- China

- /

- Auto Components

- /

- SZSE:300547

Subdued Growth No Barrier To Sichuan Chuanhuan Technology Co.,Ltd. (SZSE:300547) With Shares Advancing 34%

Despite an already strong run, Sichuan Chuanhuan Technology Co.,Ltd. (SZSE:300547) shares have been powering on, with a gain of 34% in the last thirty days. The annual gain comes to 120% following the latest surge, making investors sit up and take notice.

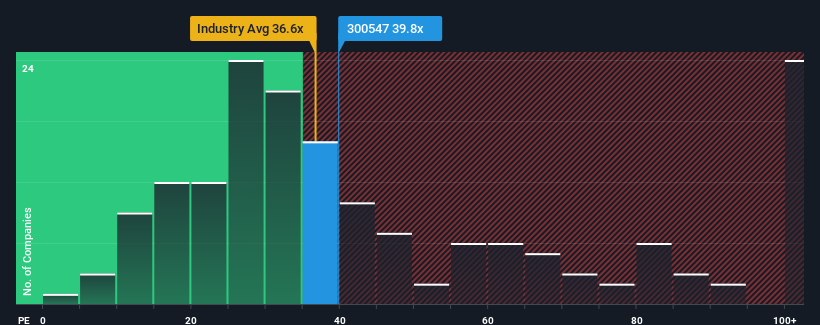

Although its price has surged higher, you could still be forgiven for feeling indifferent about Sichuan Chuanhuan TechnologyLtd's P/E ratio of 39.8x, since the median price-to-earnings (or "P/E") ratio in China is also close to 39x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Sichuan Chuanhuan TechnologyLtd as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to deteriorate like the rest, which has kept the P/E from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Sichuan Chuanhuan TechnologyLtd

How Is Sichuan Chuanhuan TechnologyLtd's Growth Trending?

The only time you'd be comfortable seeing a P/E like Sichuan Chuanhuan TechnologyLtd's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a terrific increase of 37%. The latest three year period has also seen an excellent 83% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 30% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 37% growth forecast for the broader market.

With this information, we find it interesting that Sichuan Chuanhuan TechnologyLtd is trading at a fairly similar P/E to the market. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/E falls to levels more in line with the growth outlook.

The Final Word

Sichuan Chuanhuan TechnologyLtd appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Sichuan Chuanhuan TechnologyLtd currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. When we see a weak earnings outlook with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 2 warning signs for Sichuan Chuanhuan TechnologyLtd (1 is a bit unpleasant!) that you should be aware of.

Of course, you might also be able to find a better stock than Sichuan Chuanhuan TechnologyLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300547

Sichuan Chuanhuan TechnologyLtd

Engages in the research, development, production, and sale of automotive rubber hose series products in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026