- China

- /

- Auto Components

- /

- SZSE:002239

Global Penny Stocks To Watch In October 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility, marked by easing monetary policies and fluctuating investor sentiment, the allure of penny stocks remains intriguing for many investors. Often representing smaller or newer companies, penny stocks can offer unique opportunities for growth at lower price points. Despite their vintage-sounding name, these investments can provide significant returns when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.51 | HK$927.78M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$424.49M | ✅ 4 ⚠️ 3 View Analysis > |

| HSS Engineers Berhad (KLSE:HSSEB) | MYR0.57 | MYR289.83M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.16 | SGD470.14M | ✅ 4 ⚠️ 1 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.29 | MYR518M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.34 | SGD13.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.55 | $319.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.04 | €281.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,569 stocks from our Global Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Leo Group (SZSE:002131)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Leo Group Co., Ltd. primarily offers digital marketing services in China, with a market cap of CN¥31.82 billion.

Operations: The company generates revenue from two main segments: the Manufacturing Sector, contributing CN¥4.62 billion, and the Internet Advertising Section, which brings in CN¥15.55 billion.

Market Cap: CN¥31.82B

Leo Group Co., Ltd. has recently become profitable, reporting a net income of CN¥478.19 million for the first half of 2025, compared to a loss in the previous year. Despite this turnaround, its earnings have declined by an average of 35% annually over five years. The company's financials show stability with short-term assets exceeding liabilities and more cash than total debt, although operating cash flow coverage is weak at 6.4%. Recent amendments to company bylaws suggest strategic moves towards an H-share offering in Hong Kong, potentially impacting future capital structure and governance practices.

- Take a closer look at Leo Group's potential here in our financial health report.

- Explore historical data to track Leo Group's performance over time in our past results report.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Aotecar New Energy Technology Co., Ltd. focuses on the R&D, design, manufacture, and sale of automotive AC compressors and HVAC systems with a market cap of CN¥8.67 billion.

Operations: The company's revenue primarily comes from its Thermal Management Components Manufacturing segment, generating CN¥8.50 billion.

Market Cap: CN¥8.67B

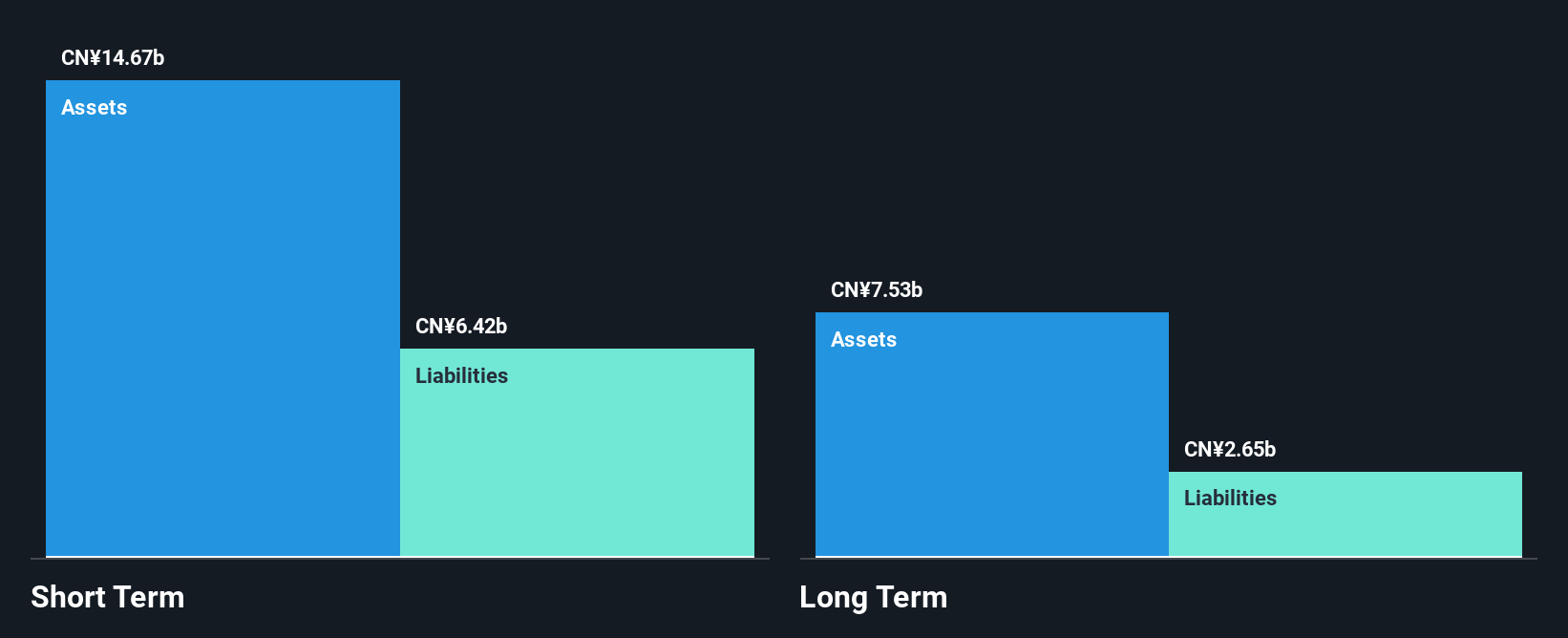

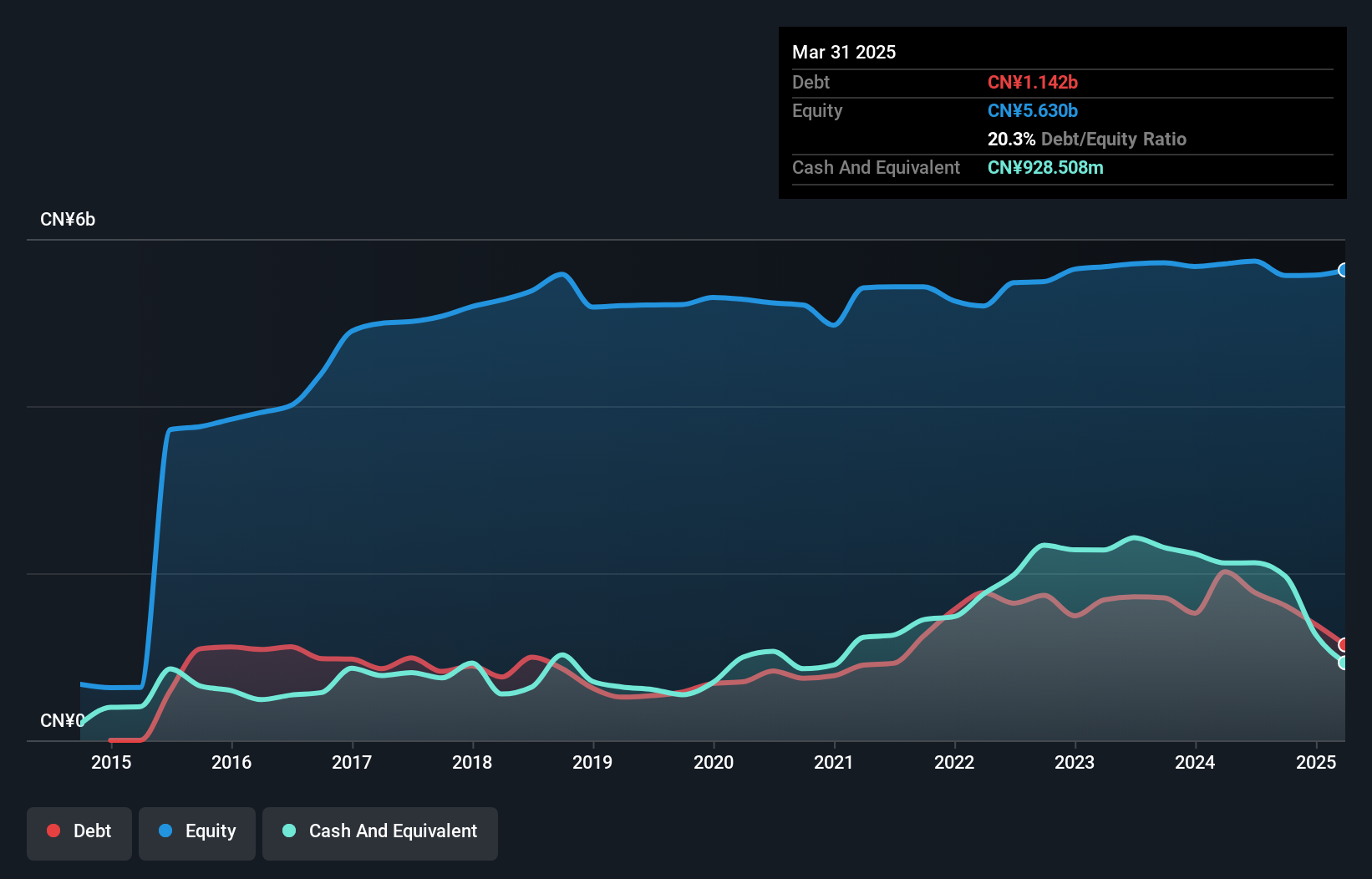

Aotecar New Energy Technology Co., Ltd. presents a mixed picture for investors in the penny stock realm. The company has demonstrated consistent revenue generation, with sales reaching CN¥3.88 billion for the first half of 2025, and earnings growth surpassing industry averages over the past year. However, its return on equity remains low at 1.9%, and recent financials were impacted by a significant one-off loss of CN¥56.9 million. A private placement raising CN¥499 million indicates strategic capital infusion efforts, while stable short-term assets exceeding liabilities provide some financial comfort amidst volatility concerns in this sector.

- Unlock comprehensive insights into our analysis of Aotecar New Energy Technology stock in this financial health report.

- Assess Aotecar New Energy Technology's previous results with our detailed historical performance reports.

Nanfang Pump Industry (SZSE:300145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Nanfang Pump Industry Co., Ltd., with a market cap of CN¥8.48 billion, operates in the general equipment manufacturing sector through its subsidiaries.

Operations: Nanfang Pump Industry Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥8.48B

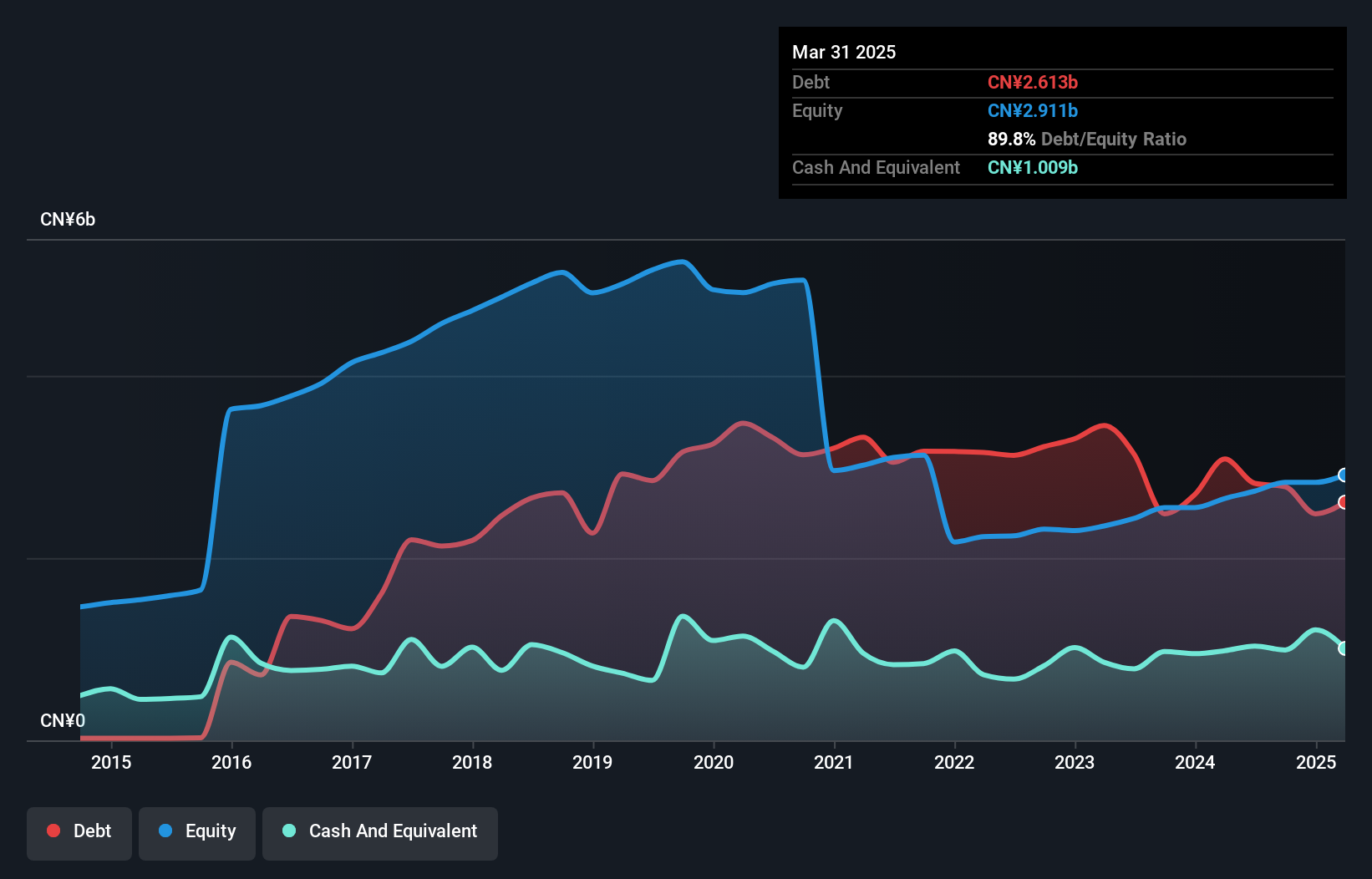

Nanfang Pump Industry Co., Ltd. offers a nuanced investment case within the penny stock spectrum. Its recent earnings report shows revenue of CN¥2.27 billion for the first half of 2025, with net income rising slightly to CN¥168.87 million year-over-year, indicating steady financial performance despite a high debt-to-equity ratio of 77.8%. The company's short-term assets comfortably cover both short and long-term liabilities, suggesting solid liquidity management. However, its profit margins have slightly decreased to 4.4%, and its share price remains highly volatile over the past three months, reflecting inherent risks typical in this investment category.

- Click here to discover the nuances of Nanfang Pump Industry with our detailed analytical financial health report.

- Learn about Nanfang Pump Industry's future growth trajectory here.

Key Takeaways

- Gain an insight into the universe of 3,569 Global Penny Stocks by clicking here.

- Curious About Other Options? We've found 17 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002239

Aotecar New Energy Technology

Engages in the research and development, design, manufacture, and sale of automotive AC compressors and HVAC systems.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives