- China

- /

- Auto Components

- /

- SZSE:000678

Optimistic Investors Push Xiangyang Automobile Bearing Co., Ltd. (SZSE:000678) Shares Up 44% But Growth Is Lacking

Despite an already strong run, Xiangyang Automobile Bearing Co., Ltd. (SZSE:000678) shares have been powering on, with a gain of 44% in the last thirty days. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 13% in the last twelve months.

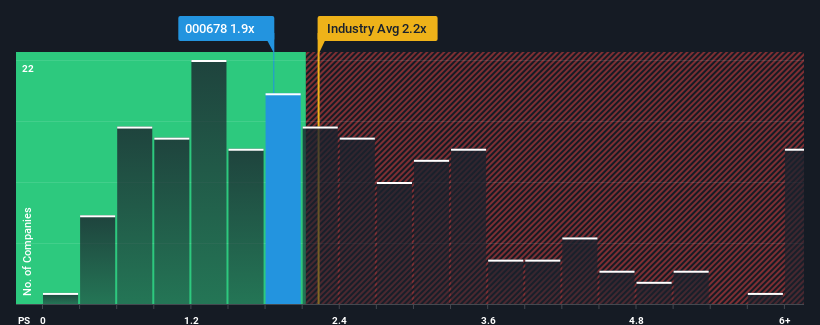

In spite of the firm bounce in price, it's still not a stretch to say that Xiangyang Automobile Bearing's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Auto Components industry in China, where the median P/S ratio is around 2.2x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Xiangyang Automobile Bearing

What Does Xiangyang Automobile Bearing's P/S Mean For Shareholders?

Xiangyang Automobile Bearing has been doing a good job lately as it's been growing revenue at a solid pace. One possibility is that the P/S is moderate because investors think this respectable revenue growth might not be enough to outperform the broader industry in the near future. If that doesn't eventuate, then existing shareholders probably aren't too pessimistic about the future direction of the share price.

Although there are no analyst estimates available for Xiangyang Automobile Bearing, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Some Revenue Growth Forecasted For Xiangyang Automobile Bearing?

The only time you'd be comfortable seeing a P/S like Xiangyang Automobile Bearing's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 16% last year. Still, revenue has fallen 1.7% in total from three years ago, which is quite disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 23% shows it's an unpleasant look.

With this in mind, we find it worrying that Xiangyang Automobile Bearing's P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Xiangyang Automobile Bearing's P/S Mean For Investors?

Xiangyang Automobile Bearing appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at Xiangyang Automobile Bearing revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. When we see revenue heading backwards in the context of growing industry forecasts, it'd make sense to expect a possible share price decline on the horizon, sending the moderate P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Xiangyang Automobile Bearing you should be aware of, and 1 of them is concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000678

Xiangyang Automobile Bearing

Researches, develops, manufactures, and sells automobile bearings in China.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives