- China

- /

- Electronic Equipment and Components

- /

- SZSE:300475

Undiscovered Gems With Promising Potential In February 2025

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets have shown resilience despite headwinds such as U.S. job growth falling short of expectations and fluctuating manufacturing activity. As major indexes like the S&P 500 experienced slight declines, investors are increasingly on the lookout for small-cap stocks that can thrive in this complex environment. Identifying promising stocks often involves looking for companies with strong fundamentals that can navigate economic challenges while capitalizing on emerging opportunities within their sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Conoil | 65.11% | 21.04% | 44.95% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

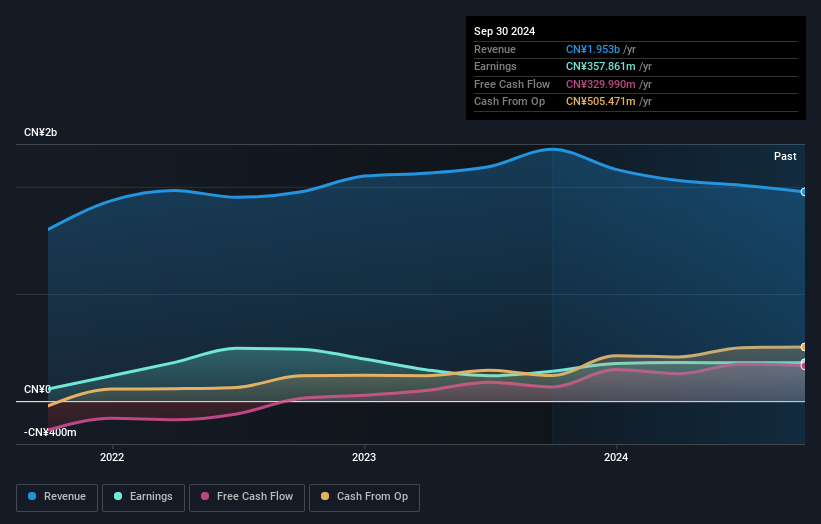

Xiangtan Electrochemical ScientificLtd (SZSE:002125)

Simply Wall St Value Rating: ★★★★★★

Overview: Xiangtan Electrochemical Scientific Co., Ltd specializes in the research, development, production, and sale of battery materials with a market cap of CN¥6.85 billion.

Operations: Xiangtan Electrochemical Scientific Co., Ltd generates revenue primarily through the sale of battery materials. The company's financial performance is influenced by its cost structure and market dynamics, which impact its net profit margin.

Xiangtan Electrochemical Scientific Ltd. showcases a promising profile with earnings growth of 27.8% over the past year, outpacing the Chemicals industry average of -5.4%. The company trades at 75% below its estimated fair value, suggesting potential undervaluation. Over five years, its debt to equity ratio impressively decreased from 120.9% to 44.6%, reflecting improved financial health and management's focus on reducing leverage. With EBIT covering interest payments by a substantial margin of 347 times, Xiangtan seems well-positioned financially. Recent board changes may further influence strategic direction positively in the near future, enhancing its appeal as an investment prospect in this sector.

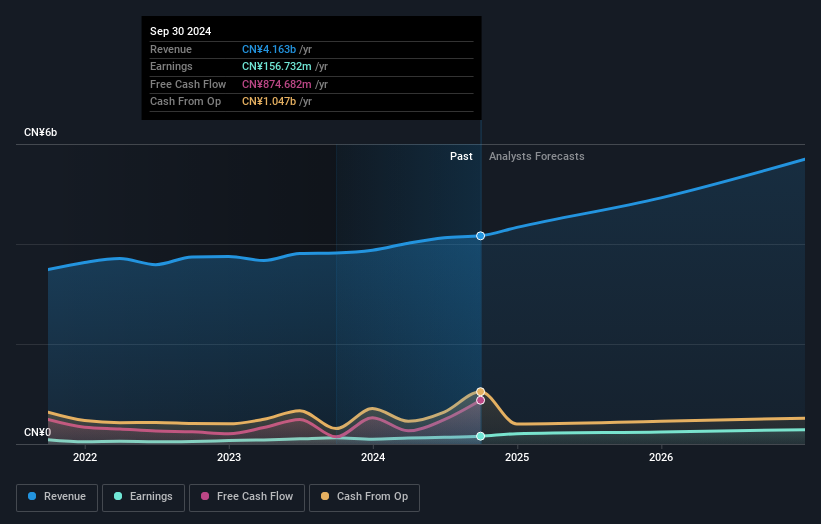

Zhejiang Asia-Pacific Mechanical & ElectronicLtd (SZSE:002284)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Asia-Pacific Mechanical & Electronic Co., Ltd focuses on the development, production, and sale of automotive parts both in China and internationally, with a market capitalization of approximately CN¥6.84 billion.

Operations: The company generates revenue primarily from automotive parts, totaling CN¥4.16 billion.

Zhejiang Asia-Pacific Mechanical & Electronic Ltd., a promising player in the auto components sector, is trading at 87.4% below its estimated fair value, suggesting potential undervaluation. The company boasts high-quality earnings and has seen a robust earnings growth of 25.8% over the past year, surpassing the industry's average of 10.5%. With more cash than total debt and interest payments well covered by EBIT at 17.4 times, financial stability seems solid despite an increase in the debt-to-equity ratio from 42.7% to 53.1% over five years. Earnings are forecasted to grow by an impressive 23.11% annually, indicating strong future prospects for this small-cap entity within its industry context.

- Navigate through the intricacies of Zhejiang Asia-Pacific Mechanical & ElectronicLtd with our comprehensive health report here.

Learn about Zhejiang Asia-Pacific Mechanical & ElectronicLtd's historical performance.

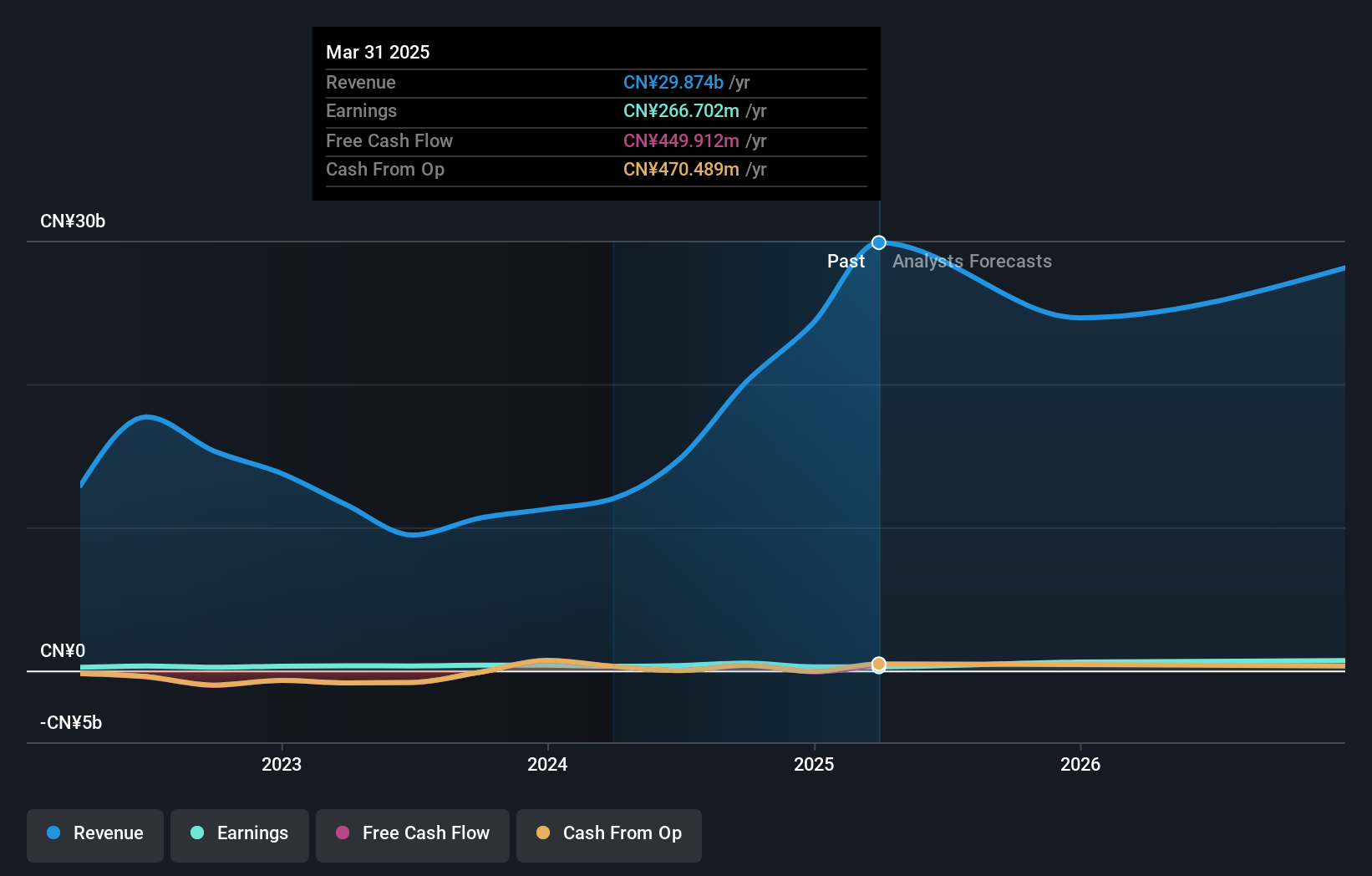

Shannon Semiconductor TechnologyLtd (SZSE:300475)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shannon Semiconductor Technology Co., Ltd. operates in the semiconductor industry and has a market cap of CN¥14.52 billion.

Operations: Shannon Semiconductor Technology generates its revenue primarily from the semiconductor sector. The company's market capitalization stands at CN¥14.52 billion.

Shannon Semiconductor Technology, a small player in the semiconductor space, has shown impressive earnings growth of 39.9% over the past year, outpacing the broader Machinery industry. The company's net debt to equity ratio is at a satisfactory 39.8%, indicating prudent financial management despite an increase from 0% to 73.3% over five years. With interest payments well covered by EBIT at 4.4 times and trading significantly below its estimated fair value by approximately 76%, Shannon appears undervalued in current market conditions. Recent developments include a notable acquisition where Liu Qingke acquired a stake for CNY 630 million, suggesting strategic interest in Shannon's potential growth trajectory.

- Dive into the specifics of Shannon Semiconductor TechnologyLtd here with our thorough health report.

Turning Ideas Into Actions

- Embark on your investment journey to our 4702 Undiscovered Gems With Strong Fundamentals selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300475

Shannon Semiconductor TechnologyLtd

Shannon Semiconductor Technology Co.,Ltd.

Moderate growth potential with mediocre balance sheet.

Market Insights

Community Narratives