- China

- /

- Auto Components

- /

- SHSE:603786

We Think KEBODA TECHNOLOGY (SHSE:603786) Can Stay On Top Of Its Debt

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, KEBODA TECHNOLOGY Co., Ltd. (SHSE:603786) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for KEBODA TECHNOLOGY

What Is KEBODA TECHNOLOGY's Net Debt?

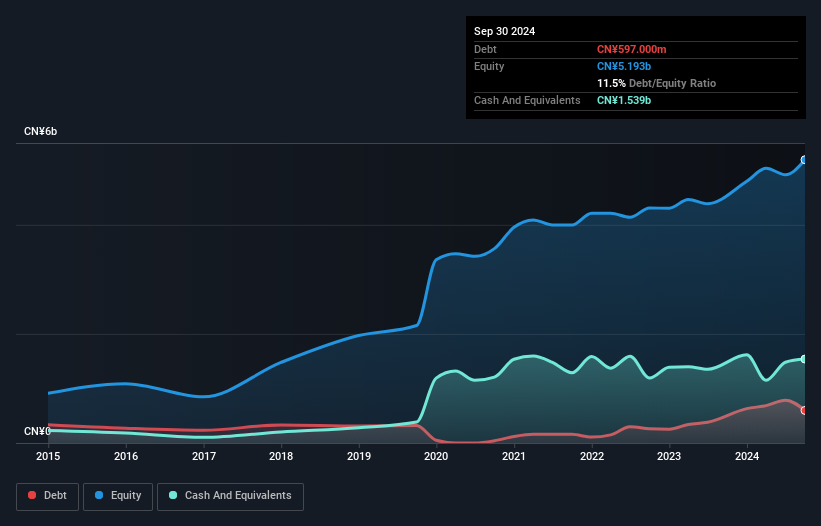

The image below, which you can click on for greater detail, shows that KEBODA TECHNOLOGY had debt of CN¥597.0m at the end of September 2024, a reduction from CN¥630.1m over a year. However, its balance sheet shows it holds CN¥1.54b in cash, so it actually has CN¥942.1m net cash.

How Strong Is KEBODA TECHNOLOGY's Balance Sheet?

We can see from the most recent balance sheet that KEBODA TECHNOLOGY had liabilities of CN¥1.58b falling due within a year, and liabilities of CN¥106.5m due beyond that. Offsetting this, it had CN¥1.54b in cash and CN¥1.96b in receivables that were due within 12 months. So it can boast CN¥1.81b more liquid assets than total liabilities.

This surplus suggests that KEBODA TECHNOLOGY has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Simply put, the fact that KEBODA TECHNOLOGY has more cash than debt is arguably a good indication that it can manage its debt safely.

On top of that, KEBODA TECHNOLOGY grew its EBIT by 63% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine KEBODA TECHNOLOGY's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While KEBODA TECHNOLOGY has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. In the last three years, KEBODA TECHNOLOGY created free cash flow amounting to 18% of its EBIT, an uninspiring performance. That limp level of cash conversion undermines its ability to manage and pay down debt.

Summing Up

While it is always sensible to investigate a company's debt, in this case KEBODA TECHNOLOGY has CN¥942.1m in net cash and a decent-looking balance sheet. And we liked the look of last year's 63% year-on-year EBIT growth. So is KEBODA TECHNOLOGY's debt a risk? It doesn't seem so to us. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of KEBODA TECHNOLOGY's earnings per share history for free.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if KEBODA TECHNOLOGY might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603786

KEBODA TECHNOLOGY

KEBODA TECHNOLOGY Co., Ltd. manufacture and sale of automotive electronics and related products for automotive industry in China.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives