- China

- /

- Electronic Equipment and Components

- /

- SHSE:688205

Undiscovered Gems These 3 Small Caps with Promising Fundamentals

Reviewed by Simply Wall St

As global markets navigate a mixed economic landscape, with U.S. consumer confidence declining and major stock indexes experiencing moderate gains, small-cap stocks continue to present unique opportunities for investors looking for growth potential amid broader market fluctuations. In this context, identifying small-cap companies with strong fundamentals becomes crucial as they can offer resilience and potential upside in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dr. Miele Cosmed Group | 21.75% | 8.35% | 15.31% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Intellego Technologies | 12.32% | 73.44% | 78.22% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Onde | 21.84% | 8.04% | 2.79% | ★★★★★☆ |

| Infinity Capital Investments | NA | 9.92% | 22.16% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Wuxi Taclink Optoelectronics Technology (SHSE:688205)

Simply Wall St Value Rating: ★★★★★★

Overview: Wuxi Taclink Optoelectronics Technology Co., Ltd. specializes in the development and manufacturing of optoelectronic devices, with a market capitalization of CN¥11 billion.

Operations: The company generates revenue primarily from the sale of optoelectronic devices. It has a market capitalization of approximately CN¥11 billion.

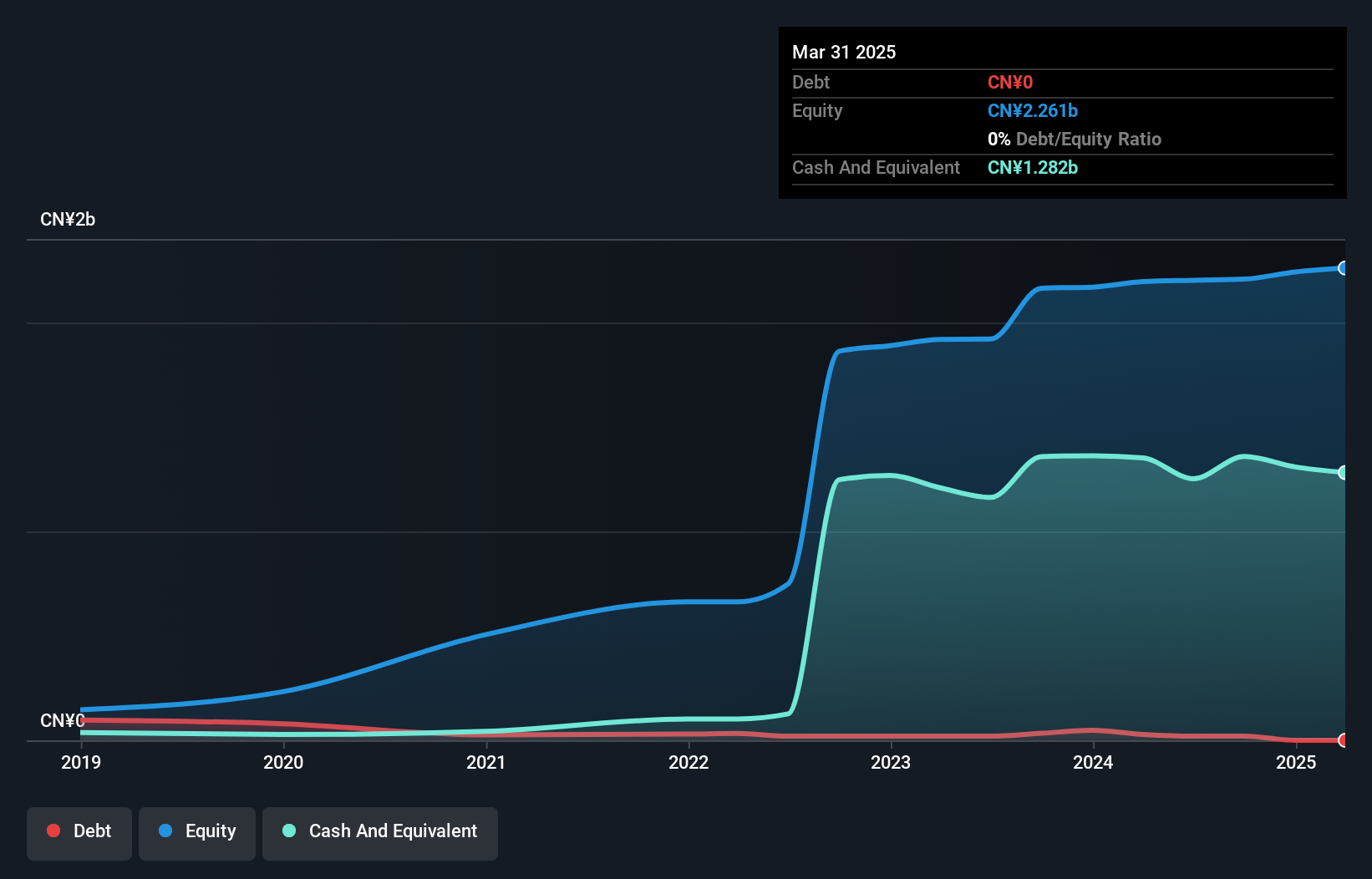

Wuxi Taclink Optoelectronics Technology, a promising player in the electronics sector, has shown robust financial health. The company reported sales of CNY 600.68 million for the first nine months of 2024, up from CNY 548.8 million last year, with net income rising to CNY 76.29 million from CNY 66.32 million. Basic earnings per share increased to CNY 0.63 from CNY 0.57 year-over-year, indicating solid profitability despite a highly volatile share price recently observed over three months. Impressively, its debt-to-equity ratio dropped significantly from 39% to just under 1% over five years, highlighting effective debt management and positioning it well against industry peers with its earnings growth outpacing the sector average by a notable margin.

Sichuan Chuanhuan TechnologyLtd (SZSE:300547)

Simply Wall St Value Rating: ★★★★★★

Overview: Sichuan Chuanhuan Technology Co., Ltd. focuses on the research, development, production, and sale of automotive rubber hose series products in China, with a market cap of CN¥5.95 billion.

Operations: The company generates revenue primarily from non-tire rubber products, amounting to CN¥1.30 billion.

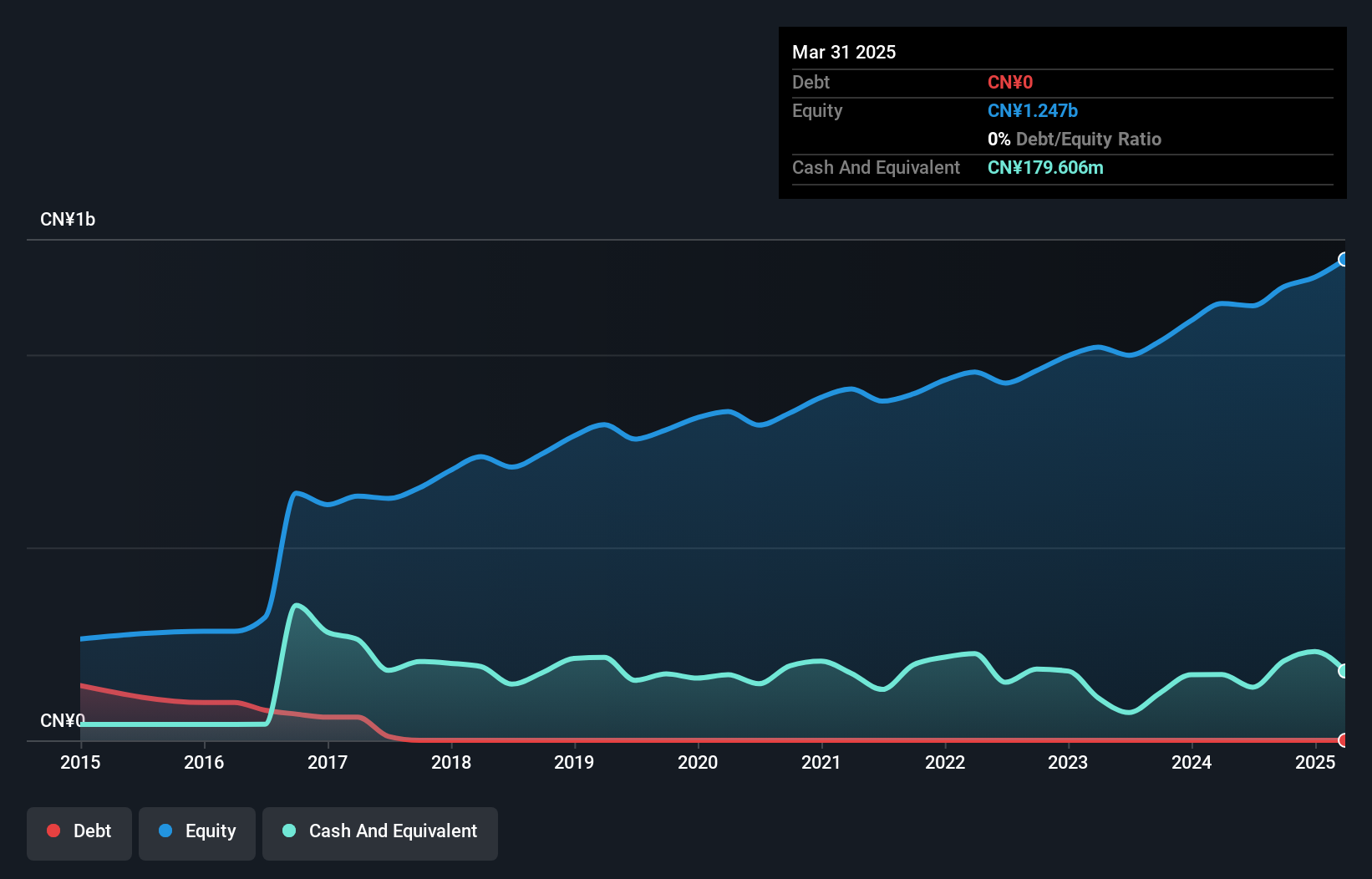

Sichuan Chuanhuan Technology, a dynamic player in the auto components sector, has demonstrated robust earnings growth of 37% over the past year, outpacing its industry peers. This growth is reflected in their net income for the first nine months of 2024, which rose to CNY 147.52 million from CNY 108.72 million a year prior. The company remains debt-free and boasts high-quality earnings, while its price-to-earnings ratio stands at an attractive 29.7x compared to the CN market's average of 35.9x. Despite recent share price volatility, these factors suggest strong underlying performance and potential value for investors.

Shanghai Wisdom Information Technology (SZSE:301315)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Wisdom Information Technology Co., Ltd., with a market cap of CN¥6.01 billion, is engaged in providing information technology services and solutions.

Operations: The company generates revenue primarily from its information technology services and solutions. It has a market capitalization of CN¥6.01 billion.

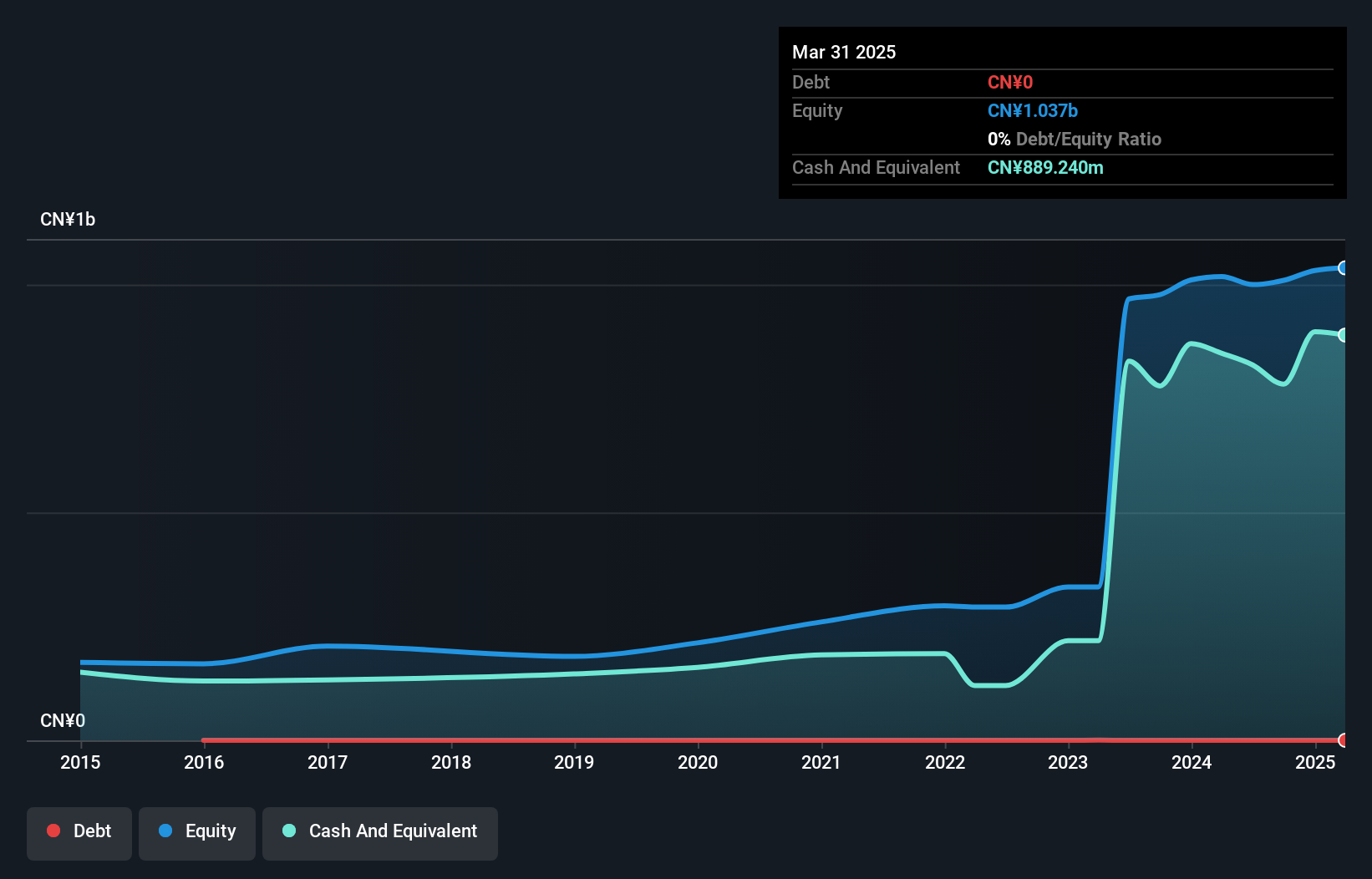

Shanghai Wisdom Information Technology, a nimble player in the IT sector, has shown resilience with earnings growth of 10.9% over the past year, outpacing the industry's -8.1%. Despite being debt-free and having high non-cash earnings quality, its share price has been notably volatile recently. The company reported a net income of CNY 29.97 million for nine months ending September 2024, up from CNY 26.07 million previously, though revenue dipped to CNY 179.63 million from CNY 191.66 million last year. Recently dropped from the S&P Global BMI Index, it remains profitable without concerns about cash runway or interest coverage due to no debt obligations.

Seize The Opportunity

- Click through to start exploring the rest of the 4633 Undiscovered Gems With Strong Fundamentals now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wuxi Taclink Optoelectronics Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688205

Wuxi Taclink Optoelectronics Technology

Wuxi Taclink Optoelectronics Technology Co., Ltd.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives