- China

- /

- Auto Components

- /

- SZSE:002537

HyUnion Holding Co.,Ltd's (SZSE:002537) Shares Climb 30% But Its Business Is Yet to Catch Up

HyUnion Holding Co.,Ltd (SZSE:002537) shareholders are no doubt pleased to see that the share price has bounced 30% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 29% over that time.

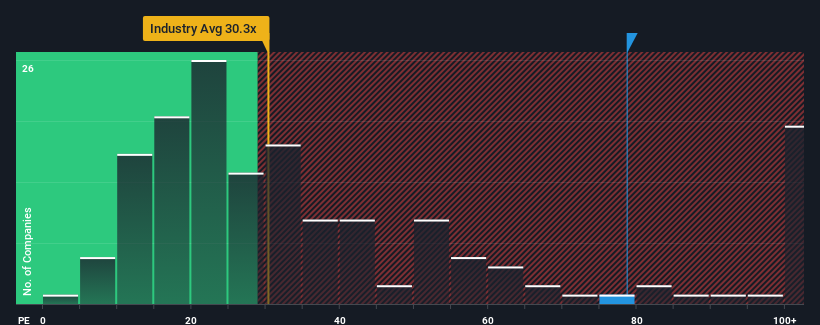

Following the firm bounce in price, HyUnion HoldingLtd's price-to-earnings (or "P/E") ratio of 78.7x might make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 18x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

For example, consider that HyUnion HoldingLtd's financial performance has been poor lately as its earnings have been in decline. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for HyUnion HoldingLtd

Does Growth Match The High P/E?

There's an inherent assumption that a company should far outperform the market for P/E ratios like HyUnion HoldingLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 45%. Unfortunately, that's brought it right back to where it started three years ago with EPS growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing that to the market, which is predicted to deliver 41% growth in the next 12 months, the company's momentum is weaker based on recent medium-term annualised earnings results.

In light of this, it's alarming that HyUnion HoldingLtd's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From HyUnion HoldingLtd's P/E?

Shares in HyUnion HoldingLtd have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of HyUnion HoldingLtd revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for HyUnion HoldingLtd that you should be aware of.

Of course, you might also be able to find a better stock than HyUnion HoldingLtd. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if HyUnion HoldingLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002537

HyUnion HoldingLtd

Manufactures and sells automotive lightweight components for automobile brands, independent brands, and other original equipment manufacturers (OEM) in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives