- China

- /

- Auto Components

- /

- SZSE:000678

Little Excitement Around Xiangyang Automobile Bearing Co., Ltd.'s (SZSE:000678) Revenues As Shares Take 26% Pounding

To the annoyance of some shareholders, Xiangyang Automobile Bearing Co., Ltd. (SZSE:000678) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 30% in that time.

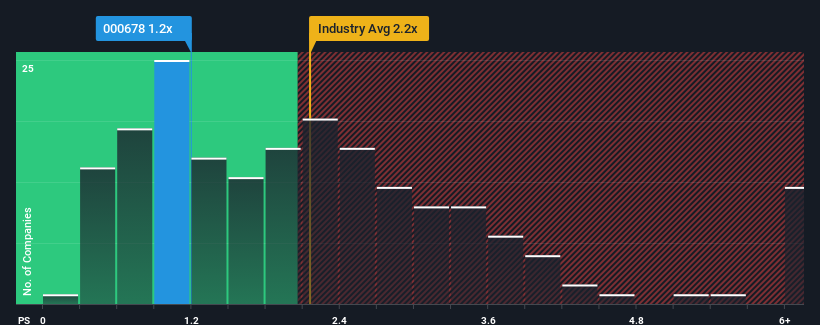

Following the heavy fall in price, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.2x, you may consider Xiangyang Automobile Bearing as an solid investment opportunity with its 1.2x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Xiangyang Automobile Bearing

What Does Xiangyang Automobile Bearing's P/S Mean For Shareholders?

The revenue growth achieved at Xiangyang Automobile Bearing over the last year would be more than acceptable for most companies. One possibility is that the P/S is low because investors think this respectable revenue growth might actually underperform the broader industry in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Xiangyang Automobile Bearing's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Xiangyang Automobile Bearing?

The only time you'd be truly comfortable seeing a P/S as low as Xiangyang Automobile Bearing's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered an exceptional 23% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 26% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why Xiangyang Automobile Bearing's P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Bottom Line On Xiangyang Automobile Bearing's P/S

Xiangyang Automobile Bearing's recently weak share price has pulled its P/S back below other Auto Components companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Xiangyang Automobile Bearing confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about this 1 warning sign we've spotted with Xiangyang Automobile Bearing.

If these risks are making you reconsider your opinion on Xiangyang Automobile Bearing, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000678

Xiangyang Automobile Bearing

Researches, develops, manufactures, and sells automobile bearings in China.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives