- China

- /

- Auto Components

- /

- SZSE:002715

What Huaiji Dengyun Auto-parts (Holding) Co.,Ltd.'s (SZSE:002715) 37% Share Price Gain Is Not Telling You

Huaiji Dengyun Auto-parts (Holding) Co.,Ltd. (SZSE:002715) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 8.4% over the last year.

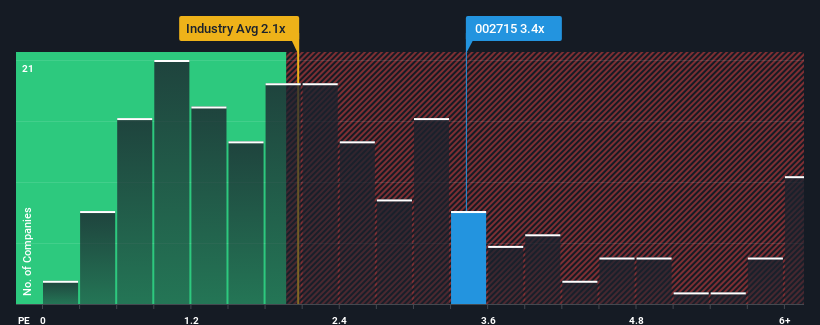

Since its price has surged higher, given close to half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.1x, you may consider Huaiji Dengyun Auto-parts (Holding)Ltd as a stock to potentially avoid with its 3.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

See our latest analysis for Huaiji Dengyun Auto-parts (Holding)Ltd

What Does Huaiji Dengyun Auto-parts (Holding)Ltd's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Huaiji Dengyun Auto-parts (Holding)Ltd over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Although there are no analyst estimates available for Huaiji Dengyun Auto-parts (Holding)Ltd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Huaiji Dengyun Auto-parts (Holding)Ltd?

The only time you'd be truly comfortable seeing a P/S as high as Huaiji Dengyun Auto-parts (Holding)Ltd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 4.4% decrease to the company's top line. This has soured the latest three-year period, which nevertheless managed to deliver a decent 18% overall rise in revenue. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 23% shows it's noticeably less attractive.

In light of this, it's alarming that Huaiji Dengyun Auto-parts (Holding)Ltd's P/S sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with recent growth rates.

What Does Huaiji Dengyun Auto-parts (Holding)Ltd's P/S Mean For Investors?

The large bounce in Huaiji Dengyun Auto-parts (Holding)Ltd's shares has lifted the company's P/S handsomely. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Huaiji Dengyun Auto-parts (Holding)Ltd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we observe slower-than-industry revenue growth alongside a high P/S ratio, we assume there to be a significant risk of the share price decreasing, which would result in a lower P/S ratio. Unless there is a significant improvement in the company's medium-term performance, it will be difficult to prevent the P/S ratio from declining to a more reasonable level.

Before you take the next step, you should know about the 1 warning sign for Huaiji Dengyun Auto-parts (Holding)Ltd that we have uncovered.

If you're unsure about the strength of Huaiji Dengyun Auto-parts (Holding)Ltd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Huaiji Dengyun Auto-parts (Holding)Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002715

Huaiji Dengyun Auto-parts (Holding)Ltd

Huaiji Dengyun Auto-parts (Holding) Co.,Ltd.

Mediocre balance sheet with very low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026