- China

- /

- Auto Components

- /

- SHSE:603997

A Piece Of The Puzzle Missing From Ningbo Jifeng Auto Parts Co., Ltd.'s (SHSE:603997) Share Price

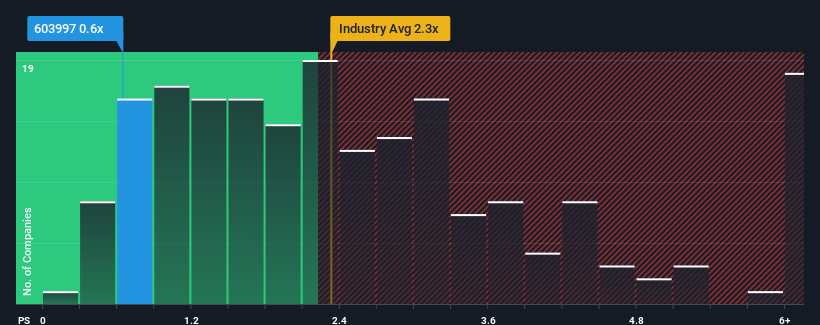

When close to half the companies operating in the Auto Components industry in China have price-to-sales ratios (or "P/S") above 2.3x, you may consider Ningbo Jifeng Auto Parts Co., Ltd. (SHSE:603997) as an attractive investment with its 0.6x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ningbo Jifeng Auto Parts

How Ningbo Jifeng Auto Parts Has Been Performing

With revenue growth that's inferior to most other companies of late, Ningbo Jifeng Auto Parts has been relatively sluggish. Perhaps the market is expecting the current trend of poor revenue growth to continue, which has kept the P/S suppressed. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ningbo Jifeng Auto Parts.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ningbo Jifeng Auto Parts' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.0% last year. This was backed up an excellent period prior to see revenue up by 31% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 22% during the coming year according to the eleven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 24%, which is not materially different.

With this information, we find it odd that Ningbo Jifeng Auto Parts is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Key Takeaway

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Ningbo Jifeng Auto Parts' revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. When we see middle-of-the-road revenue growth like this, we assume it must be the potential risks that are what is placing pressure on the P/S ratio. Perhaps investors are concerned that the company could underperform against the forecasts over the near term.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ningbo Jifeng Auto Parts, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Ningbo Jifeng Auto Parts, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jifeng Auto Parts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603997

Ningbo Jifeng Auto Parts

Manufactures automotive interior parts in China and internationally.

Reasonable growth potential and fair value.

Market Insights

Community Narratives