- South Korea

- /

- Chemicals

- /

- KOSDAQ:A033500

Asian Stocks Estimated To Be 12.7% To 26.2% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets respond to favorable trade deal news, Asian equities have shown resilience amid ongoing tariff discussions and economic uncertainties. In this environment, identifying undervalued stocks—those trading below their intrinsic value—can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1174.00 | ¥2321.82 | 49.4% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥23.34 | CN¥46.18 | 49.5% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥51.15 | CN¥101.32 | 49.5% |

| Polaris Holdings (TSE:3010) | ¥220.00 | ¥433.40 | 49.2% |

| Nan Ya Printed Circuit Board (TWSE:8046) | NT$177.00 | NT$350.10 | 49.4% |

| LigaChem Biosciences (KOSDAQ:A141080) | ₩139000.00 | ₩277490.02 | 49.9% |

| Hibino (TSE:2469) | ¥2345.00 | ¥4664.61 | 49.7% |

| Heartland Group Holdings (NZSE:HGH) | NZ$0.82 | NZ$1.62 | 49.4% |

| Forum Engineering (TSE:7088) | ¥1206.00 | ¥2405.10 | 49.9% |

| Andes Technology (TWSE:6533) | NT$274.50 | NT$542.92 | 49.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Dongsung FineTec (KOSDAQ:A033500)

Overview: Dongsung FineTec Co., Ltd. is a South Korean company that manufactures and sells cryogenic insulation products, with a market cap of approximately ₩811.48 billion.

Operations: The company's revenue segments include the Gas Business, generating approximately ₩23.03 billion, and Cooling Material, contributing around ₩609.47 billion.

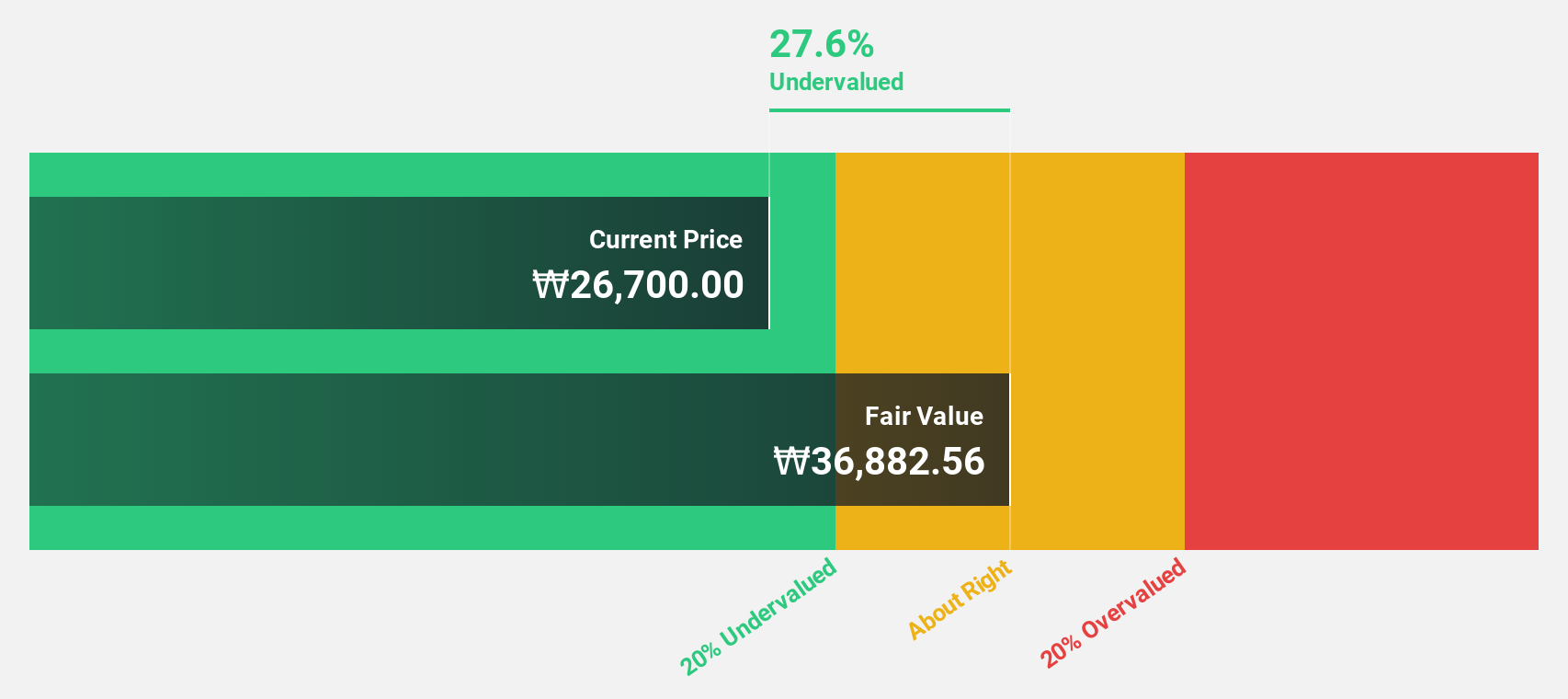

Estimated Discount To Fair Value: 26.2%

Dongsung FineTec is trading at ₩27,950, significantly undervalued compared to its estimated fair value of ₩37,869.08. Its earnings are projected to grow at 22.6% annually, outpacing the Korean market's growth rate and reflecting robust financial health despite an unstable dividend track record. Recent quarterly results showed net income of KRW 9 billion, up from KRW 8.69 billion a year earlier, reinforcing its strong cash flow position in the Asian market.

- Our growth report here indicates Dongsung FineTec may be poised for an improving outlook.

- Click to explore a detailed breakdown of our findings in Dongsung FineTec's balance sheet health report.

Nanjing Vazyme Biotech (SHSE:688105)

Overview: Nanjing Vazyme Biotech Co., Ltd provides technology solutions in life science, biomedicine, and in vitro diagnostics with a market cap of CN¥10.52 billion.

Operations: Nanjing Vazyme Biotech Co., Ltd generates revenue through its technology solutions in life science, biomedicine, and in vitro diagnostics.

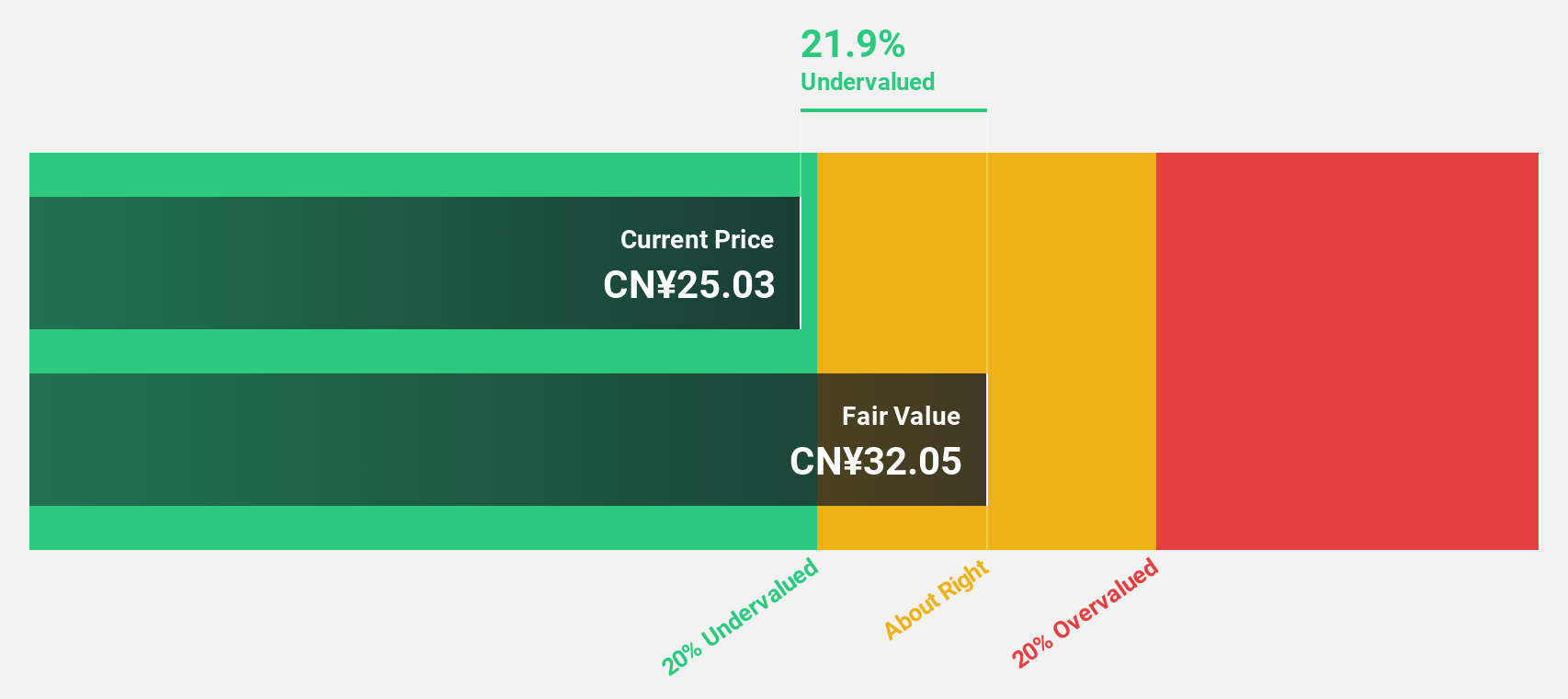

Estimated Discount To Fair Value: 17.1%

Nanjing Vazyme Biotech is trading at CN¥26.44, slightly below its fair value estimate of CN¥31.91, suggesting it may be undervalued based on cash flows. The company is expected to become profitable within three years, with earnings projected to grow 78.27% annually—surpassing market averages despite a low forecasted return on equity of 5.6%. A recent share buyback plan worth CN¥10 million aims to enhance shareholder value through potential equity incentives or employee stock ownership plans.

- Our expertly prepared growth report on Nanjing Vazyme Biotech implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Nanjing Vazyme Biotech.

Zhejiang Yinlun MachineryLtd (SZSE:002126)

Overview: Zhejiang Yinlun Machinery Co., Ltd. focuses on the research, development, manufacturing, and sale of thermal management and exhaust gas post-treatment products, with a market cap of CN¥24.97 billion.

Operations: The company generates revenue primarily from the sale of thermal management and exhaust gas post-treatment products.

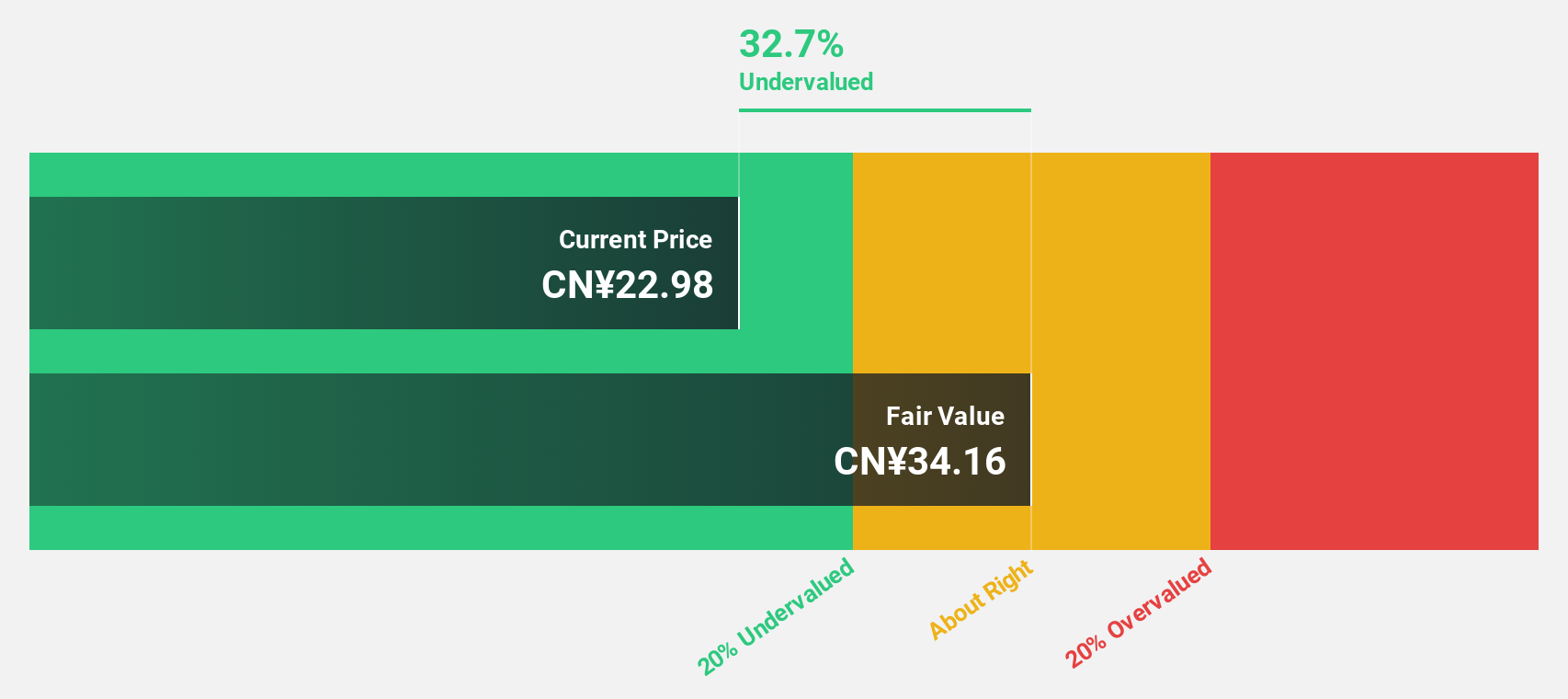

Estimated Discount To Fair Value: 12.7%

Zhejiang Yinlun Machinery is trading at CN¥30.13, undervalued relative to its fair value estimate of CN¥34.53. Earnings grew 18.9% last year and are projected to rise 25.12% annually, outpacing the Chinese market's growth rate of 23.5%. Despite a lower future return on equity forecast of 16.1%, recent share buybacks totaling CN¥34.96 million may enhance shareholder value through equity incentives or employee stock ownership plans.

- According our earnings growth report, there's an indication that Zhejiang Yinlun MachineryLtd might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Zhejiang Yinlun MachineryLtd.

Make It Happen

- Reveal the 265 hidden gems among our Undervalued Asian Stocks Based On Cash Flows screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A033500

Dongsung FineTec

Engages in the manufacture and sale of cryogenic insulation products in South Korea.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives