- China

- /

- Auto Components

- /

- SHSE:603997

Ningbo Jifeng Auto Parts (SHSE:603997) shareholder returns have been decent, earning 71% in 5 years

Stock pickers are generally looking for stocks that will outperform the broader market. And the truth is, you can make significant gains if you buy good quality businesses at the right price. To wit, the Ningbo Jifeng Auto Parts share price has climbed 63% in five years, easily topping the market return of 5.7% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 9.0%.

Since it's been a strong week for Ningbo Jifeng Auto Parts shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Ningbo Jifeng Auto Parts

Ningbo Jifeng Auto Parts wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

In the last 5 years Ningbo Jifeng Auto Parts saw its revenue grow at 6.0% per year. That's not a very high growth rate considering the bottom line. The modest growth is probably broadly reflected in the share price, which is up 10%, per year over 5 years. The business could be one worth watching but we generally prefer faster revenue growth.

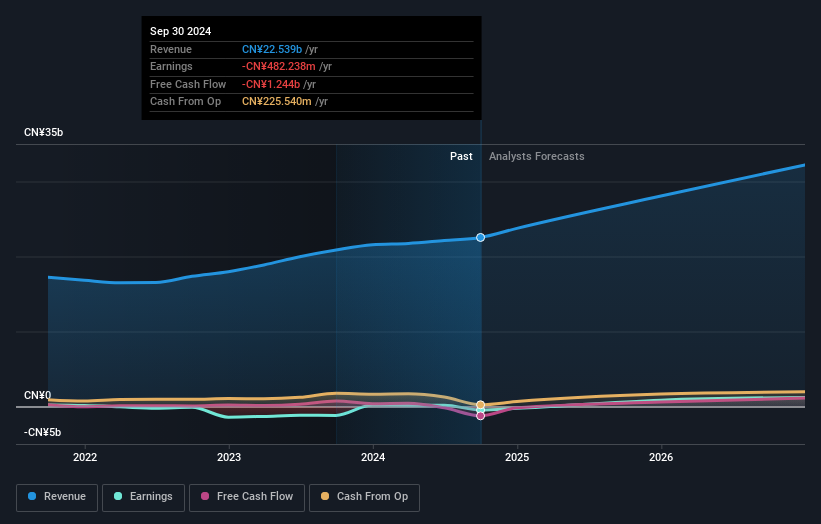

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Ningbo Jifeng Auto Parts is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Ningbo Jifeng Auto Parts stock, you should check out this free report showing analyst consensus estimates for future profits.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Ningbo Jifeng Auto Parts' total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Ningbo Jifeng Auto Parts shareholders, and that cash payout contributed to why its TSR of 71%, over the last 5 years, is better than the share price return.

A Different Perspective

Ningbo Jifeng Auto Parts shareholders gained a total return of 9.0% during the year. Unfortunately this falls short of the market return. On the bright side, the longer term returns (running at about 11% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. You could get a better understanding of Ningbo Jifeng Auto Parts' growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Of course Ningbo Jifeng Auto Parts may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jifeng Auto Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603997

Ningbo Jifeng Auto Parts

Manufactures automotive interior parts in China and internationally.

Reasonable growth potential with acceptable track record.

Market Insights

Community Narratives