- China

- /

- Auto Components

- /

- SZSE:300304

Exploring Undiscovered Gems in Asia for August 2025

Reviewed by Simply Wall St

As global markets continue to navigate complex economic landscapes, recent developments have seen the Bank of England cutting rates amidst labor market concerns and the U.S. Nasdaq Composite reaching fresh all-time highs. In this dynamic environment, identifying promising small-cap stocks in Asia can offer unique opportunities for investors seeking growth potential beyond mainstream indices. A good stock in this context often combines strong fundamentals with resilience to broader market fluctuations, making it a compelling candidate for those exploring undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Hong Ho Precision TextileLtd | 3.47% | 54.41% | 83.19% | ★★★★★★ |

| System ResearchLtd | 12.02% | 10.93% | 15.51% | ★★★★★★ |

| Toukei Computer | NA | 5.63% | 13.86% | ★★★★★★ |

| Shangri-La Hotel | NA | 23.33% | 39.56% | ★★★★★★ |

| Zhejiang Wanfeng ChemicalLtd | 12.56% | 19.68% | -28.34% | ★★★★★★ |

| Kaneko Seeds | NA | 1.50% | -1.04% | ★★★★★★ |

| Alltek Technology | 100.78% | 4.48% | 7.73% | ★★★★★☆ |

| Guangdong Delian Group | 28.18% | 5.07% | -36.51% | ★★★★★☆ |

| Ogaki Kyoritsu Bank | 100.29% | 3.05% | 10.51% | ★★★★☆☆ |

| Fengyinhe Holdings | 0.60% | 39.37% | 65.41% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Jiangsu Bide Science and TechnologyLtd (SHSE:605298)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jiangsu Bide Science and Technology Co., Ltd. operates primarily in the rail transit equipment sector and has a market capitalization of CN¥4.47 billion.

Operations: Bide's revenue is primarily derived from its rail transit equipment segment, totaling CN¥488.72 million. The company's focus on this sector influences its financial performance and strategic priorities.

Jiangsu Bide Science and Technology Ltd. stands out in the Asian market with its impressive earnings growth of 74% over the past year, surpassing the Machinery industry average of 1%. Despite this, it's important to note that earnings have decreased by 35% annually over five years. The company's debt-to-equity ratio has risen from 0.2 to 0.8 in five years, yet it maintains more cash than total debt, indicating a manageable financial position. While its share price has been highly volatile recently, Jiangsu Bide's high-quality past earnings suggest resilience amidst market fluctuations.

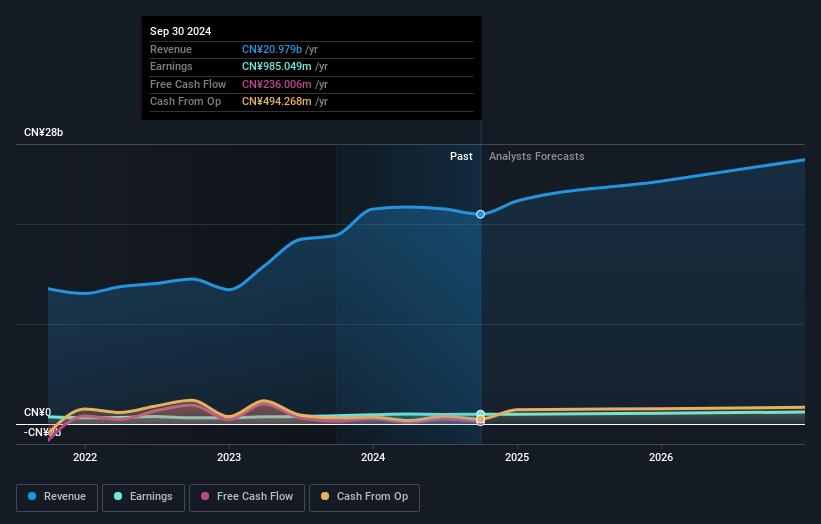

NORINCO International Cooperation (SZSE:000065)

Simply Wall St Value Rating: ★★★★★☆

Overview: NORINCO International Cooperation Ltd. is an engineering contractor operating across Asia, Africa, the Middle East, and internationally with a market cap of CN¥13.18 billion.

Operations: The company generates revenue primarily from engineering contracting services across multiple regions. It reports a net profit margin of 3.5%, reflecting its profitability after accounting for expenses.

NORINCO International Cooperation, a smaller player in the construction sector, trades at a favorable price-to-earnings ratio of 13.7x compared to the broader CN market's 43.8x. The company's net debt to equity ratio stands at a satisfactory 13.2%, reflecting prudent financial management with debt levels reduced from 60.1% to 55.5% over five years. Despite experiencing negative earnings growth of -2.6% last year, which is better than the industry average of -5.4%, NORINCO shows potential for improvement with forecasted earnings growth of 10%. Recent shareholder meetings have focused on strategic agreements and insurance for key personnel, indicating proactive governance measures.

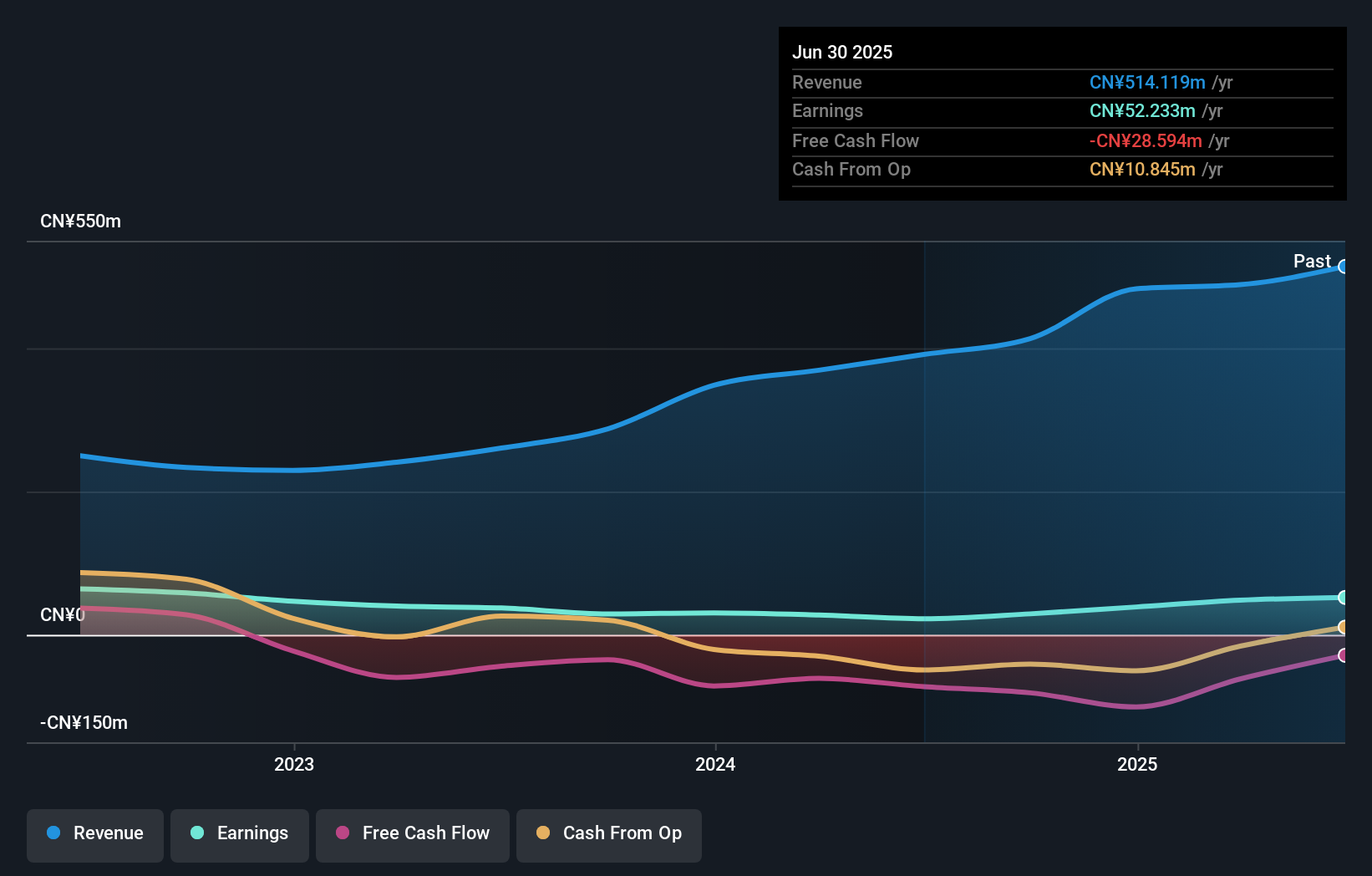

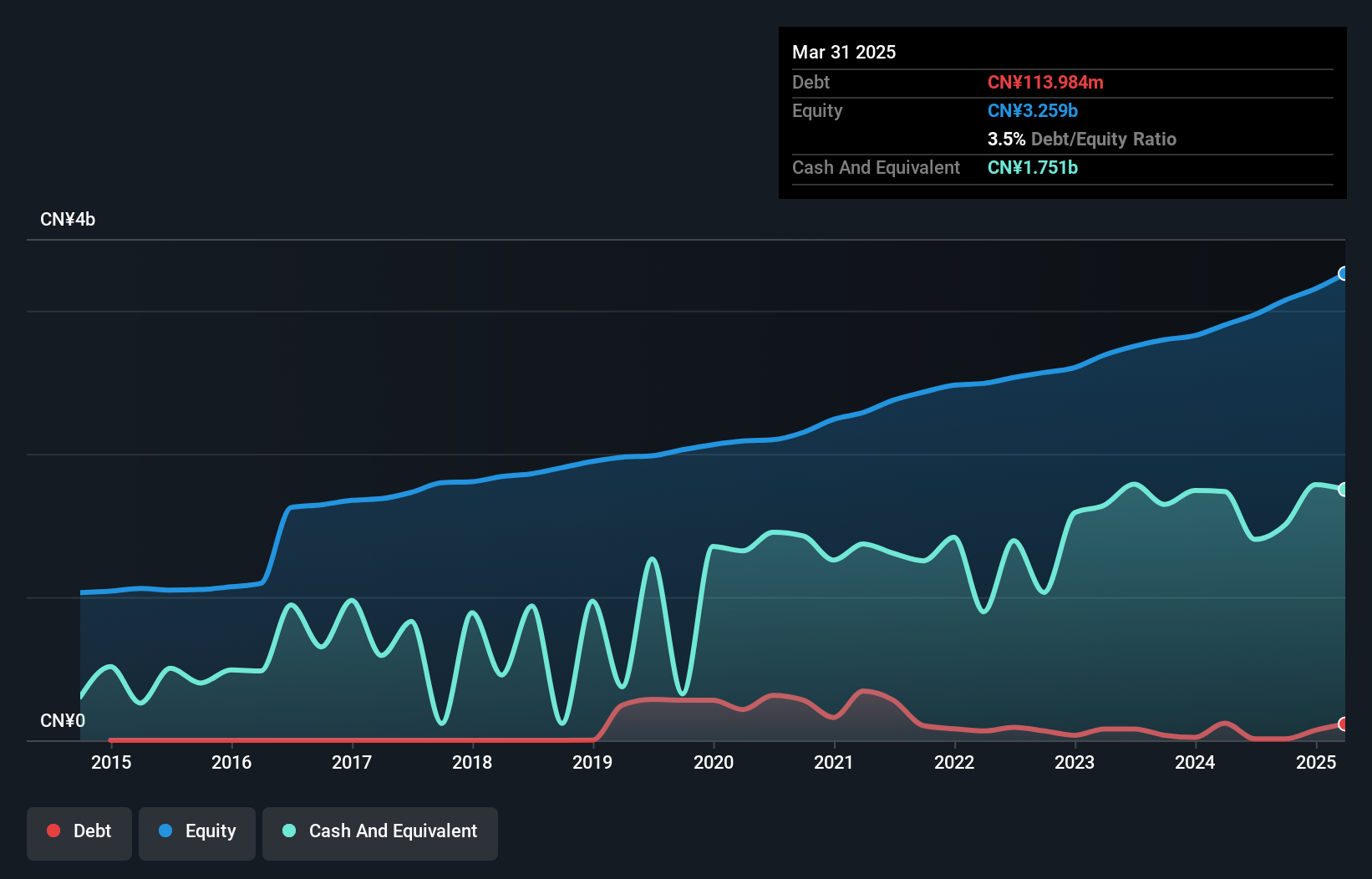

Jiangsu Yunyi ElectricLtd (SZSE:300304)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Yunyi Electric Co., Ltd. is engaged in the research, development, manufacturing, marketing, and sale of automotive electronic parts both in China and internationally, with a market capitalization of approximately CN¥11.52 billion.

Operations: Yunyi Electric generates its revenue primarily from the sale of automotive electronic parts in both domestic and international markets. The company's financial performance is highlighted by a net profit margin of 8.5%, reflecting its efficiency in converting sales into actual profit after all expenses.

Jiangsu Yunyi Electric, a small player in the auto components sector, has shown impressive earnings growth of 19.7% over the past year, outpacing the industry's 4.3%. The company is trading at a significant discount of 38.7% below its estimated fair value and boasts high-quality earnings. Over five years, it has reduced its debt-to-equity ratio from 10.3 to 3.5 while maintaining more cash than total debt, indicating financial prudence. Recent board changes and amendments to governance systems could signal strategic shifts aimed at fostering future growth in this volatile market space.

- Delve into the full analysis health report here for a deeper understanding of Jiangsu Yunyi ElectricLtd.

Learn about Jiangsu Yunyi ElectricLtd's historical performance.

Next Steps

- Investigate our full lineup of 2494 Asian Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300304

Jiangsu Yunyi ElectricLtd

Researches, develops, manufactures, markets, and sells automotive electronic parts in China and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion