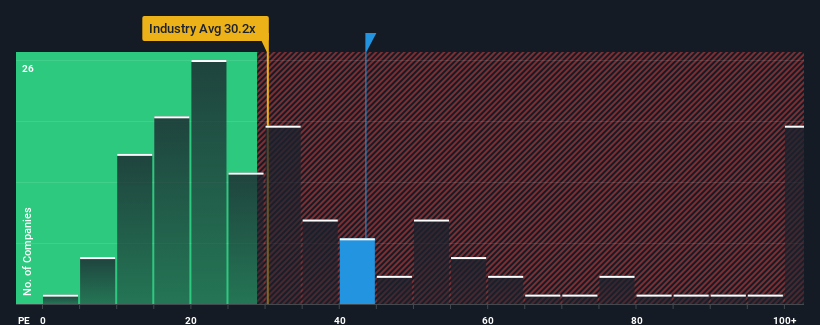

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 29x, you may consider Zhejiang Songyuan Automotive Safety SystemsLtd as a stock to potentially avoid with its 43.5x P/E ratio. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

Zhejiang Songyuan Automotive Safety SystemsLtd certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for Zhejiang Songyuan Automotive Safety SystemsLtd

Is There Enough Growth For Zhejiang Songyuan Automotive Safety SystemsLtd?

Zhejiang Songyuan Automotive Safety SystemsLtd's P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 35% last year. The strong recent performance means it was also able to grow EPS by 34% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Shifting to the future, estimates from the three analysts covering the company suggest earnings should grow by 58% over the next year. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we can see why Zhejiang Songyuan Automotive Safety SystemsLtd is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Zhejiang Songyuan Automotive Safety SystemsLtd's P/E

The large bounce in Zhejiang Songyuan Automotive Safety SystemsLtd's shares has lifted the company's P/E to a fairly high level. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhejiang Songyuan Automotive Safety SystemsLtd maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Zhejiang Songyuan Automotive Safety SystemsLtd that you need to be mindful of.

If these risks are making you reconsider your opinion on Zhejiang Songyuan Automotive Safety SystemsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Songyuan Automotive Safety SystemsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300893

Zhejiang Songyuan Automotive Safety SystemsLtd

Engages in the design, research, development, production, sale, and service of automotive passive safety system products in China and internationally.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives