- China

- /

- Auto Components

- /

- SHSE:603758

Further Upside For Chongqing Qin'an M&E PLC. (SHSE:603758) Shares Could Introduce Price Risks After 36% Bounce

The Chongqing Qin'an M&E PLC. (SHSE:603758) share price has done very well over the last month, posting an excellent gain of 36%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

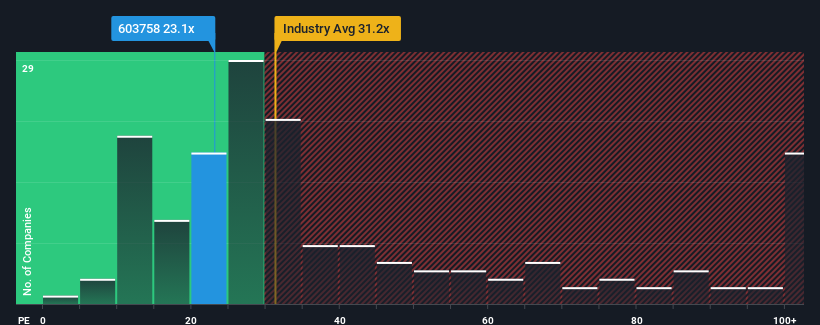

Although its price has surged higher, Chongqing Qin'an M&E's price-to-earnings (or "P/E") ratio of 23.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 37x and even P/E's above 72x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times haven't been advantageous for Chongqing Qin'an M&E as its earnings have been falling quicker than most other companies. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

Check out our latest analysis for Chongqing Qin'an M&E

Does Growth Match The Low P/E?

Chongqing Qin'an M&E's P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a frustrating 36% decrease to the company's bottom line. Still, the latest three year period has seen an excellent 53% overall rise in EPS, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest earnings should grow by 119% over the next year. That's shaping up to be materially higher than the 41% growth forecast for the broader market.

With this information, we find it odd that Chongqing Qin'an M&E is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Key Takeaway

Chongqing Qin'an M&E's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Chongqing Qin'an M&E's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

Plus, you should also learn about these 3 warning signs we've spotted with Chongqing Qin'an M&E.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603758

Chongqing Qin'an M&E

Together with its subsidiary, engages in the research, development, production and sales of core components of automobile engines, key components of transmissions, new energy hybrid drive systems and other products in China.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives