- China

- /

- Auto Components

- /

- SZSE:002984

Qingdao Sentury Tire Co., Ltd.'s (SZSE:002984) Price Is Right But Growth Is Lacking After Shares Rocket 26%

The Qingdao Sentury Tire Co., Ltd. (SZSE:002984) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 43%.

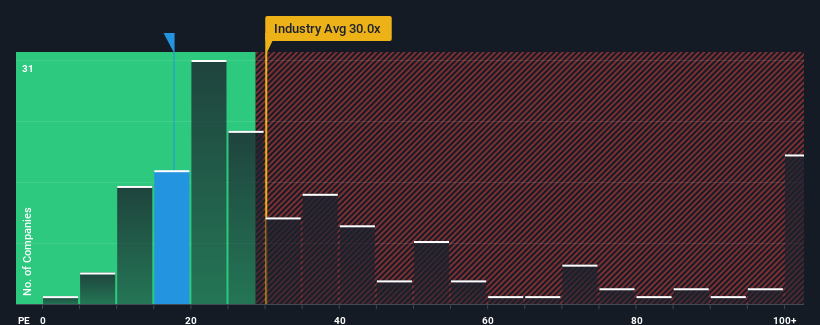

Although its price has surged higher, Qingdao Sentury Tire's price-to-earnings (or "P/E") ratio of 17.6x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 33x and even P/E's above 63x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times have been advantageous for Qingdao Sentury Tire as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Qingdao Sentury Tire

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Qingdao Sentury Tire would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 82% last year. The strong recent performance means it was also able to grow EPS by 38% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 19% per annum as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 25% each year, which is noticeably more attractive.

With this information, we can see why Qingdao Sentury Tire is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Qingdao Sentury Tire's P/E?

Qingdao Sentury Tire's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Qingdao Sentury Tire's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Qingdao Sentury Tire that you need to take into consideration.

You might be able to find a better investment than Qingdao Sentury Tire. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Qingdao Sentury Tire might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002984

Qingdao Sentury Tire

Engages in the development, production, and sale of tires primarily in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success