- Hong Kong

- /

- Construction

- /

- SEHK:9900

LifeTech Scientific And 2 Other Noteworthy Penny Stocks In Global

Reviewed by Simply Wall St

The global markets have been making headlines with the Federal Reserve's recent decision to cut interest rates for the first time this year, leading major U.S. stock indexes to reach record highs and sparking a rally among small-cap stocks. In such an evolving economic landscape, investors often seek opportunities in various corners of the market, including penny stocks. While the term 'penny stocks' might seem outdated, these investments can still offer significant potential by combining affordability with growth prospects when supported by strong financials.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.56 | HK$971.08M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.70 | A$412.55M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.625 | MYR317.8M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.48 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.41 | MYR566.19M | ✅ 5 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.30 | SGD12.99B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.22 | £194.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.065 | €285.43M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,720 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases globally, with a market cap of HK$8.66 billion.

Operations: The company's revenue is primarily derived from three segments: Structural Heart Diseases Business (CN¥527.87 million), Peripheral Vascular Diseases Business (CN¥762.08 million), and Cardiac Pacing and Electrophysiology Business (CN¥37.63 million).

Market Cap: HK$8.66B

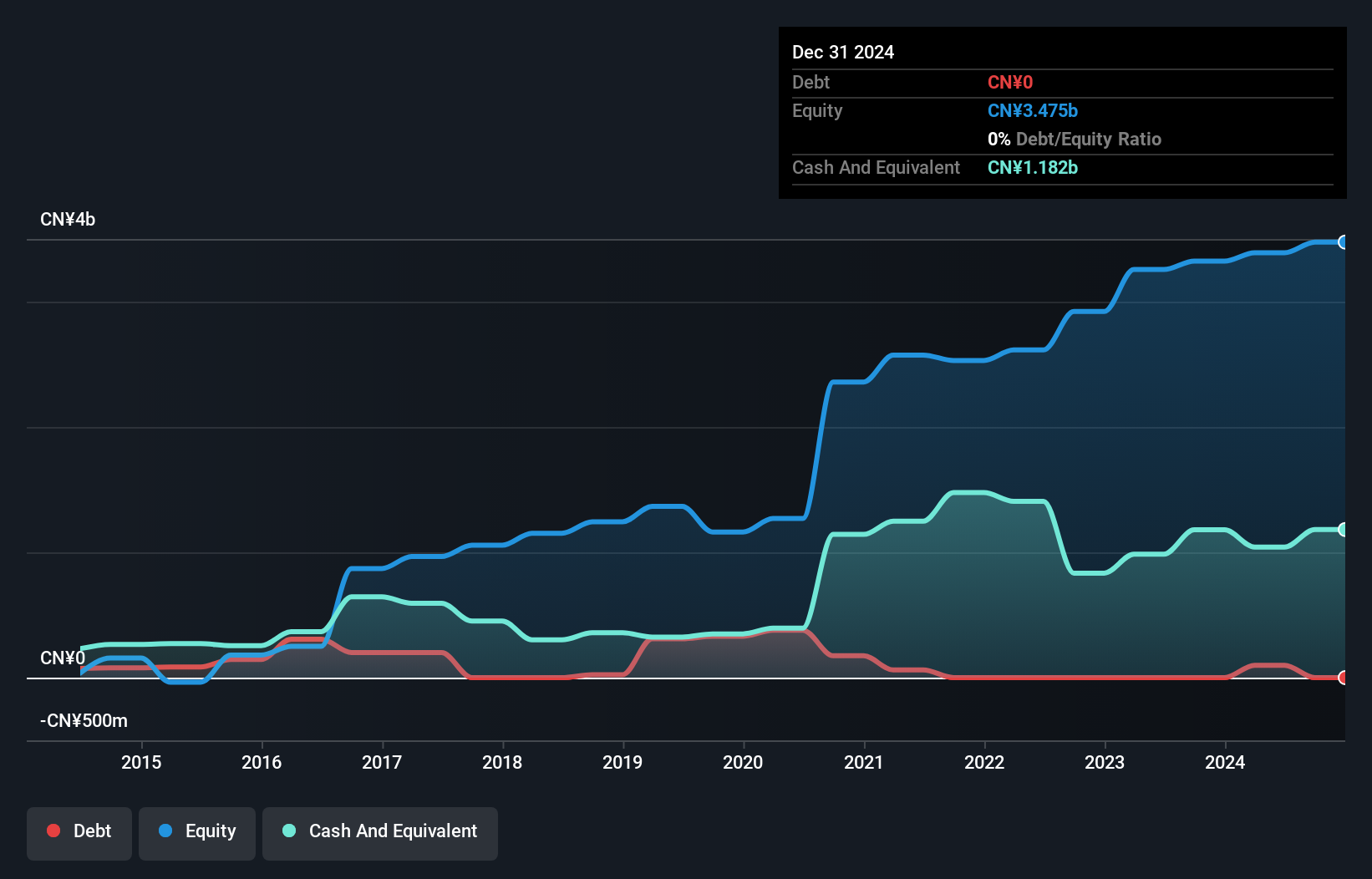

LifeTech Scientific, with a market cap of HK$8.66 billion, has faced challenges with declining earnings over the past five years and a recent drop in net profit margins from 19.4% to 5.4%. Despite this, the company remains debt-free and its seasoned board offers stability. Recent developments include the admission of their Congenital Heart Defect Occluder into China's NMPA Special Approval Procedure for Innovative Medical Devices, potentially expediting its market launch and enhancing their product portfolio. This strategic move could address clinical needs in congenital heart disease treatments while supporting LifeTech’s growth trajectory in medical devices.

- Navigate through the intricacies of LifeTech Scientific with our comprehensive balance sheet health report here.

- Assess LifeTech Scientific's previous results with our detailed historical performance reports.

Hong Kong Zcloud Technology Construction (SEHK:9900)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hong Kong Zcloud Technology Construction Limited is an investment holding company that provides subcontracting works for public and private sectors in Hong Kong, with a market cap of HK$7.41 billion.

Operations: The company generates revenue of HK$1.28 billion from its building construction and RMAA services.

Market Cap: HK$7.41B

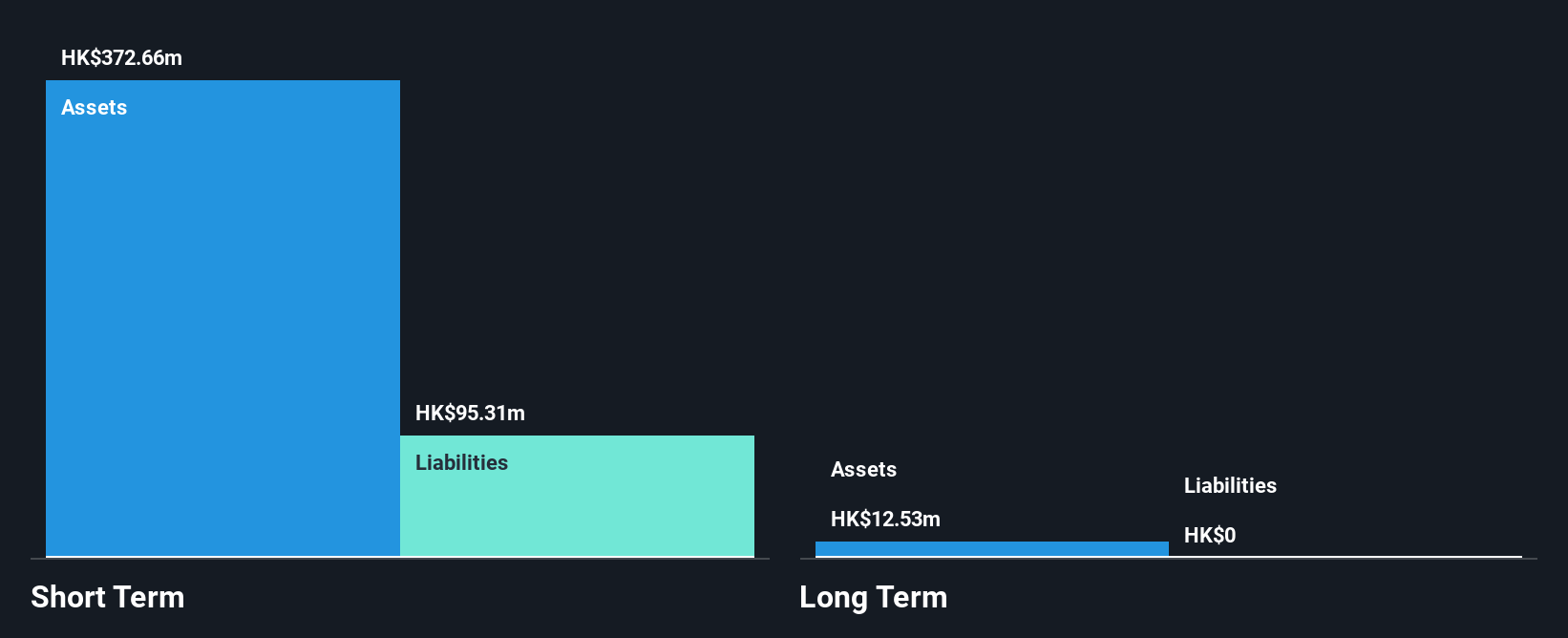

Hong Kong Zcloud Technology Construction, with a market cap of HK$7.41 billion, has demonstrated moderate earnings growth of 12.1% over the past year, surpassing the construction industry's decline. Despite high share price volatility and a relatively inexperienced board and management team, the company maintains financial stability with no debt and sufficient short-term assets to cover liabilities. Recent inclusion in the S&P Global BMI Index could enhance visibility among investors. The company's recent stock split may increase liquidity but also signals potential for future strategic moves or capital restructuring efforts to support growth initiatives.

- Click here and access our complete financial health analysis report to understand the dynamics of Hong Kong Zcloud Technology Construction.

- Explore historical data to track Hong Kong Zcloud Technology Construction's performance over time in our past results report.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★★

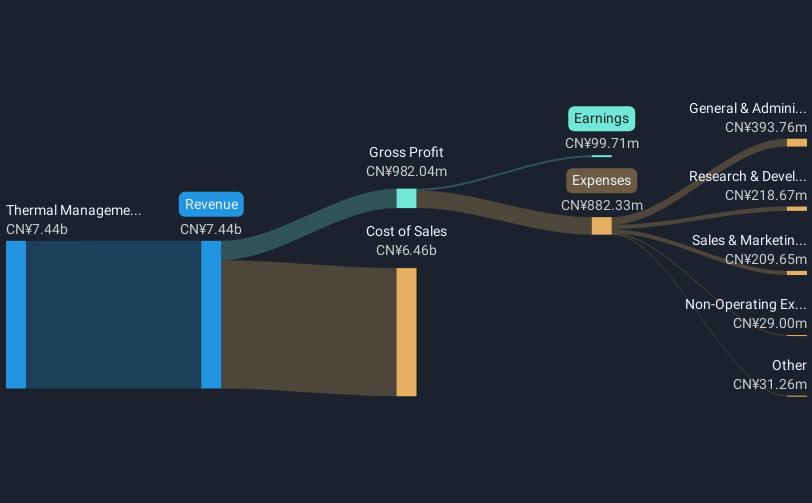

Overview: Aotecar New Energy Technology Co., Ltd. specializes in the research, design, manufacture, and sale of automotive AC compressors and HVAC systems, with a market cap of CN¥8.89 billion.

Operations: The company generates its revenue primarily from the manufacturing of thermal management components, with this segment contributing CN¥8.50 billion.

Market Cap: CN¥8.89B

Aotecar New Energy Technology, with a market cap of CN¥8.89 billion, has shown significant earnings growth of 48.8% annually over the past five years, though recent growth slowed to 10.6%. The company's short-term assets comfortably cover both its short- and long-term liabilities, reflecting solid financial health. Despite a large one-off loss impacting recent results and low return on equity at 1.9%, Aotecar's debt is well-managed with operating cash flow covering 82.5% of debt obligations. Recent earnings reports indicate stable revenue growth and improved net income year-over-year, highlighting operational resilience amidst industry challenges.

- Get an in-depth perspective on Aotecar New Energy Technology's performance by reading our balance sheet health report here.

- Examine Aotecar New Energy Technology's past performance report to understand how it has performed in prior years.

Make It Happen

- Access the full spectrum of 3,720 Global Penny Stocks by clicking on this link.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Zcloud Technology Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9900

Hong Kong Zcloud Technology Construction

An investment holding company, engages in the provision of subcontracting works for public and private sectors in Hong Kong.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives