- South Korea

- /

- Machinery

- /

- KOSE:A075580

Asian Market Stocks Trading Below Estimated Value

Reviewed by Simply Wall St

As the Asian markets respond positively to a temporary de-escalation in U.S.-China trade tensions, investors are closely watching for opportunities that may arise from this newfound stability. In such an environment, identifying stocks trading below their estimated value becomes crucial, as these can offer potential growth prospects amid shifting economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| PixArt Imaging (TPEX:3227) | NT$221.50 | NT$440.53 | 49.7% |

| Shenzhen KSTAR Science and Technology (SZSE:002518) | CN¥22.82 | CN¥44.97 | 49.3% |

| Livero (TSE:9245) | ¥1706.00 | ¥3373.09 | 49.4% |

| Shandong Sunway Chemical Group (SZSE:002469) | CN¥9.24 | CN¥18.47 | 50% |

| H.U. Group Holdings (TSE:4544) | ¥3018.00 | ¥5975.82 | 49.5% |

| Brangista (TSE:6176) | ¥590.00 | ¥1164.79 | 49.3% |

| GEM (SZSE:002340) | CN¥6.26 | CN¥12.51 | 50% |

| Medley (TSE:4480) | ¥3080.00 | ¥6156.79 | 50% |

| Cosmax (KOSE:A192820) | ₩204500.00 | ₩404417.20 | 49.4% |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥39.53 | CN¥77.97 | 49.3% |

Let's dive into some prime choices out of the screener.

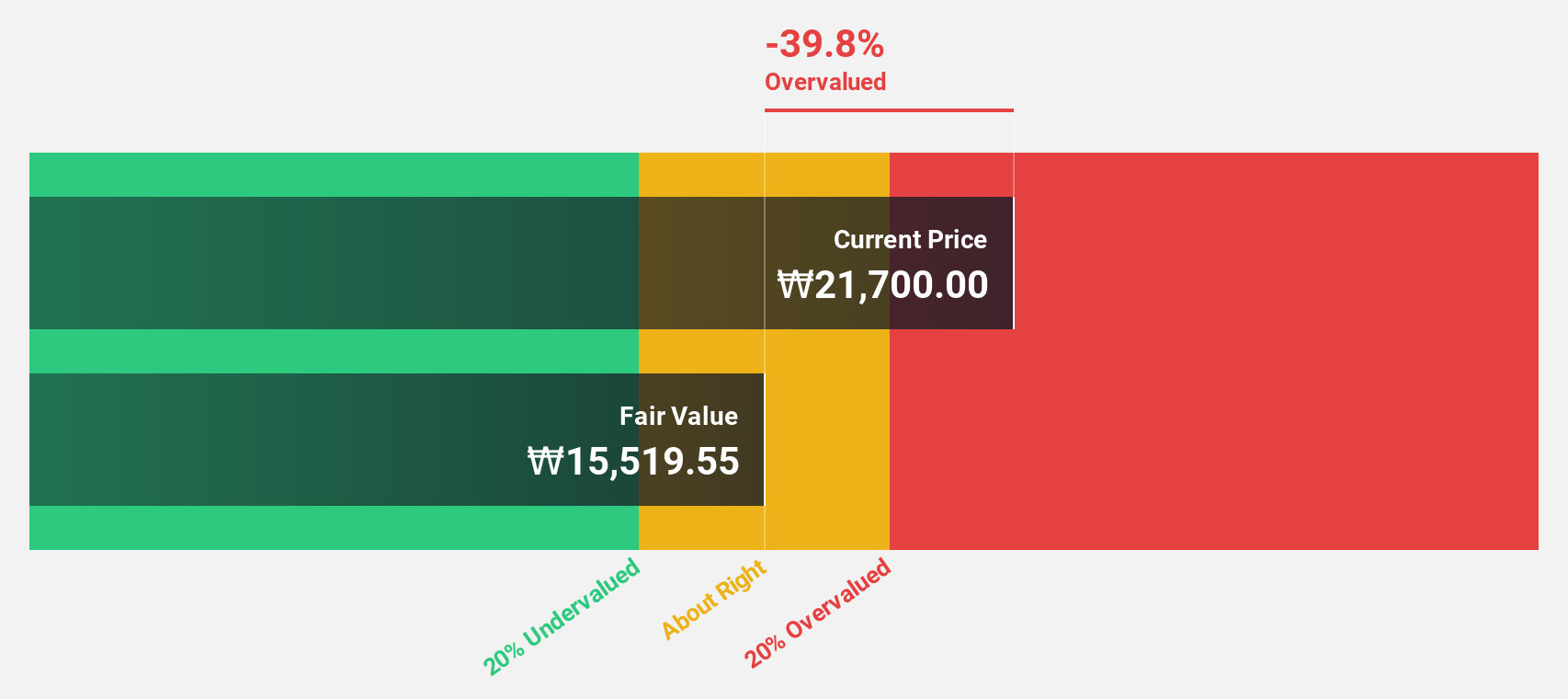

Sejin Heavy Industries (KOSE:A075580)

Overview: Sejin Heavy Industries Co., Ltd. is a South Korean company that manufactures and sells shipbuilding equipment, with a market cap of approximately ₩683.90 billion.

Operations: The company generates revenue of ₩352.38 billion from its shipbuilding sector.

Estimated Discount To Fair Value: 13.2%

Sejin Heavy Industries is trading at ₩12,030, below its estimated fair value of ₩13,859.75. Despite a volatile share price and profit margins declining from 4.6% to 3.2%, earnings are forecast to grow significantly at 52.22% annually, outpacing the Korean market's 20.4%. However, debt coverage by operating cash flow remains inadequate and the dividend yield of 1.66% lacks sufficient backing from earnings or free cash flows.

- The analysis detailed in our Sejin Heavy Industries growth report hints at robust future financial performance.

- Navigate through the intricacies of Sejin Heavy Industries with our comprehensive financial health report here.

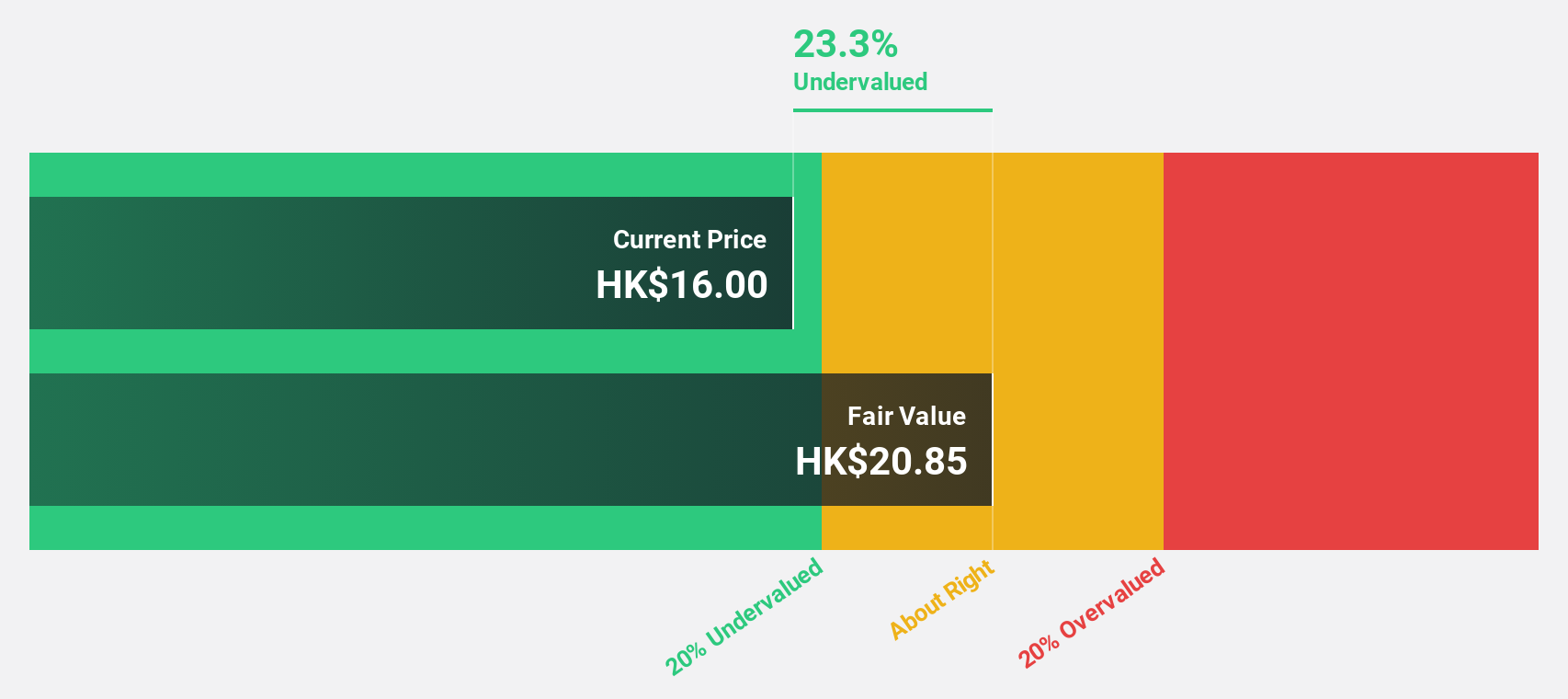

Genscript Biotech (SEHK:1548)

Overview: Genscript Biotech Corporation is an investment holding company that manufactures and sells life science research products and services across the United States, Europe, Mainland China, Asia Pacific, and other international markets with a market cap of HK$23.73 billion.

Operations: The company's revenue segments include Biologics Development Services at $95.02 million, Life Science Services and Products at $454.95 million, and Industrial Synthetic Biology Products at $53.69 million.

Estimated Discount To Fair Value: 43.9%

Genscript Biotech is currently trading at HK$10.94, significantly below its estimated fair value of HK$19.49, highlighting its undervaluation based on cash flows. The company reported a remarkable turnaround with net income of US$2.96 billion for 2024, compared to a loss the previous year. Forecasts indicate robust earnings growth of 65.8% annually over the next three years, surpassing market averages despite a modest revenue growth rate relative to higher benchmarks.

- Insights from our recent growth report point to a promising forecast for Genscript Biotech's business outlook.

- Click to explore a detailed breakdown of our findings in Genscript Biotech's balance sheet health report.

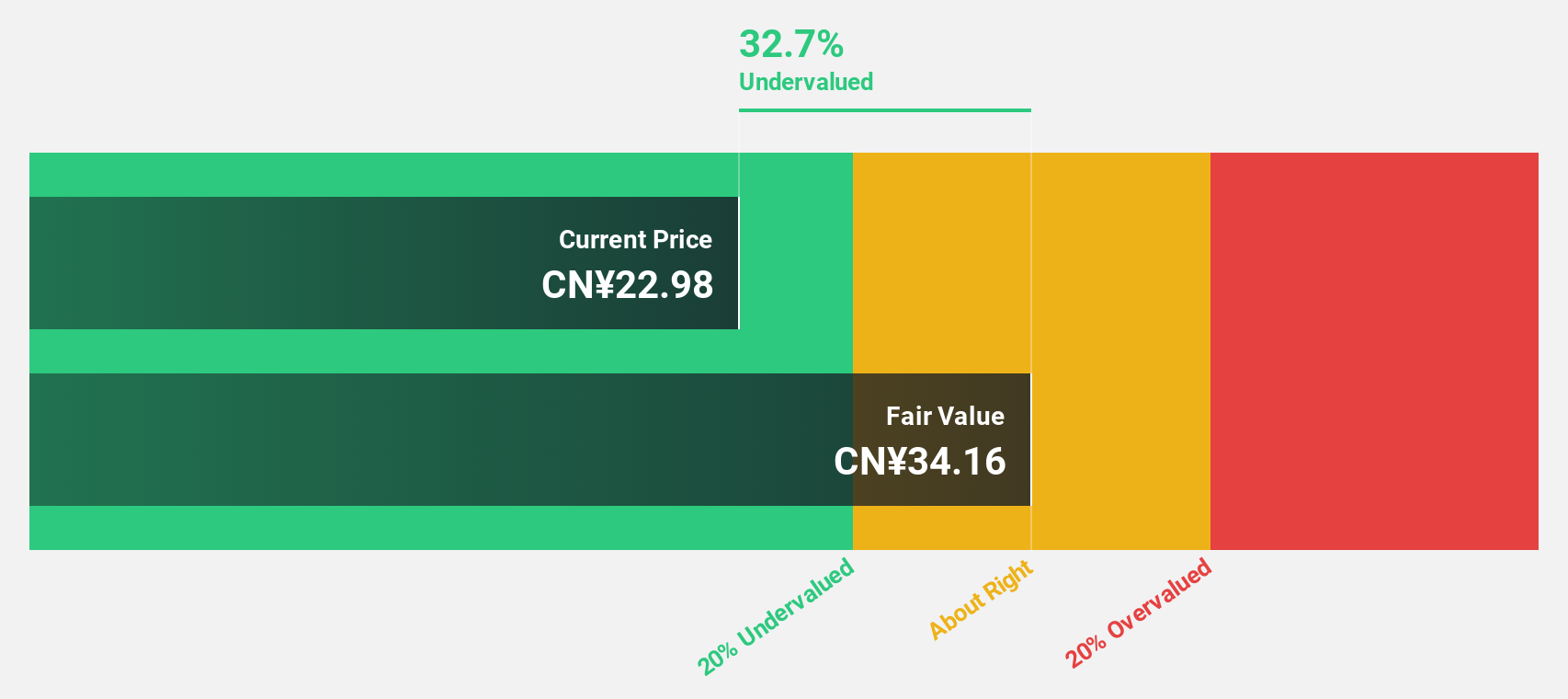

Zhejiang Yinlun MachineryLtd (SZSE:002126)

Overview: Zhejiang Yinlun Machinery Co., Ltd. focuses on the research, development, manufacturing, and sale of thermal management and exhaust gas post-treatment products, with a market cap of CN¥22.93 billion.

Operations: The company generates revenue from its operations in the research, development, manufacturing, and sale of thermal management and exhaust gas post-treatment products.

Estimated Discount To Fair Value: 16.2%

Zhejiang Yinlun Machinery is trading at CNY 27.67, below its estimated fair value of CNY 33.01, suggesting undervaluation based on cash flows. The company reported a net income increase to CNY 783.53 million for 2024 and continues to show earnings growth with a forecasted annual increase of 25.7%, outpacing the Chinese market average. Recent initiatives include a share buyback program worth up to CNY 100 million and an approved cash dividend, enhancing shareholder value.

- Our expertly prepared growth report on Zhejiang Yinlun MachineryLtd implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Zhejiang Yinlun MachineryLtd's balance sheet by reading our health report here.

Turning Ideas Into Actions

- Gain an insight into the universe of 302 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A075580

Sejin Heavy Industries

Manufactures and sells shipbuilding equipment in South Korea.

Solid track record with moderate growth potential.

Market Insights

Community Narratives