- China

- /

- Electronic Equipment and Components

- /

- SZSE:002175

Undervalued Penny Stocks In Global For June 2025

Reviewed by Simply Wall St

Global markets have experienced mixed performance recently, with U.S. stock indexes fluctuating amid geopolitical tensions and economic uncertainties, while smaller-cap indexes showed relative strength. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area for those seeking growth opportunities at lower price points. Despite being an outdated term, these stocks can offer significant upside potential when supported by strong financial health and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.28 | HK$776.07M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.98 | £447.18M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.74 | SEK280.44M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.435 | SGD176.3M | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.20 | SGD8.66B | ✅ 5 ⚠️ 0 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.28 | £412.61M | ✅ 3 ⚠️ 2 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.38 | SEK2.28B | ✅ 4 ⚠️ 1 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.50 | MYR2.49B | ✅ 5 ⚠️ 0 View Analysis > |

| Bisalloy Steel Group (ASX:BIS) | A$3.28 | A$154.21M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.865 | £11.91M | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 3,923 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Guangxi Oriental Intelligent Manufacturing Technology (SZSE:002175)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. operates in the intelligent manufacturing sector, focusing on advanced technology solutions, with a market cap of CN¥5.44 billion.

Operations: Revenue segments for Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. are not reported.

Market Cap: CN¥5.44B

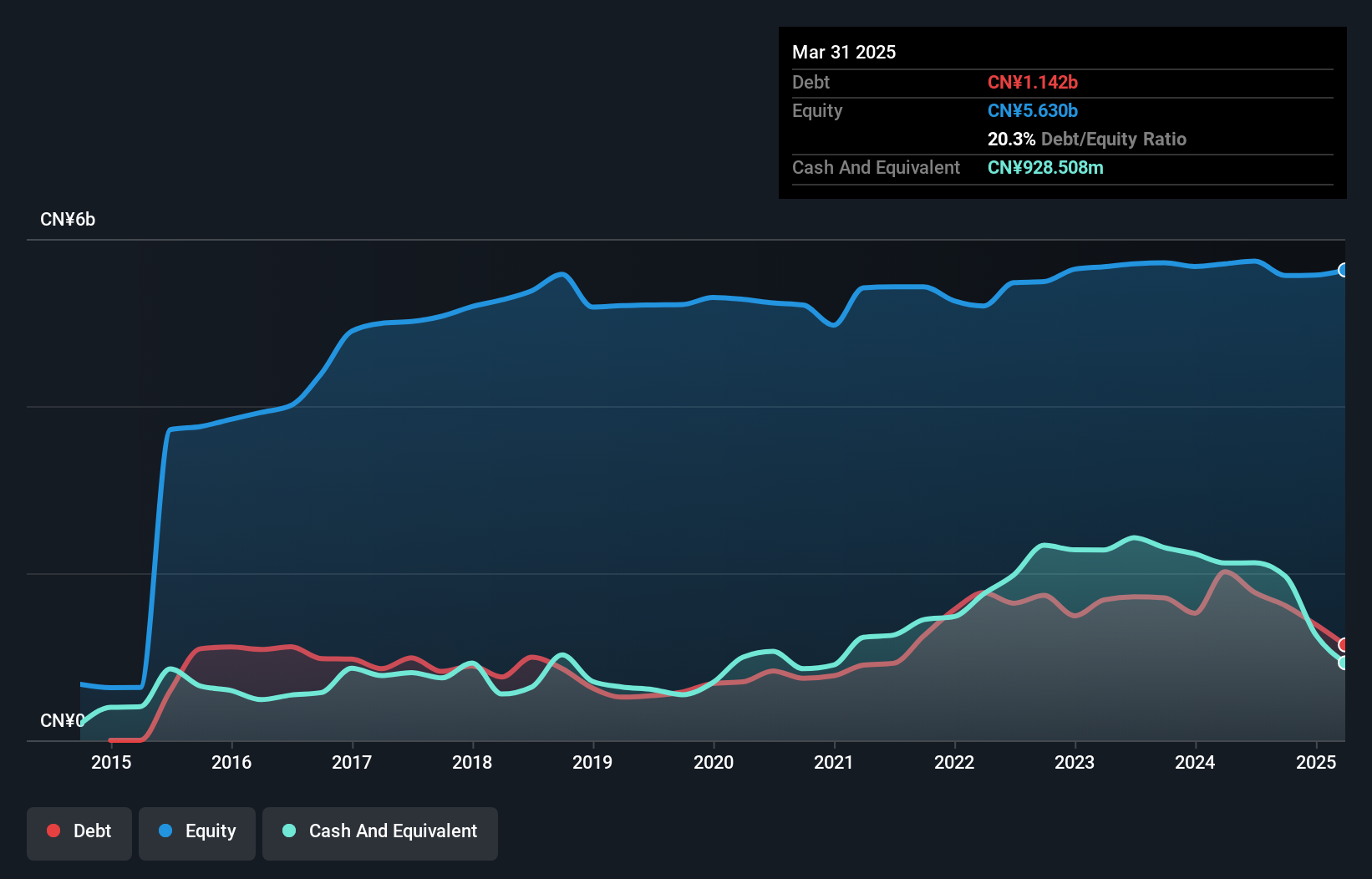

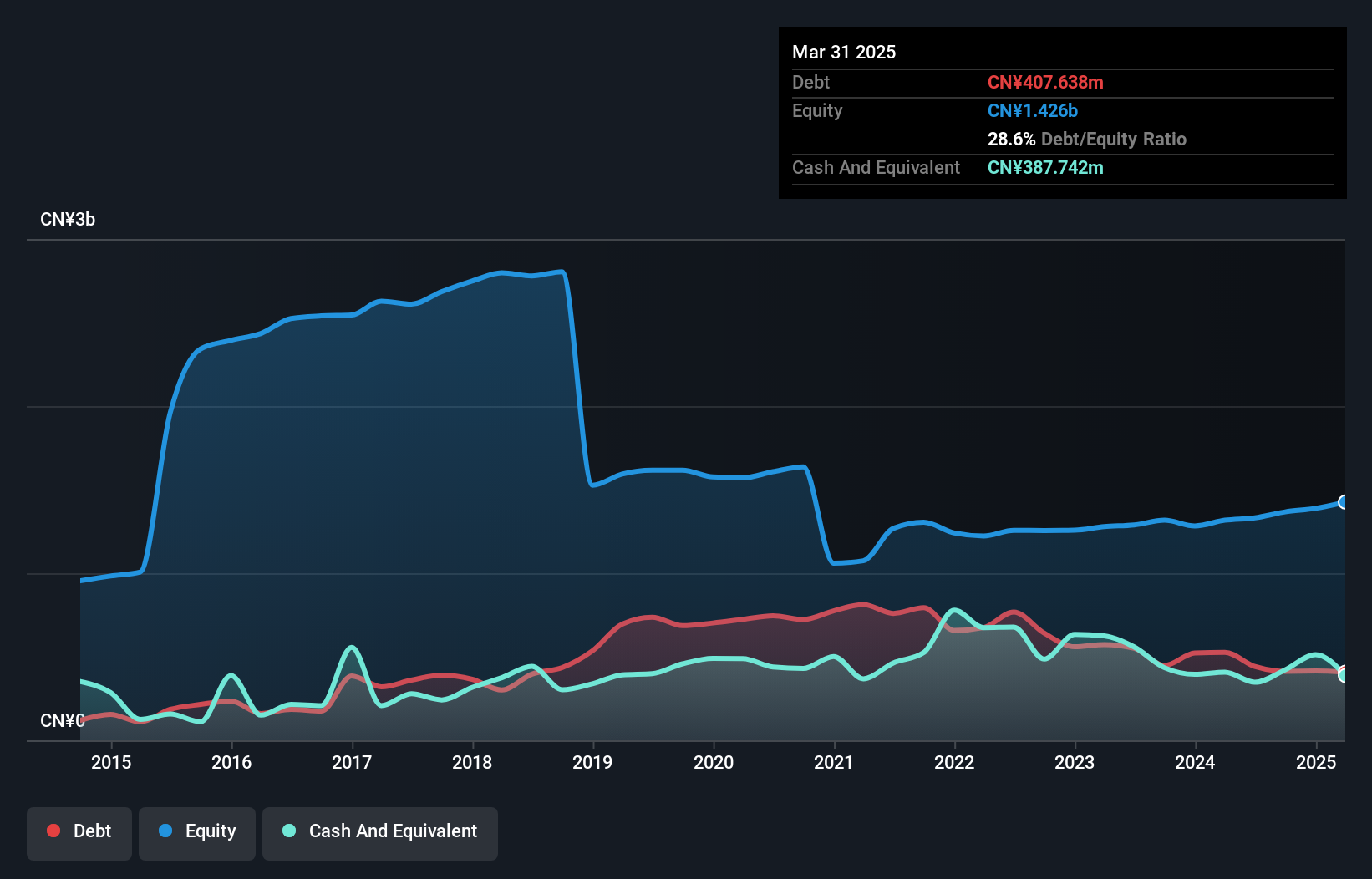

Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. presents a mixed picture for investors interested in penny stocks. The company reported annual revenue of CN¥325.52 million, indicating some operational scale, but net income declined significantly to CN¥16.61 million from the previous year. Despite this, it maintains a strong balance sheet with short-term assets exceeding both short and long-term liabilities and more cash than debt, reducing financial risk. However, profit margins have narrowed to 4.6%, and earnings growth has been negative recently due to large one-off gains impacting results, highlighting volatility in financial performance amidst an experienced management team.

- Click here and access our complete financial health analysis report to understand the dynamics of Guangxi Oriental Intelligent Manufacturing Technology.

- Explore historical data to track Guangxi Oriental Intelligent Manufacturing Technology's performance over time in our past results report.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aotecar New Energy Technology Co., Ltd. focuses on the R&D, design, manufacture, and sale of automotive AC compressors and HVAC systems, with a market cap of CN¥7.66 billion.

Operations: The company generates its revenue primarily from the manufacturing of thermal management components, totaling CN¥8.41 billion.

Market Cap: CN¥7.66B

Aotecar New Energy Technology Co., Ltd. offers a complex landscape for penny stock investors, with its market cap at CN¥7.66 billion and revenue reaching CN¥8.41 billion primarily from automotive components. The company shows financial resilience, with short-term assets of CN¥6.5 billion surpassing both short and long-term liabilities, while maintaining satisfactory debt levels covered by operating cash flow at 55%. Earnings have grown significantly by 46.5% over the past year despite large one-off losses impacting results, though return on equity remains low at 1.9%. Recent dividend decreases may signal caution in shareholder returns moving forward.

- Get an in-depth perspective on Aotecar New Energy Technology's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into Aotecar New Energy Technology's track record.

Wutong Holding Group (SZSE:300292)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Wutong Holding Group Co., Ltd. manufactures intelligent telecommunication devices and provides internet information services in China, with a market cap of CN¥6.28 billion.

Operations: Revenue Segments: No specific revenue segments are reported for Wutong Holding Group Co., Ltd.

Market Cap: CN¥6.28B

Wutong Holding Group presents a mixed picture for penny stock investors. With a market cap of CN¥6.28 billion, the company shows solid financial health, as short-term assets of CN¥2.1 billion exceed both short and long-term liabilities. Its debt levels are satisfactory, with interest well covered by EBIT and operating cash flow covering 34.5% of debt. The company has demonstrated impressive earnings growth of 150.7% over the past year, significantly outpacing industry averages; however, its return on equity remains low at 7.2%. Despite stable weekly volatility and an experienced management team, profit margins remain modest at 2.1%.

- Take a closer look at Wutong Holding Group's potential here in our financial health report.

- Evaluate Wutong Holding Group's historical performance by accessing our past performance report.

Key Takeaways

- Reveal the 3,923 hidden gems among our Global Penny Stocks screener with a single click here.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002175

Guangxi Oriental Intelligent Manufacturing Technology

Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd.

Flawless balance sheet very low.

Market Insights

Community Narratives