- China

- /

- Auto Components

- /

- SZSE:002239

Discover 3 Promising Global Penny Stocks Under US$2B Market Cap

Reviewed by Simply Wall St

Global markets have shown resilience recently, with U.S. equities rallying on the back of a 90-day tariff pause between the U.S. and China, which has led to strong gains across major indices like the Nasdaq Composite and S&P 500. Amid this backdrop of easing trade tensions and cooling inflation, investors might find themselves exploring various opportunities in less traditional areas of the market. Penny stocks, often representing smaller or newer companies with potential for growth at lower price points, continue to offer intriguing possibilities for those seeking value beyond mainstream investments.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.41 | SGD166.17M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.16 | SGD8.5B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.58 | SEK268.45M | ✅ 4 ⚠️ 2 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.985 | MYR1.54B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.375 | MYR1.09B | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.18 | HK$750.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.24 | HK$2.12B | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.93 | £443.18M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.344 | £2.37B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 5,616 stocks from our Global Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Guangdong DFP New Material Group (SHSE:601515)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Guangdong DFP New Material Group Co., Ltd. operates in the new materials industry, focusing on the production and sale of specialized materials, with a market cap of CN¥7.57 billion.

Operations: No specific revenue segments are reported for Guangdong DFP New Material Group Co., Ltd.

Market Cap: CN¥7.57B

Guangdong DFP New Material Group Co., Ltd., with a market cap of CN¥7.57 billion, has faced challenges in recent financial performance, reporting a net loss of CN¥9.85 million for Q1 2025 and a significant decline in full-year revenue to CN¥1.42 billion from the previous year's CN¥2.63 billion. Despite being unprofitable and experiencing increased losses over the past five years, the company maintains strong liquidity with short-term assets exceeding both short-term and long-term liabilities. Additionally, its debt is well covered by operating cash flow, while shareholders have not been significantly diluted recently following a modest share buyback program.

- Click to explore a detailed breakdown of our findings in Guangdong DFP New Material Group's financial health report.

- Understand Guangdong DFP New Material Group's earnings outlook by examining our growth report.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aotecar New Energy Technology Co., Ltd. focuses on the research, development, design, manufacture, and sale of automotive AC compressors and HVAC systems with a market cap of CN¥8.26 billion.

Operations: The company's revenue is primarily derived from its Thermal Management Components Manufacturing segment, which generated CN¥8.41 billion.

Market Cap: CN¥8.26B

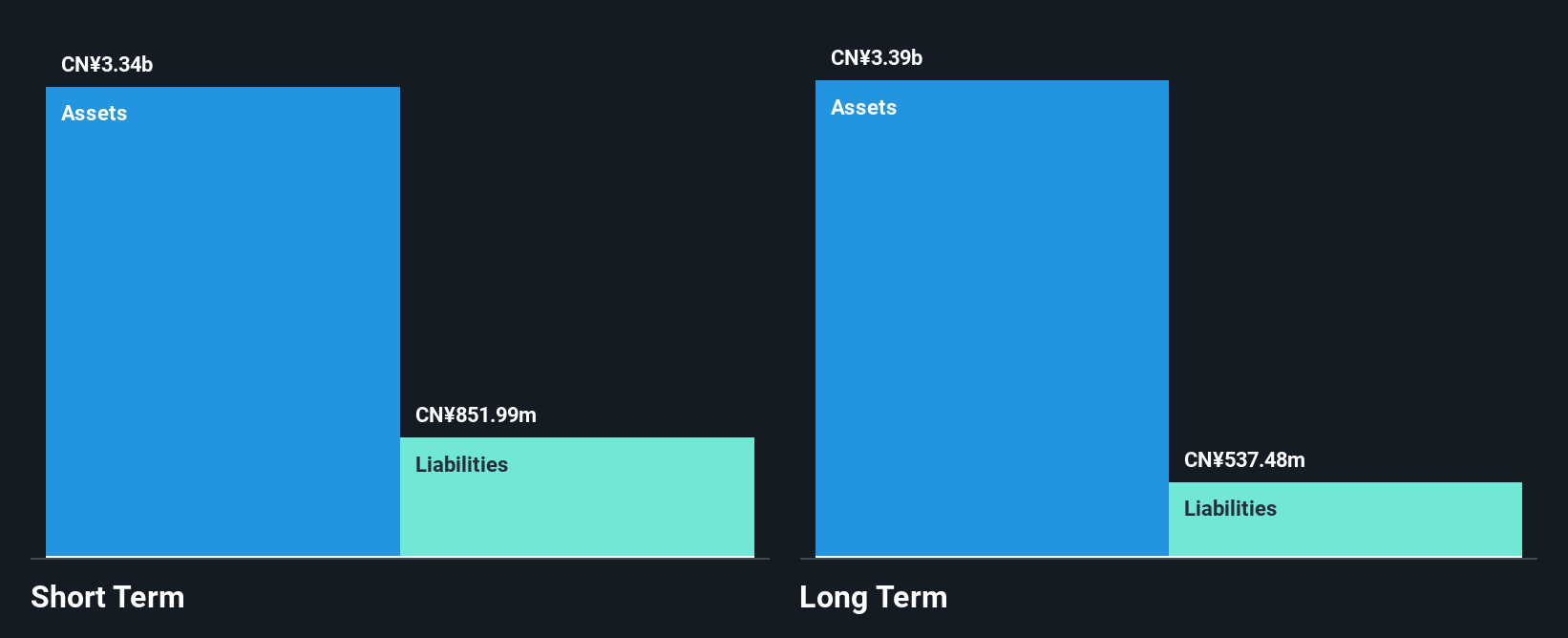

Aotecar New Energy Technology Co., Ltd. has demonstrated robust growth, with earnings rising by 46.5% over the past year, outpacing the broader Auto Components industry. The company reported a net income of CN¥105.78 million for 2024 and CN¥46.69 million for Q1 2025, reflecting steady revenue increases to CN¥8.14 billion annually and CN¥1.91 billion quarterly. Despite a one-off loss impacting recent financials, its short-term assets comfortably cover liabilities, and debt levels remain satisfactory with strong interest coverage from profits. Additionally, Aotecar is pursuing strategic capital initiatives through private placements to bolster future growth prospects.

- Take a closer look at Aotecar New Energy Technology's potential here in our financial health report.

- Understand Aotecar New Energy Technology's track record by examining our performance history report.

Beijing Watertek Information Technology (SZSE:300324)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Watertek Information Technology Co., Ltd. operates in the information technology sector and has a market capitalization of CN¥6.77 billion.

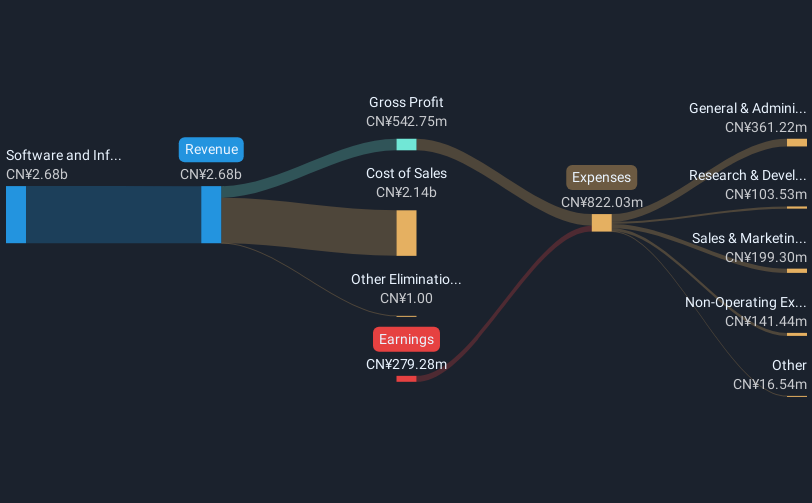

Operations: The company generates CN¥2.73 billion in revenue from its Software and Information Technology Services Industry segment.

Market Cap: CN¥6.77B

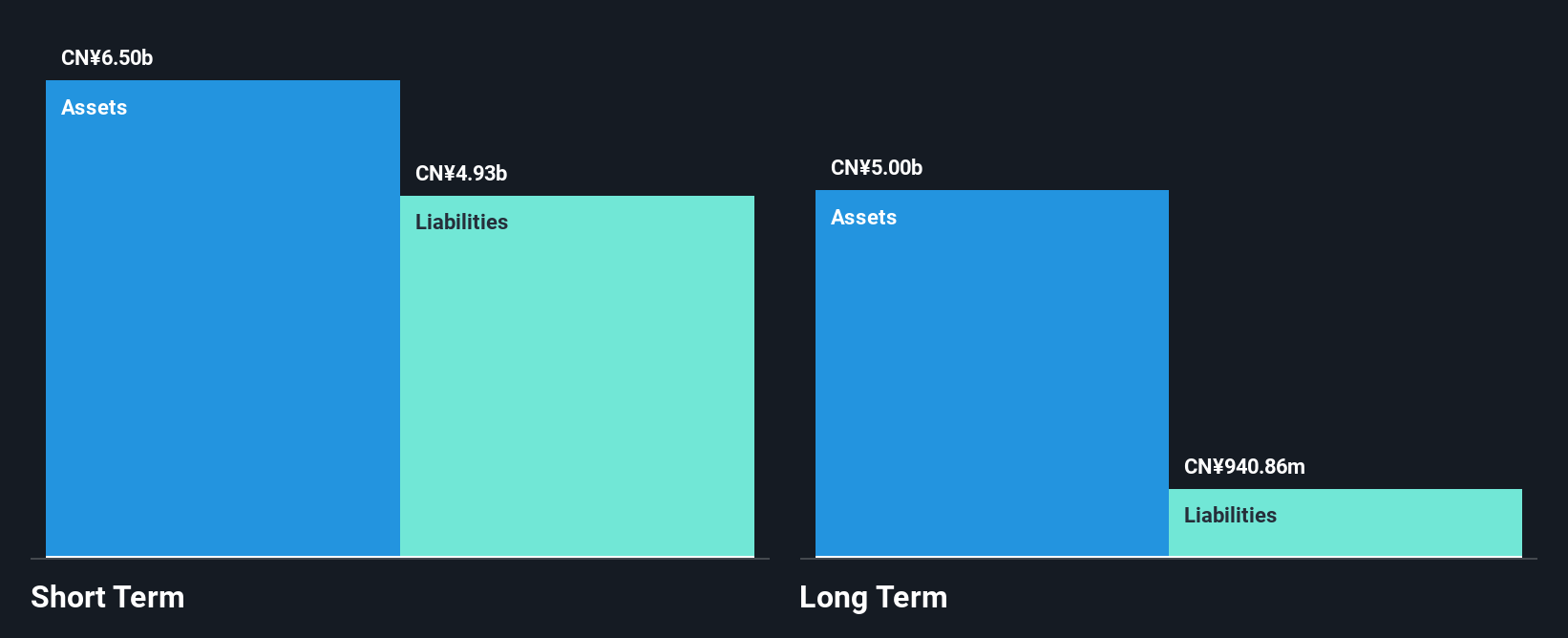

Beijing Watertek Information Technology Co., Ltd. operates with a market capitalization of CN¥6.77 billion, generating revenue of CN¥2.73 billion in 2024, though it remains unprofitable with a net loss of CN¥274.53 million for the year and CN¥59.13 million for Q1 2025. Despite this, the company has reduced its debt-to-equity ratio over five years and maintains more cash than total debt, providing a cash runway exceeding three years based on current free cash flow trends. However, its share price has been highly volatile recently, reflecting ongoing financial challenges despite stable short-term asset coverage against liabilities.

- Unlock comprehensive insights into our analysis of Beijing Watertek Information Technology stock in this financial health report.

- Explore historical data to track Beijing Watertek Information Technology's performance over time in our past results report.

Seize The Opportunity

- Click this link to deep-dive into the 5,616 companies within our Global Penny Stocks screener.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002239

Aotecar New Energy Technology

Engages in the research and development, design, manufacture, and sale of automotive AC compressors and HVAC systems.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives