- China

- /

- Auto Components

- /

- SZSE:002510

Undiscovered Gems To Watch In February 2025

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and potential tariff changes, small-cap stocks have been lagging behind their larger counterparts, with the Russell 2000 trailing the S&P 500 by a notable margin. In this environment, identifying promising small-cap companies that can weather economic fluctuations and capitalize on niche opportunities becomes crucial for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Yuen Foong Yu Consumer Products | 27.23% | 0.46% | -3.46% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sonix TechnologyLtd | NA | -10.07% | -16.54% | ★★★★★★ |

| Pacific Construction | 21.40% | -3.50% | 26.25% | ★★★★★★ |

| First Copper Technology | 17.03% | 3.07% | 19.66% | ★★★★★★ |

| Ve Wong | 11.84% | 0.61% | 3.56% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Huang Hsiang Construction | 266.70% | 13.12% | 15.19% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

TangshanJidong Equipment and EngineeringLtd (SZSE:000856)

Simply Wall St Value Rating: ★★★★★☆

Overview: TangshanJidong Equipment and Engineering Co., Ltd. operates in the manufacturing and sale of cement equipment both domestically in China and internationally, with a market capitalization of CN¥3.16 billion.

Operations: TangshanJidong Equipment and Engineering Co., Ltd. generates revenue primarily from its equipment manufacturing segment, which brought in CN¥2.52 billion. The company's market capitalization stands at CN¥3.16 billion, indicating its scale within the industry.

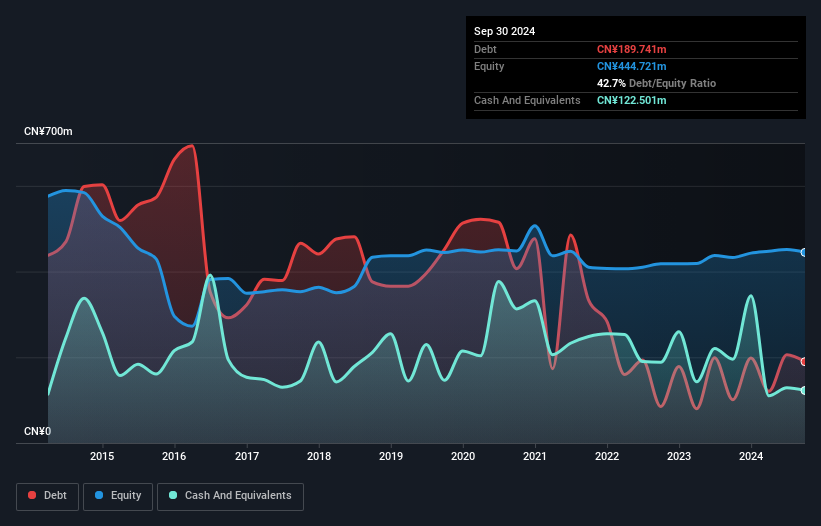

TangshanJidong Equipment and Engineering Ltd. is navigating through a transformative phase, with its earnings growth of 0.5% over the past year outpacing the broader machinery industry, which saw a -0.06% shift. This performance was notably impacted by a one-off gain of CN¥25M, suggesting some volatility in earnings quality. Over five years, the company has significantly improved its financial health by reducing its debt to equity ratio from 101.6% down to 42.7%, and maintaining an interest coverage ratio of 6.4x EBIT indicates strong debt management capabilities despite not being free cash flow positive recently.

- Navigate through the intricacies of TangshanJidong Equipment and EngineeringLtd with our comprehensive health report here.

Understand TangshanJidong Equipment and EngineeringLtd's track record by examining our Past report.

Tianjin Motor DiesLtd (SZSE:002510)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tianjin Motor Dies Co., Ltd. specializes in the R&D, design, production, and sale of automobile body panel molds and supporting products both domestically and internationally, with a market cap of CN¥6.48 billion.

Operations: Tianjin Motor Dies Co., Ltd. generates revenue primarily from the sale of automobile body panel molds and supporting products. The company's financial performance is influenced by its market presence both in China and internationally, with a market capitalization of CN¥6.48 billion.

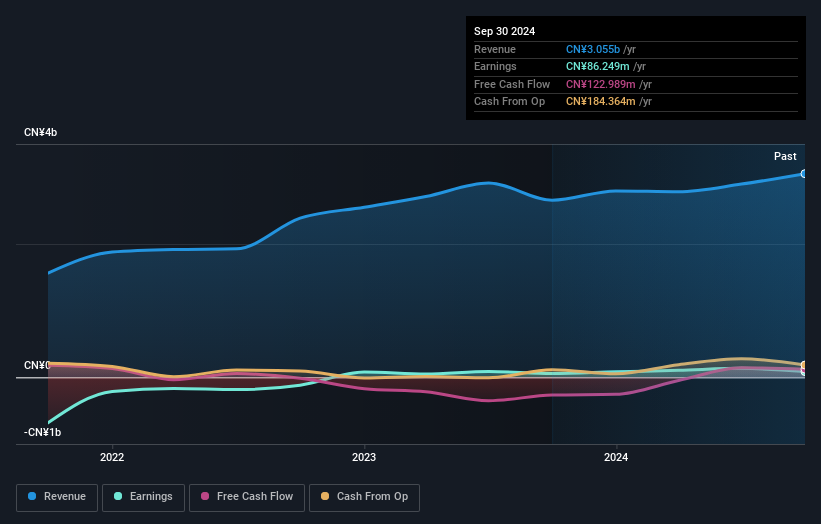

Tianjin Motor Dies, a compact player in the auto components sector, showcases a robust financial profile with earnings growth of 50% over the past year, outpacing the industry average of 10.5%. Despite its highly volatile share price recently, it maintains high-quality earnings and satisfactory interest coverage. The net debt to equity ratio stands at a reasonable 35.7%, though there has been an increase from 45.9% to 76.9% over five years which could reflect strategic investments or expansion efforts. The company is free cash flow positive, suggesting effective capital management amid industry challenges and opportunities for future growth.

- Click here to discover the nuances of Tianjin Motor DiesLtd with our detailed analytical health report.

Explore historical data to track Tianjin Motor DiesLtd's performance over time in our Past section.

ADATA Technology (TPEX:3260)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ADATA Technology Co., Ltd. is a global manufacturer and seller of memory products, with a market capitalization of NT$25.55 billion.

Operations: ADATA generates revenue primarily from its Electronics Division, contributing NT$41.31 billion, while the Biotech Department adds NT$37.68 million.

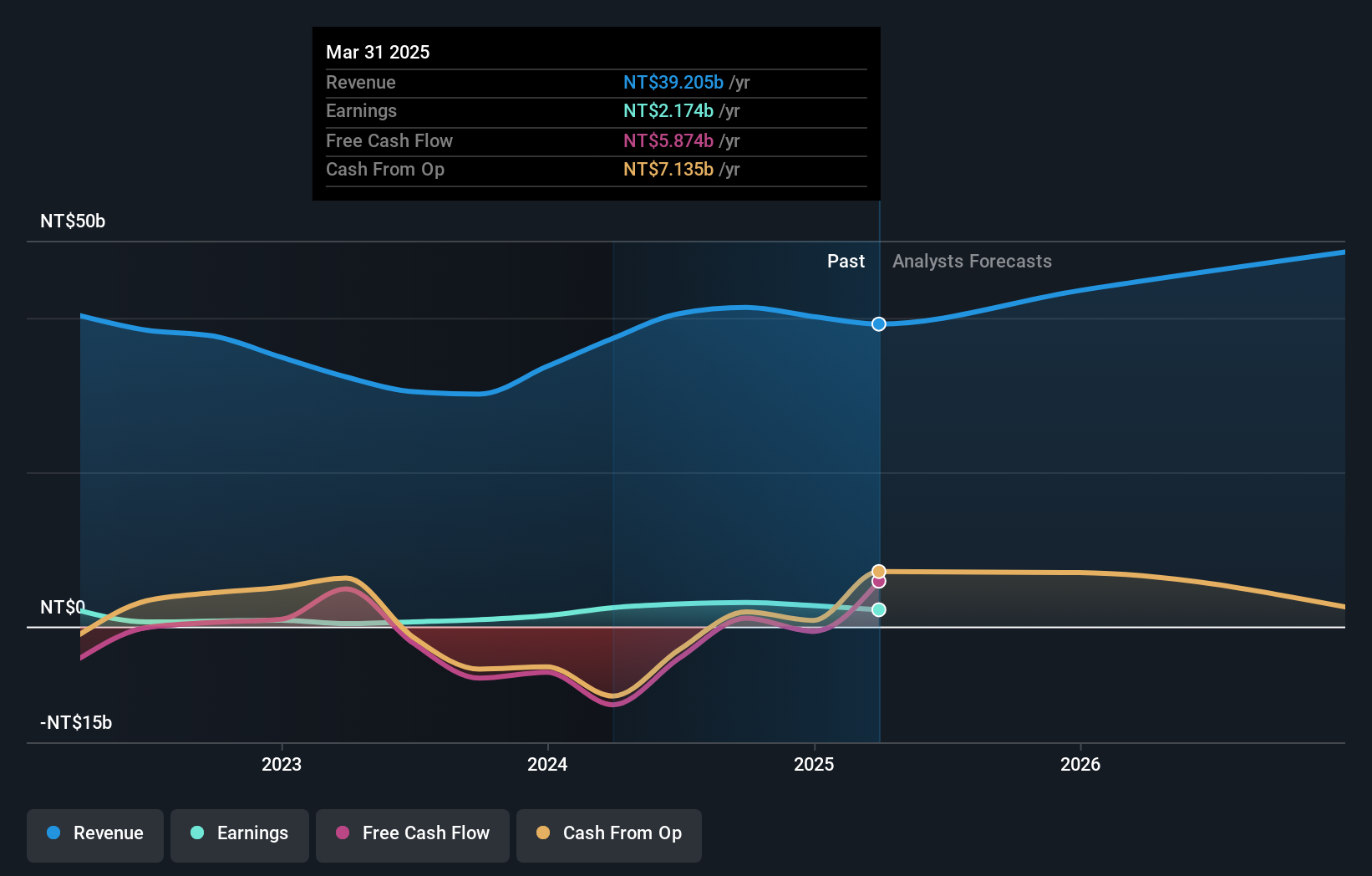

ADATA Technology has shown impressive earnings growth of 251% over the past year, outpacing the semiconductor industry's 5.9%. Despite a high net debt to equity ratio at 129%, its interest payments are comfortably covered by EBIT at 6.5x. The company's price-to-earnings ratio stands attractively low at 8.2x compared to the TW market's 21.4x, suggesting potential undervaluation in this space. Recent activities include a follow-on equity offering and participation in CES 2025, indicating proactive capital strategies and industry engagement. However, with operating cash flow not fully covering debt, financial management remains crucial for future stability.

- Click to explore a detailed breakdown of our findings in ADATA Technology's health report.

Evaluate ADATA Technology's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Dive into all 4711 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Motor DiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002510

Tianjin Motor DiesLtd

Tianjin Motor Dies Co., Ltd. engages in the research and development, design, production, and sale of automobile body panel molds and supporting products in China and internationally.

Mediocre balance sheet unattractive dividend payer.

Market Insights

Community Narratives