- China

- /

- Auto Components

- /

- SHSE:688155

Slammed 36% Shanghai SK Automation Technology Co.,Ltd (SHSE:688155) Screens Well Here But There Might Be A Catch

Shanghai SK Automation Technology Co.,Ltd (SHSE:688155) shareholders that were waiting for something to happen have been dealt a blow with a 36% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 25% in that time.

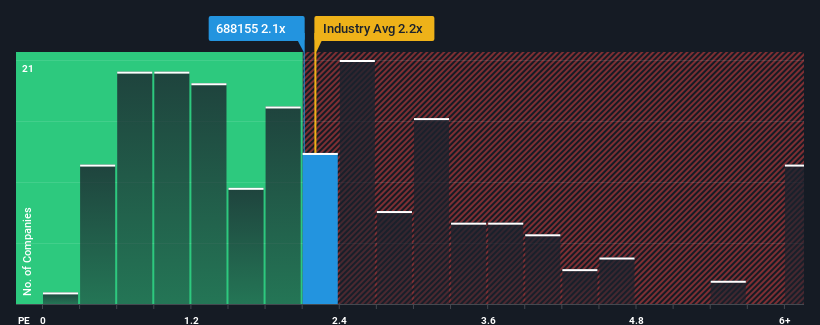

Even after such a large drop in price, there still wouldn't be many who think Shanghai SK Automation TechnologyLtd's price-to-sales (or "P/S") ratio of 2.1x is worth a mention when the median P/S in China's Auto Components industry is similar at about 2.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Shanghai SK Automation TechnologyLtd

What Does Shanghai SK Automation TechnologyLtd's Recent Performance Look Like?

Shanghai SK Automation TechnologyLtd could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Shanghai SK Automation TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shanghai SK Automation TechnologyLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai SK Automation TechnologyLtd would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 11% gain to the company's revenues. The latest three year period has also seen an excellent 297% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the only analyst covering the company suggest revenue should grow by 38% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Shanghai SK Automation TechnologyLtd's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Shanghai SK Automation TechnologyLtd's P/S?

With its share price dropping off a cliff, the P/S for Shanghai SK Automation TechnologyLtd looks to be in line with the rest of the Auto Components industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Shanghai SK Automation TechnologyLtd's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 4 warning signs for Shanghai SK Automation TechnologyLtd you should be aware of, and 3 of them are concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688155

Shanghai SK Automation TechnologyLtd

Engages in the research, development, production, and sale of intelligent manufacturing equipment for new energy vehicles and fuel vehicles.

High growth potential with excellent balance sheet.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)