- China

- /

- Auto Components

- /

- SHSE:603982

Nanjing Chervon Auto Precision Technology Co., Ltd's (SHSE:603982) 25% Dip In Price Shows Sentiment Is Matching Revenues

Nanjing Chervon Auto Precision Technology Co., Ltd (SHSE:603982) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

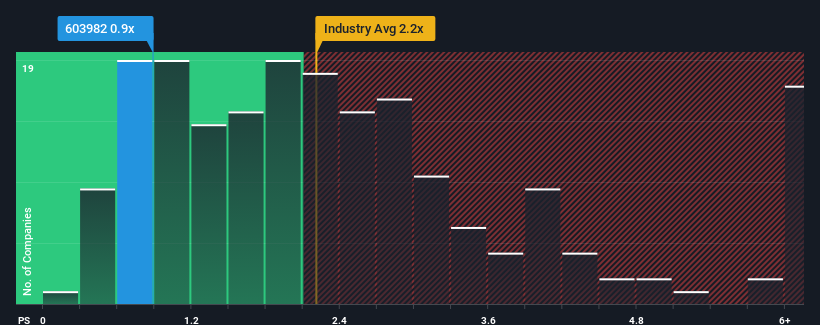

Following the heavy fall in price, considering around half the companies operating in China's Auto Components industry have price-to-sales ratios (or "P/S") above 2.2x, you may consider Nanjing Chervon Auto Precision Technology as an solid investment opportunity with its 0.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Nanjing Chervon Auto Precision Technology

What Does Nanjing Chervon Auto Precision Technology's P/S Mean For Shareholders?

The revenue growth achieved at Nanjing Chervon Auto Precision Technology over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Although there are no analyst estimates available for Nanjing Chervon Auto Precision Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

Nanjing Chervon Auto Precision Technology's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 8.1% last year. This was backed up an excellent period prior to see revenue up by 32% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 24% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Nanjing Chervon Auto Precision Technology's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

What We Can Learn From Nanjing Chervon Auto Precision Technology's P/S?

Nanjing Chervon Auto Precision Technology's recently weak share price has pulled its P/S back below other Auto Components companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

In line with expectations, Nanjing Chervon Auto Precision Technology maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Nanjing Chervon Auto Precision Technology that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Chervon Auto Precision Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603982

Nanjing Chervon Auto Precision Technology

Nanjing Chervon Auto Precision Technology Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success