- China

- /

- Construction

- /

- SZSE:300008

3 Promising Penny Stocks With Market Caps Under US$2B

Reviewed by Simply Wall St

Global markets have recently experienced fluctuations, with U.S. stocks ending the week lower amid tariff uncertainties and mixed economic data. Despite these challenges, investors continue to seek opportunities in various market segments, including penny stocks—a term that may seem outdated but still holds relevance for those looking at smaller or newer companies with growth potential. When backed by strong financials and solid fundamentals, penny stocks can offer a unique opportunity for investors to uncover hidden value in quality companies poised for growth.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Bosideng International Holdings (SEHK:3998) | HK$3.83 | HK$43.97B | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.545 | MYR2.71B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.995 | £481.5M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.08 | £329.19M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.405 | MYR1.13B | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.922 | £146.94M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.85 | MYR282.15M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.705 | MYR417.12M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.13 | HK$717.31M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$144.03M | ★★★★☆☆ |

Click here to see the full list of 5,716 stocks from our Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Aotecar New Energy Technology (SZSE:002239)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Aotecar New Energy Technology Co., Ltd. specializes in the R&D, design, manufacture, and sale of automotive AC compressors and HVAC systems, with a market cap of CN¥8.67 billion.

Operations: The company generates revenue of CN¥7.51 billion from its Thermal Management Components Manufacturing segment.

Market Cap: CN¥8.67B

Aotecar New Energy Technology, with a market cap of CN¥8.67 billion and revenue from its Thermal Management Components Manufacturing segment at CN¥7.51 billion, presents a mixed investment case. While the company has become profitable over the past five years with earnings growing by 35.6% annually, recent performance shows negative earnings growth and declining profit margins from 2.1% to 1.4%. The company's short-term assets exceed both short and long-term liabilities, indicating solid liquidity management despite an increase in its debt-to-equity ratio over five years. Additionally, interest coverage is not a concern due to sufficient earnings relative to interest expenses.

- Click here and access our complete financial health analysis report to understand the dynamics of Aotecar New Energy Technology.

- Examine Aotecar New Energy Technology's past performance report to understand how it has performed in prior years.

Bestway Marine & Energy TechnologyLtd (SZSE:300008)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Bestway Marine & Energy Technology Co., Ltd offers marine and offshore engineering research and design services in China, with a market cap of CN¥8.14 billion.

Operations: No specific revenue segments have been reported for Bestway Marine & Energy Technology Co., Ltd.

Market Cap: CN¥8.14B

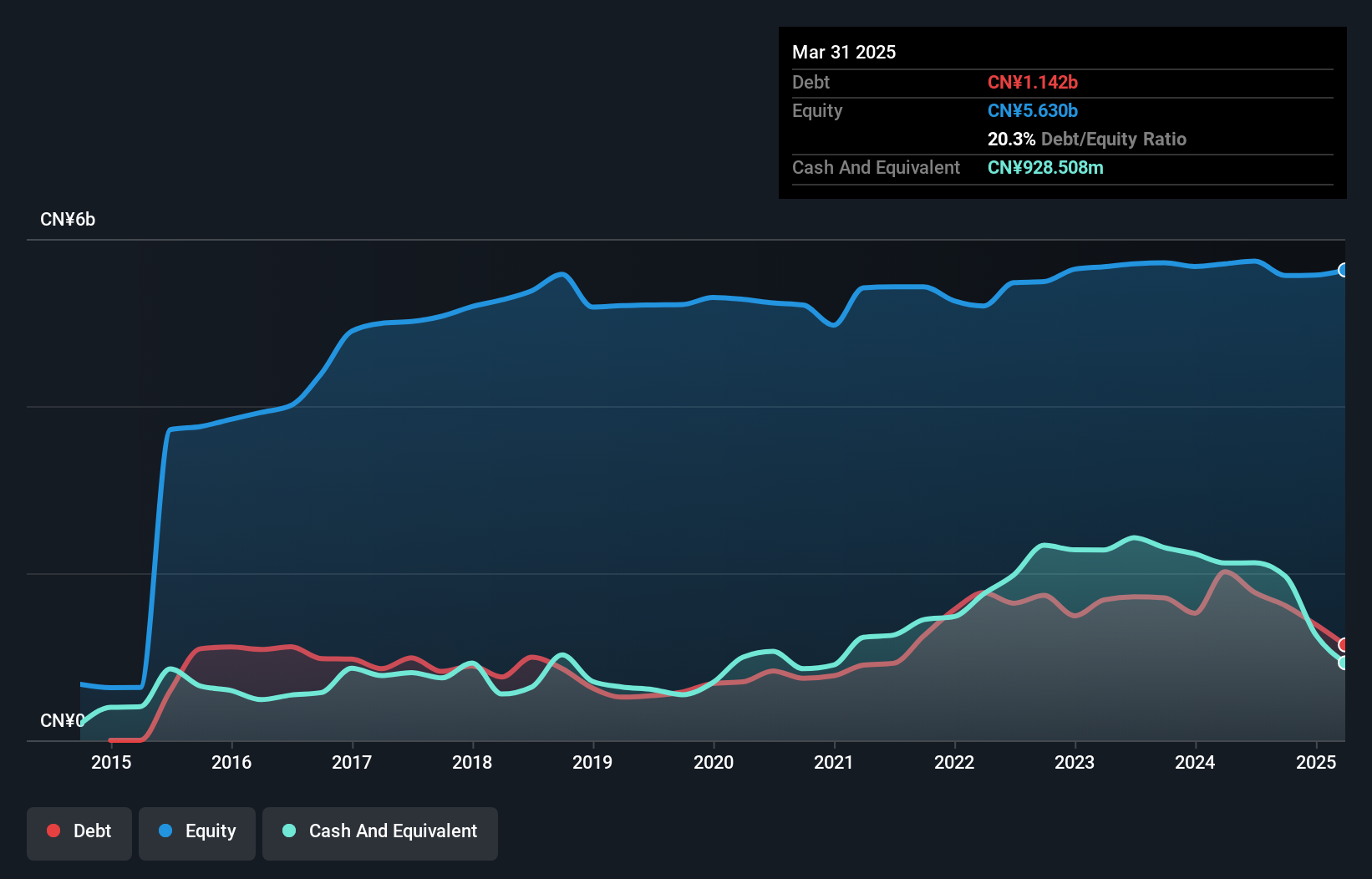

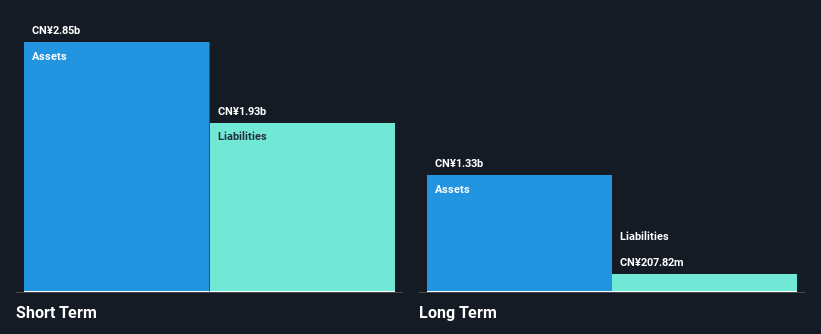

Bestway Marine & Energy Technology Ltd., with a market cap of CN¥8.14 billion, presents an intriguing yet cautious investment case. Despite achieving profitability over the past five years with earnings growing at 76.6% annually, recent performance shows negative earnings growth and declining profit margins from 4.5% to 2.5%. The company's debt position has improved significantly, reducing its debt to equity ratio from 46% to a satisfactory 21.5%, and interest payments are well covered by EBIT (18.4x). Short-term assets comfortably cover both short and long-term liabilities, reflecting robust liquidity management amidst stable weekly volatility at 5%.

- Dive into the specifics of Bestway Marine & Energy TechnologyLtd here with our thorough balance sheet health report.

- Gain insights into Bestway Marine & Energy TechnologyLtd's historical outcomes by reviewing our past performance report.

Sichuan Etrol Technologies (SZSE:300370)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sichuan Etrol Technologies Co., Ltd. is a Chinese company that manufactures and sells smart industry, automation, and oil and gas products and solutions, with a market cap of CN¥5.02 billion.

Operations: The company generates its revenue primarily from China, amounting to CN¥466.33 million.

Market Cap: CN¥5.02B

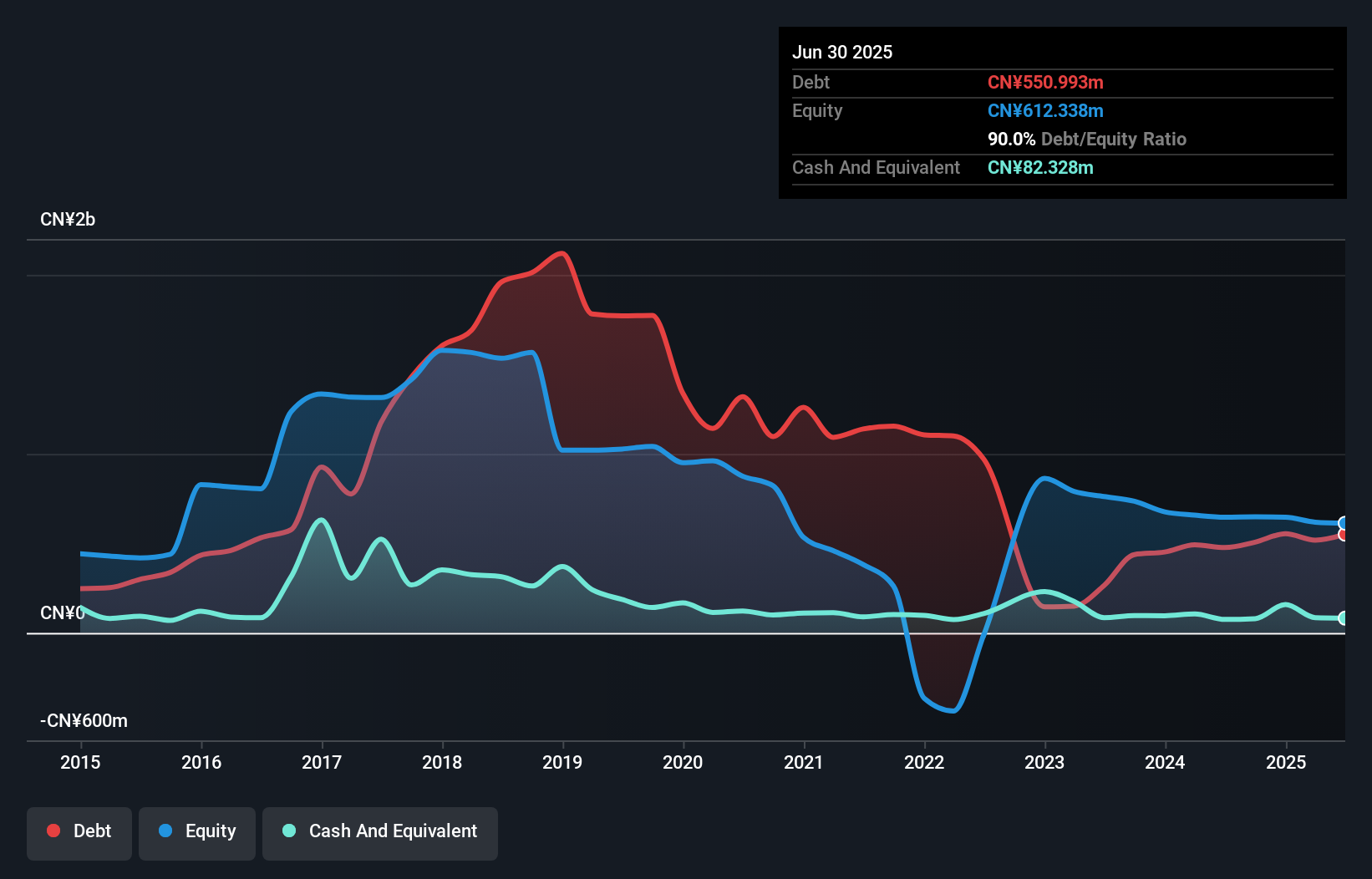

Sichuan Etrol Technologies, with a market cap of CN¥5.02 billion, presents a mixed investment case in the penny stock landscape. The company is unprofitable with a negative return on equity of -17.09%, but it has managed to reduce its losses by 1.2% per year over the past five years. Its financial position shows short-term assets exceeding both short and long-term liabilities, although it faces high net debt to equity at 65.9%. The management team is experienced with an average tenure of 7.1 years, yet the board's tenure suggests inexperience at 2.8 years on average.

- Click here to discover the nuances of Sichuan Etrol Technologies with our detailed analytical financial health report.

- Assess Sichuan Etrol Technologies' previous results with our detailed historical performance reports.

Summing It All Up

- Investigate our full lineup of 5,716 Penny Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bestway Marine & Energy TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300008

Bestway Marine & Energy TechnologyLtd

Provides marine and offshore engineering research and design services in China.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives