- Japan

- /

- Electronic Equipment and Components

- /

- TSE:3156

3 Asian Stocks Estimated To Be Up To 36.7% Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with concerns over artificial intelligence valuations and economic uncertainties, Asian markets have mirrored these sentiments, experiencing fluctuations influenced by similar factors. In this environment, identifying undervalued stocks becomes crucial for investors seeking opportunities that may offer potential upside when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Xi'an NovaStar Tech (SZSE:301589) | CN¥156.19 | CN¥304.29 | 48.7% |

| Q & M Dental Group (Singapore) (SGX:QC7) | SGD0.49 | SGD0.95 | 48.5% |

| Nippon Thompson (TSE:6480) | ¥716.00 | ¥1409.41 | 49.2% |

| Ningxia Building Materials GroupLtd (SHSE:600449) | CN¥13.18 | CN¥26.14 | 49.6% |

| NEXON Games (KOSDAQ:A225570) | ₩12350.00 | ₩24179.77 | 48.9% |

| New Zealand King Salmon Investments (NZSE:NZK) | NZ$0.195 | NZ$0.39 | 49.5% |

| Foxconn Industrial Internet (SHSE:601138) | CN¥56.61 | CN¥111.22 | 49.1% |

| China Ruyi Holdings (SEHK:136) | HK$2.43 | HK$4.80 | 49.4% |

| Beijing Roborock Technology (SHSE:688169) | CN¥156.22 | CN¥302.76 | 48.4% |

| Beijing Beimo High-tech Frictional MaterialLtd (SZSE:002985) | CN¥28.57 | CN¥56.17 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

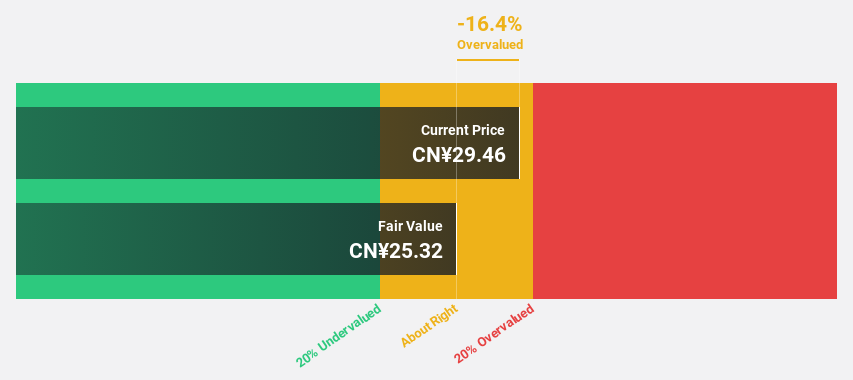

Autel Intelligent Technology (SHSE:688208)

Overview: Autel Intelligent Technology Corp., Ltd. specializes in the research, development, production, sale, and servicing of automotive intelligent diagnostics equipment, detection and analysis systems, and automotive electronic components with a market cap of CN¥22.43 billion.

Operations: Autel Intelligent Technology Corp., Ltd. generates revenue through its focus on automotive intelligent diagnostics equipment, detection and analysis systems, and automotive electronic components.

Estimated Discount To Fair Value: 13.6%

Autel Intelligent Technology appears undervalued, trading at CN¥33.97 below its estimated fair value of CN¥39.31, with earnings growing by 83.5% over the past year and forecasted to grow at 23.21% annually. Despite a dividend yield of 3.41% not covered by free cash flows, recent partnerships like the one with ZEEKR enhance its strategic positioning in EV charging infrastructure, potentially boosting future cash flow generation amidst robust revenue growth projections of 21.7% per year.

- Our expertly prepared growth report on Autel Intelligent Technology implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Autel Intelligent Technology with our detailed financial health report.

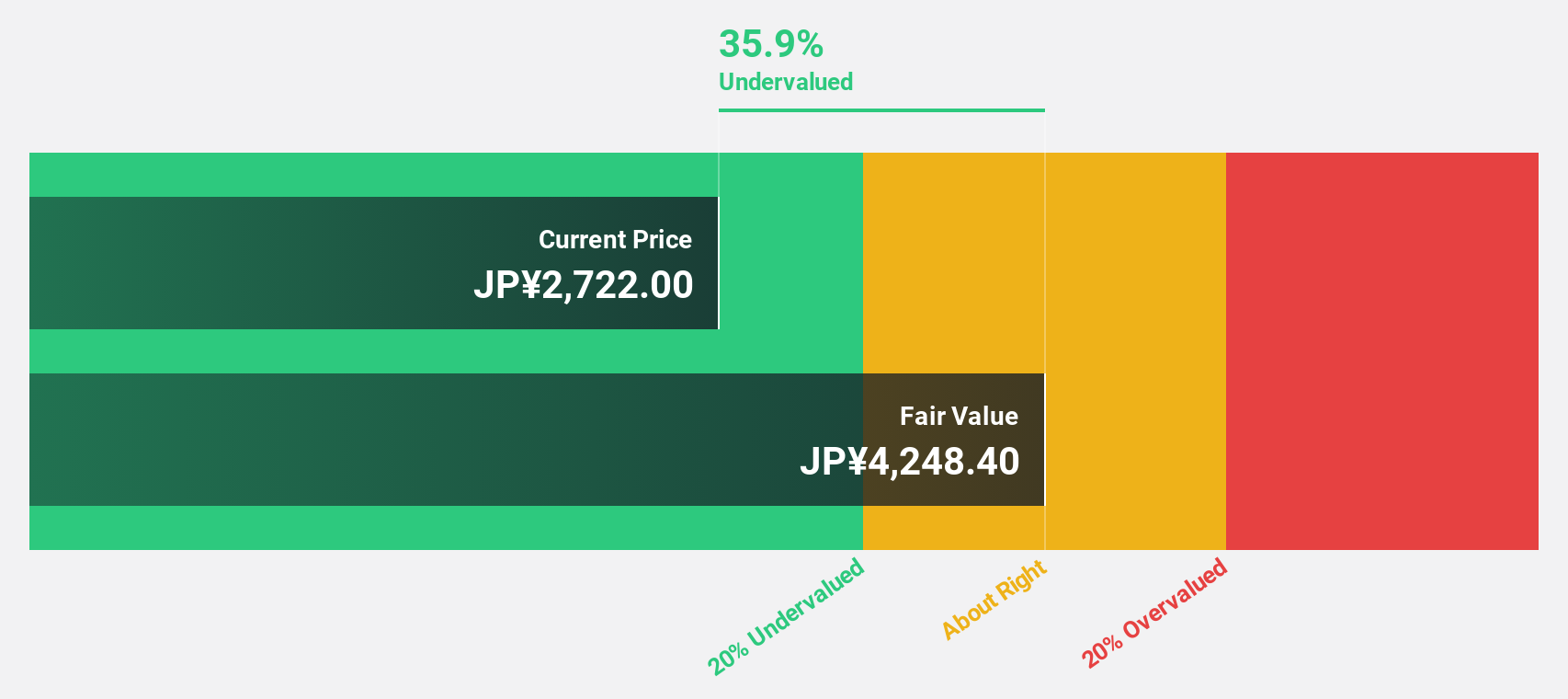

Restar (TSE:3156)

Overview: Restar Corporation is involved in the sale of semiconductors, electronic components, image sensors, cameras, peripheral equipment, and related products across Japan, China, South Korea, Vietnam, Taiwan and internationally with a market cap of ¥75.66 billion.

Operations: Restar generates revenue through the distribution of semiconductors, electronic components, image sensors, cameras, and peripheral equipment across several key markets including Japan, China, South Korea, Vietnam, Taiwan and beyond.

Estimated Discount To Fair Value: 36.7%

Restar Corporation is trading at ¥2,691, significantly below its estimated fair value of ¥4,252.12, indicating potential undervaluation based on discounted cash flow analysis. Despite a stable dividend of JPY 60 per share and earnings projected to grow substantially at 30.18% annually—outpacing the JP market—the company's profit margins have decreased from last year. However, revenue growth forecasts of 6.6% annually exceed the JP market's average but remain modest overall.

- Our earnings growth report unveils the potential for significant increases in Restar's future results.

- Delve into the full analysis health report here for a deeper understanding of Restar.

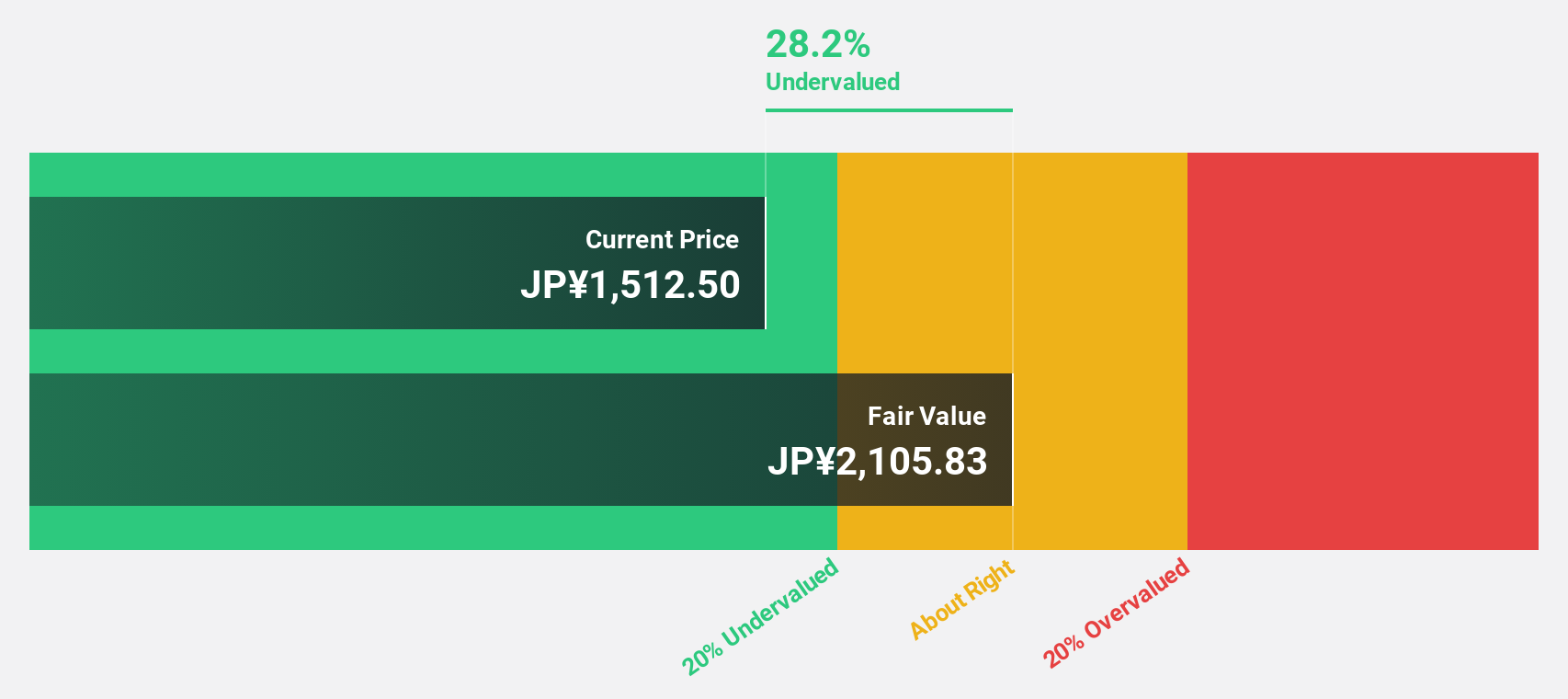

Nipro (TSE:8086)

Overview: Nipro Corporation, along with its subsidiaries, operates in the medical devices, pharmaceuticals, and pharma packaging sectors with a market cap of ¥245.95 billion.

Operations: The company's revenue is derived from its operations in the medical devices, pharmaceuticals, and pharma packaging sectors.

Estimated Discount To Fair Value: 28.4%

Nipro Corporation, trading at ¥1,508, is significantly below its estimated fair value of ¥2,105.83 based on discounted cash flow analysis. Earnings have surged by a very large margin over the past year and are projected to grow 20.69% annually, surpassing the JP market's growth rate. However, debt coverage by operating cash flow is inadequate and recent dividend cuts reflect financial instability. Revenue growth is modest but slightly outpaces the market average.

- Insights from our recent growth report point to a promising forecast for Nipro's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Nipro.

Where To Now?

- Get an in-depth perspective on all 273 Undervalued Asian Stocks Based On Cash Flows by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3156

Restar

Engages in the sale of semiconductors, electronic components, image sensors, cameras, peripheral equipment, and related products in Japan, China, South Korea, Vietnam, Taiwan, and internationally.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success