- China

- /

- Auto Components

- /

- SZSE:002328

Shanghai Xinpeng IndustryLtd's (SZSE:002328) Conservative Accounting Might Explain Soft Earnings

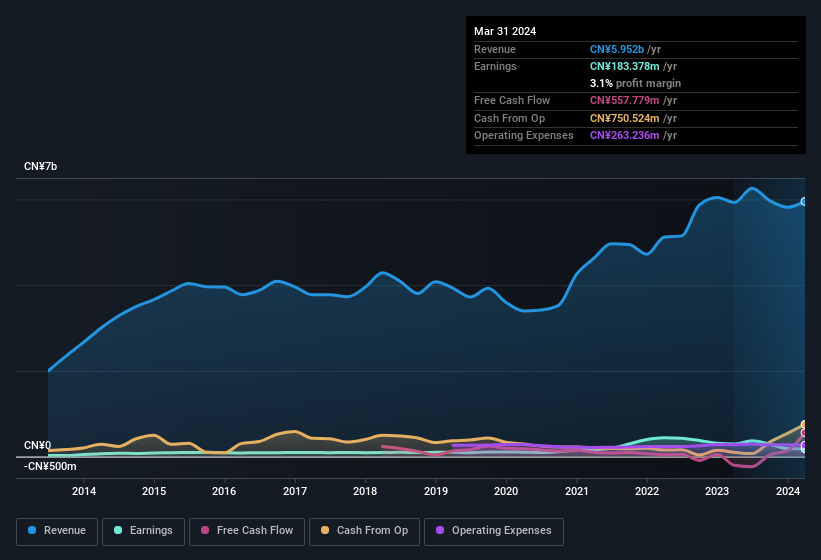

The market for Shanghai Xinpeng Industry Co.,Ltd.'s (SZSE:002328) shares didn't move much after it posted weak earnings recently. We think that the softer headline numbers might be getting counterbalanced by some positive underlying factors.

View our latest analysis for Shanghai Xinpeng IndustryLtd

Examining Cashflow Against Shanghai Xinpeng IndustryLtd's Earnings

Many investors haven't heard of the accrual ratio from cashflow, but it is actually a useful measure of how well a company's profit is backed up by free cash flow (FCF) during a given period. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. You could think of the accrual ratio from cashflow as the 'non-FCF profit ratio'.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While it's not a problem to have a positive accrual ratio, indicating a certain level of non-cash profits, a high accrual ratio is arguably a bad thing, because it indicates paper profits are not matched by cash flow. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

Shanghai Xinpeng IndustryLtd has an accrual ratio of -0.14 for the year to March 2024. That indicates that its free cash flow quite significantly exceeded its statutory profit. Indeed, in the last twelve months it reported free cash flow of CN¥558m, well over the CN¥183.4m it reported in profit. Notably, Shanghai Xinpeng IndustryLtd had negative free cash flow last year, so the CN¥558m it produced this year was a welcome improvement. Having said that, there is more to the story. The accrual ratio is reflecting the impact of unusual items on statutory profit, at least in part.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Shanghai Xinpeng IndustryLtd.

How Do Unusual Items Influence Profit?

Shanghai Xinpeng IndustryLtd's profit was reduced by unusual items worth CN¥49m in the last twelve months, and this helped it produce high cash conversion, as reflected by its unusual items. In a scenario where those unusual items included non-cash charges, we'd expect to see a strong accrual ratio, which is exactly what has happened in this case. While deductions due to unusual items are disappointing in the first instance, there is a silver lining. We looked at thousands of listed companies and found that unusual items are very often one-off in nature. And, after all, that's exactly what the accounting terminology implies. If Shanghai Xinpeng IndustryLtd doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Shanghai Xinpeng IndustryLtd's Profit Performance

In conclusion, both Shanghai Xinpeng IndustryLtd's accrual ratio and its unusual items suggest that its statutory earnings are probably reasonably conservative. Looking at all these factors, we'd say that Shanghai Xinpeng IndustryLtd's underlying earnings power is at least as good as the statutory numbers would make it seem. So while earnings quality is important, it's equally important to consider the risks facing Shanghai Xinpeng IndustryLtd at this point in time. For example - Shanghai Xinpeng IndustryLtd has 2 warning signs we think you should be aware of.

Our examination of Shanghai Xinpeng IndustryLtd has focussed on certain factors that can make its earnings look better than they are. And it has passed with flying colours. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002328

Shanghai Xinpeng IndustryLtd

Engages in the manufacture of automotive parts, metal and communication parts in China and internationally.

Excellent balance sheet established dividend payer.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026