- China

- /

- Auto Components

- /

- SZSE:300304

Jiangsu Yunyi ElectricLtd And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

As Asian markets navigate a complex landscape of economic signals, including Japan's interest rate hikes and China's mixed growth indicators, investors are increasingly looking for opportunities in the region's small-cap sector. In this context, identifying stocks with robust fundamentals becomes crucial, as these companies may offer resilience amid broader market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Envipro Holdings | 45.78% | 5.54% | -10.67% | ★★★★★★ |

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| Te Chang Construction | 10.33% | 13.82% | 17.08% | ★★★★★★ |

| Central Forest Group | NA | 5.20% | 24.71% | ★★★★★★ |

| ISE Chemicals | 1.29% | 16.36% | 32.61% | ★★★★★★ |

| Jiangsu Rainbow Heavy Industries | 25.93% | 19.62% | 2.58% | ★★★★★☆ |

| Guangdong Goworld | 24.88% | -0.23% | -11.19% | ★★★★★☆ |

| CTCI Advanced Systems | 28.70% | 17.79% | 19.38% | ★★★★★☆ |

| Shandong Sacred Sun Power SourcesLtd | 19.20% | 12.37% | 36.24% | ★★★★★☆ |

| Guangdong Tloong Technology GroupLtd | 38.37% | -9.77% | -17.24% | ★★★★★☆ |

Let's review some notable picks from our screened stocks.

Jiangsu Yunyi ElectricLtd (SZSE:300304)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Yunyi Electric Co., Ltd. engages in the research, development, manufacturing, marketing, and sales of automotive electronic parts both in China and internationally with a market capitalization of CN¥10.19 billion.

Operations: Yunyi Electric generates revenue primarily from the sale of automotive electronic parts. The company has a market capitalization of CN¥10.19 billion, reflecting its position in the industry.

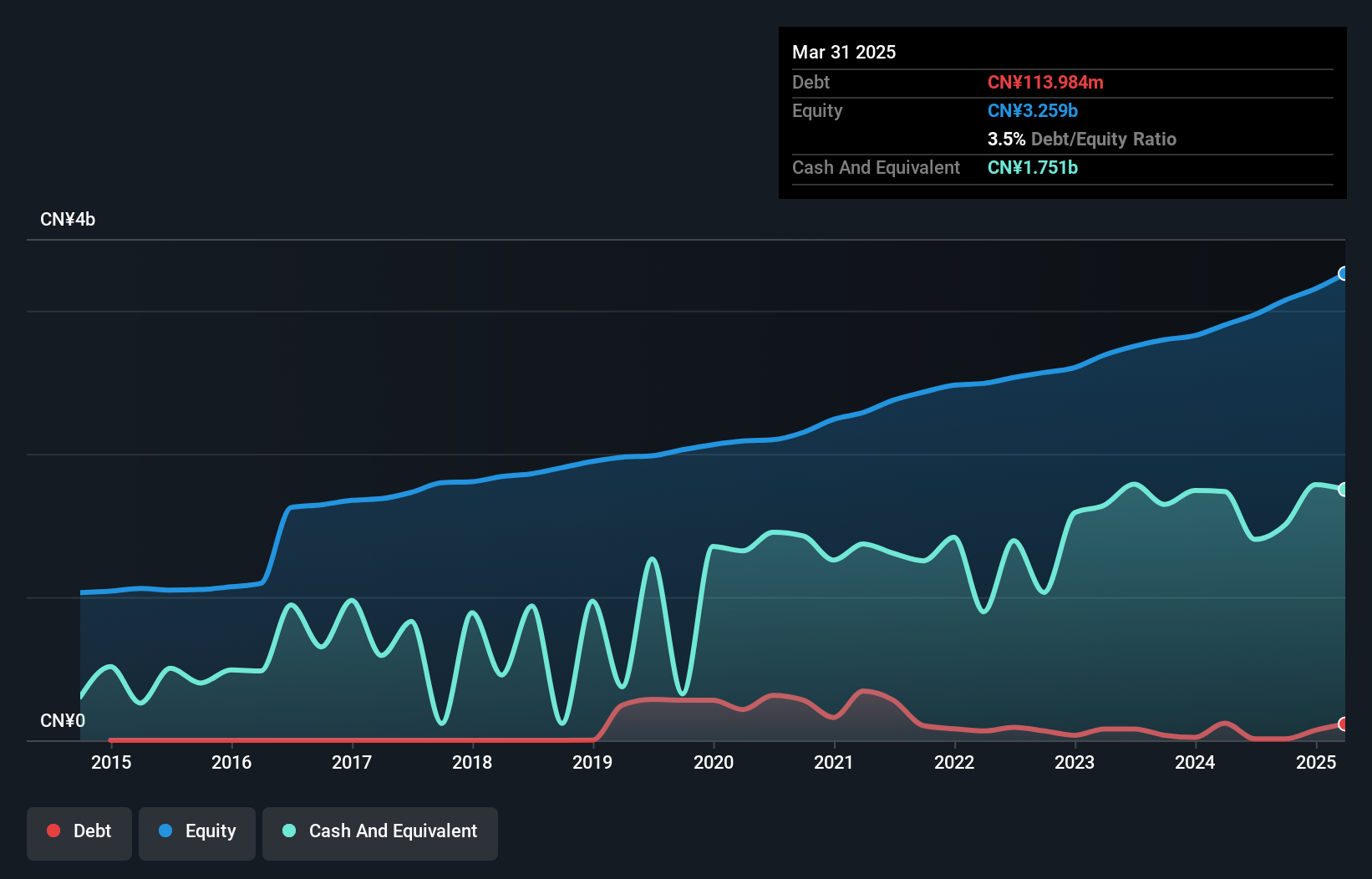

Jiangsu Yunyi Electric, a dynamic player in the auto components sector, reported impressive earnings growth of 12.4% over the past year, outpacing the industry's 8%. This growth is reflected in their recent financials where net income rose to CNY 331.24 million from CNY 307.26 million a year ago. The company seems to be trading at an attractive valuation with a price-to-earnings ratio of 24x, notably lower than the CN market average of 43.5x. Over five years, they've significantly reduced their debt-to-equity ratio from 13% to just 1.3%, enhancing their financial stability and appeal as a promising investment prospect in Asia's competitive market landscape.

Shandong Tongda Island New MaterialsLtd (SZSE:300321)

Simply Wall St Value Rating: ★★★★★★

Overview: Shandong Tongda Island New Materials Co., Ltd. operates in the artificial leather industry and has a market capitalization of CN¥4.70 billion.

Operations: The company generates revenue primarily from the artificial leather industry, amounting to CN¥390.06 million.

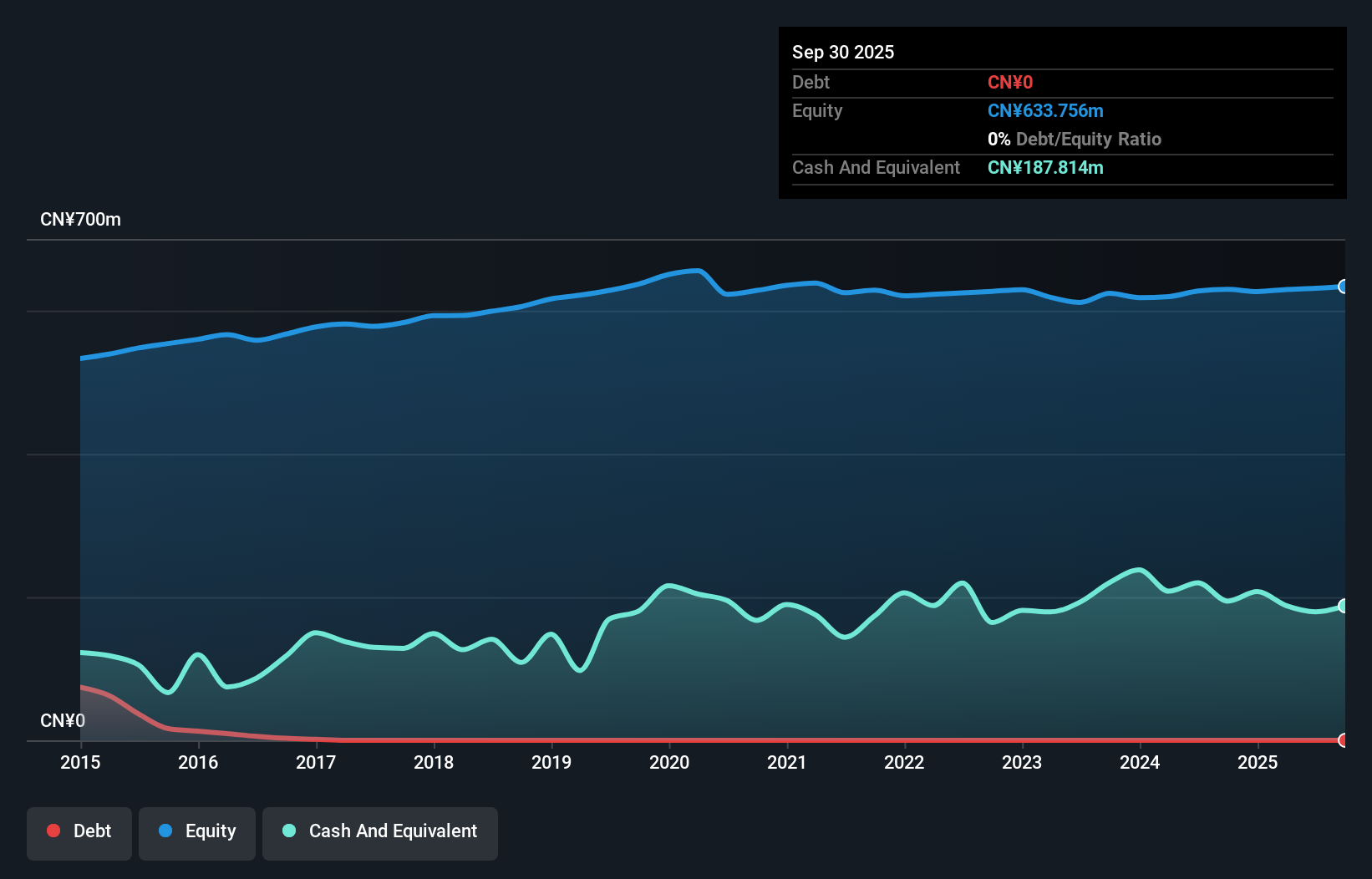

Shandong Tongda Island New Materials, a nimble player in the chemicals sector, has shown notable earnings growth of 43% over the past year, outpacing the industry's 7%. Despite this impressive uptick, its earnings have been impacted by a CN¥2.5 million one-off gain recently. The company operates debt-free and has maintained this status for five years, which suggests prudent financial management. However, it faces challenges with free cash flow being negative. Recent amendments to its articles of association signal potential strategic shifts that could influence future performance and governance structures.

Wuhan Huakang Century Clean Technology (SZSE:301235)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Wuhan Huakang Century Clean Technology Co., Ltd. operates in the clean technology sector and has a market capitalization of CN¥4.39 billion.

Operations: Wuhan Huakang Century Clean Technology generates its revenue primarily from its operations in the clean technology sector. With a market capitalization of CN¥4.39 billion, the company focuses on leveraging its expertise to drive financial performance.

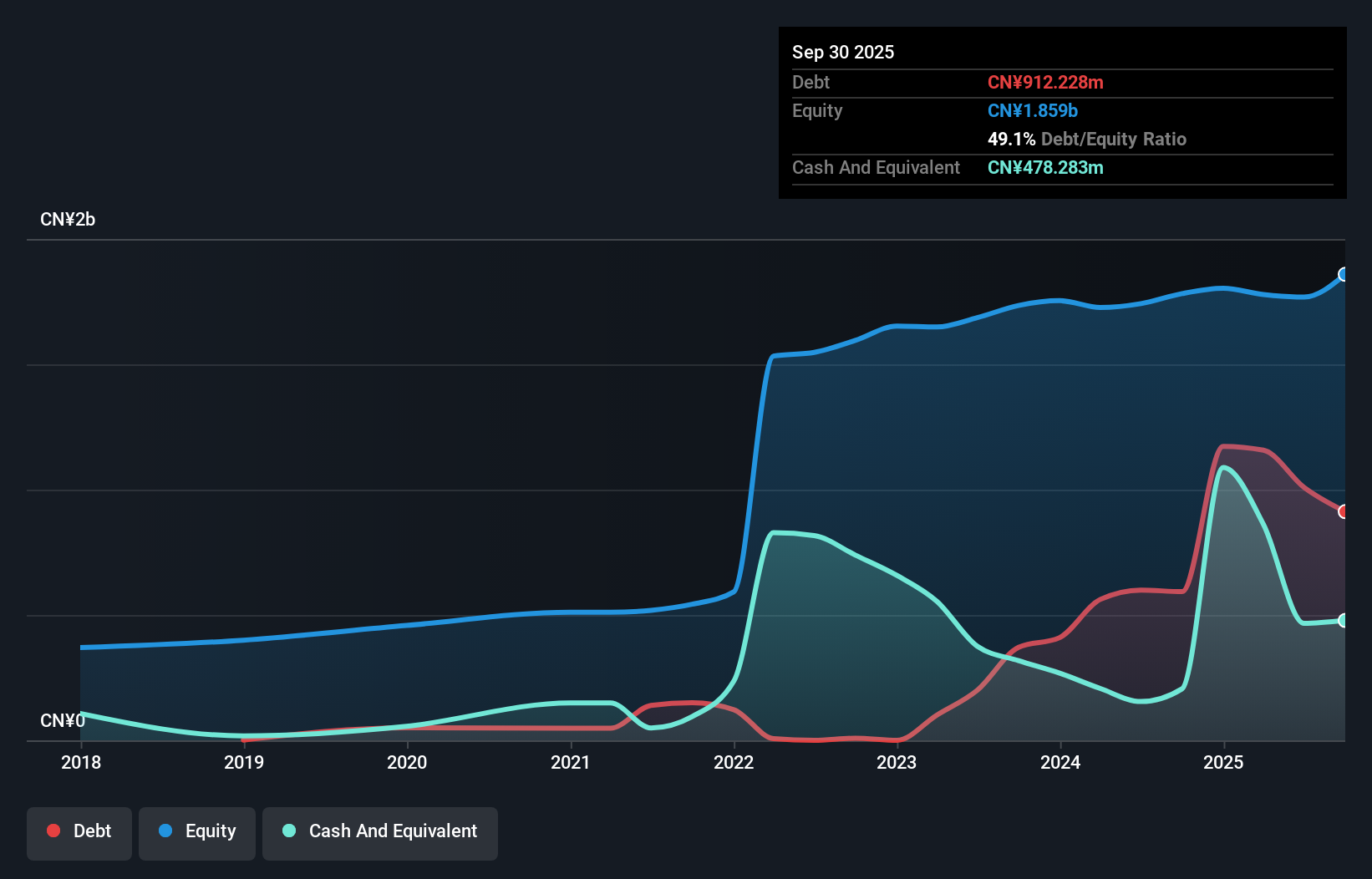

Wuhan Huakang Century Clean Technology, with its nimble market presence, has shown impressive growth. Over the past year, earnings surged by 62%, outpacing the Medical Equipment industry's modest 0.6% rise. The company's net income for the nine months ending September 2025 reached CNY 61.16 million, up from CNY 19.64 million a year earlier, reflecting robust performance despite a volatile share price recently observed over three months. Its debt to equity ratio climbed to 49.1% over five years; however, interest payments remain well-covered at a satisfactory EBIT coverage of 5.2x, suggesting financial stability amidst expansion efforts.

Turning Ideas Into Actions

- Gain an insight into the universe of 2497 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300304

Jiangsu Yunyi ElectricLtd

Researches, develops, manufactures, markets, and sells automotive electronic parts in China and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion