- China

- /

- Auto Components

- /

- SZSE:300863

Ningbo KBE Electrical Technology Co.,Ltd.'s (SZSE:300863) Shareholders Might Be Looking For Exit

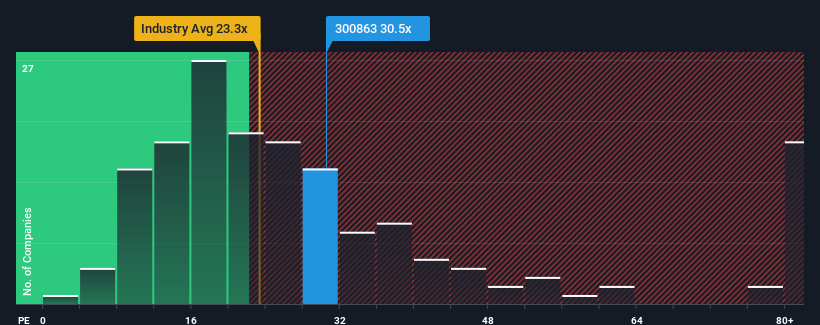

Ningbo KBE Electrical Technology Co.,Ltd.'s (SZSE:300863) price-to-earnings (or "P/E") ratio of 30.5x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 26x and even P/E's below 16x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

The recently shrinking earnings for Ningbo KBE Electrical TechnologyLtd have been in line with the market. One possibility is that the P/E is high because investors think the company can turn things around and break free from the broader downward trend in earnings. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Ningbo KBE Electrical TechnologyLtd

What Are Growth Metrics Telling Us About The High P/E?

There's an inherent assumption that a company should outperform the market for P/E ratios like Ningbo KBE Electrical TechnologyLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.7%. Even so, admirably EPS has lifted 151% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 36% as estimated by the only analyst watching the company. That's shaping up to be similar to the 36% growth forecast for the broader market.

In light of this, it's curious that Ningbo KBE Electrical TechnologyLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

The Bottom Line On Ningbo KBE Electrical TechnologyLtd's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Ningbo KBE Electrical TechnologyLtd currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You need to take note of risks, for example - Ningbo KBE Electrical TechnologyLtd has 2 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of Ningbo KBE Electrical TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo KBE Electrical TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300863

Ningbo KBE Electrical TechnologyLtd

Ningbo KBE Electrical Technology Co.,Ltd.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026