- China

- /

- Auto Components

- /

- SHSE:688326

Beijing Jingwei Hirain Technologies Co., Inc. (SHSE:688326) Looks Just Right With A 38% Price Jump

Despite an already strong run, Beijing Jingwei Hirain Technologies Co., Inc. (SHSE:688326) shares have been powering on, with a gain of 38% in the last thirty days. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 38% over that time.

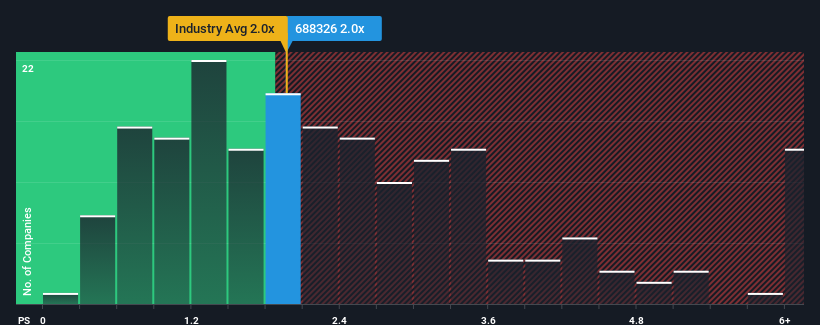

Although its price has surged higher, you could still be forgiven for feeling indifferent about Beijing Jingwei Hirain Technologies' P/S ratio of 2x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in China is about the same. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Beijing Jingwei Hirain Technologies

How Beijing Jingwei Hirain Technologies Has Been Performing

Beijing Jingwei Hirain Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Beijing Jingwei Hirain Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Beijing Jingwei Hirain Technologies would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The latest three year period has also seen an excellent 56% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the five analysts following the company. With the industry predicted to deliver 23% growth , the company is positioned for a comparable revenue result.

With this information, we can see why Beijing Jingwei Hirain Technologies is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Beijing Jingwei Hirain Technologies' P/S

Beijing Jingwei Hirain Technologies' stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Beijing Jingwei Hirain Technologies maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Beijing Jingwei Hirain Technologies you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Jingwei Hirain Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688326

Beijing Jingwei Hirain Technologies

Beijing Jingwei Hirain Technologies Co., Inc.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026