- South Korea

- /

- Semiconductors

- /

- KOSDAQ:A218410

Asian Growth Stocks With High Insider Ownership Expecting Up To 23% Revenue Growth

Reviewed by Simply Wall St

Amid a backdrop of mixed performances in global markets, Asia's economic landscape continues to be shaped by geopolitical developments and evolving trade dynamics, particularly between the U.S. and China. As investors navigate these complexities, growth companies with high insider ownership can offer unique insights into potential revenue expansions, reflecting both confidence from those within the company and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 30% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31.2% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 55.2% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Let's dive into some prime choices out of the screener.

RFHIC (KOSDAQ:A218410)

Simply Wall St Growth Rating: ★★★★★☆

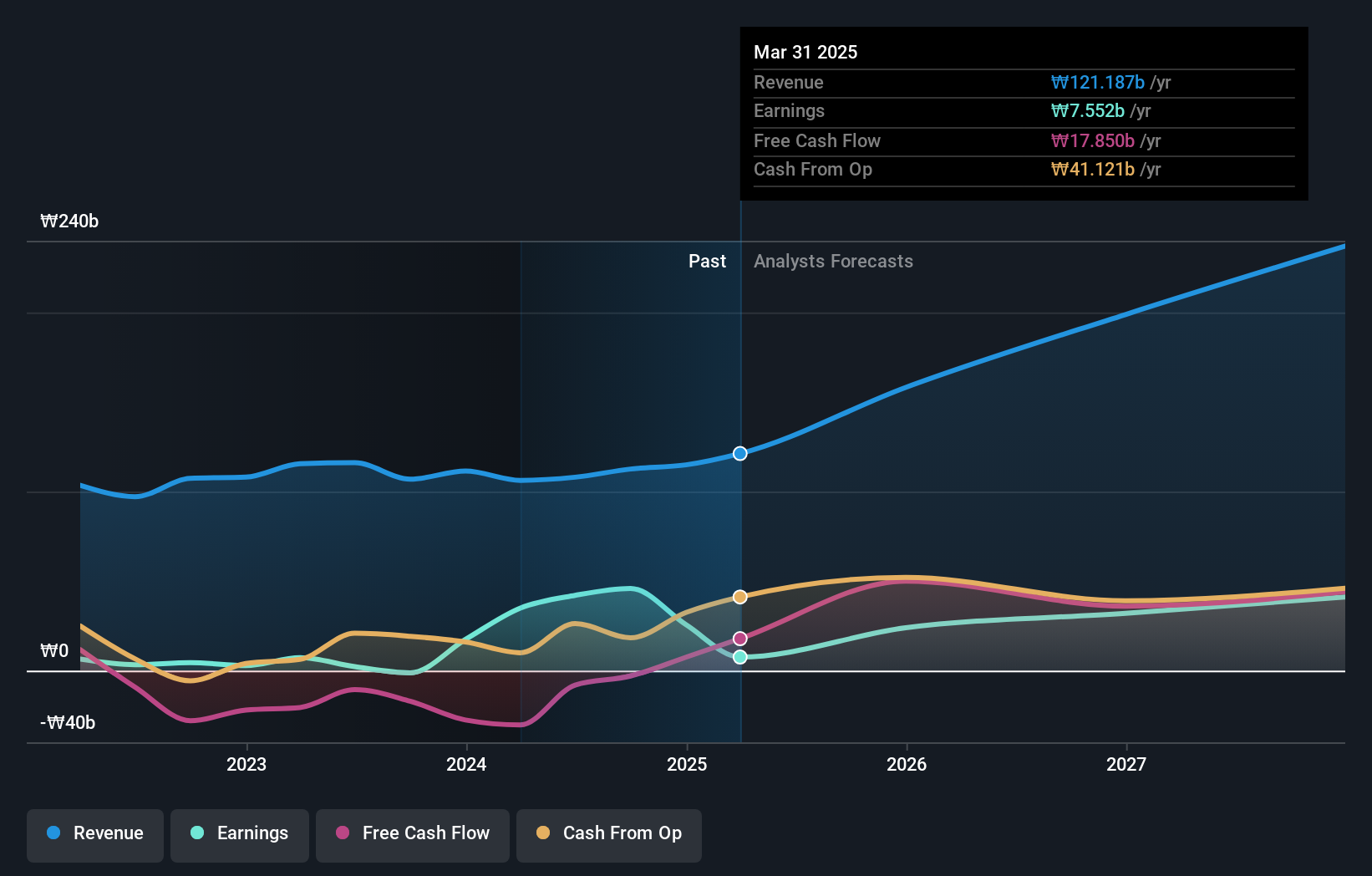

Overview: RFHIC Corporation designs and manufactures radio frequency and microwave components for wireless infrastructure, commercial and military radar, and RF energy applications in South Korea and internationally, with a market cap of ₩931.70 billion.

Operations: The company's revenue segments consist of Rfhic at ₩92.98 billion, Rs Systems at ₩33.09 billion, Rf Materials at ₩17.87 billion, and Rfhic US Corporation at ₩18.10 billion.

Insider Ownership: 37.4%

Revenue Growth Forecast: 23.6% p.a.

RFHIC exhibits strong growth potential with its earnings projected to increase significantly at 28.94% annually, outpacing the Korean market's 28.1%. Revenue is also set to grow robustly at 23.6% per year, surpassing the market average of 10.3%. However, its return on equity is expected to remain low at 9.8%, and profit margins have declined from last year's high of 38.9% to a current level of 8.5%.

- Get an in-depth perspective on RFHIC's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, RFHIC's share price might be too optimistic.

Bethel Automotive Safety Systems (SHSE:603596)

Simply Wall St Growth Rating: ★★★★★☆

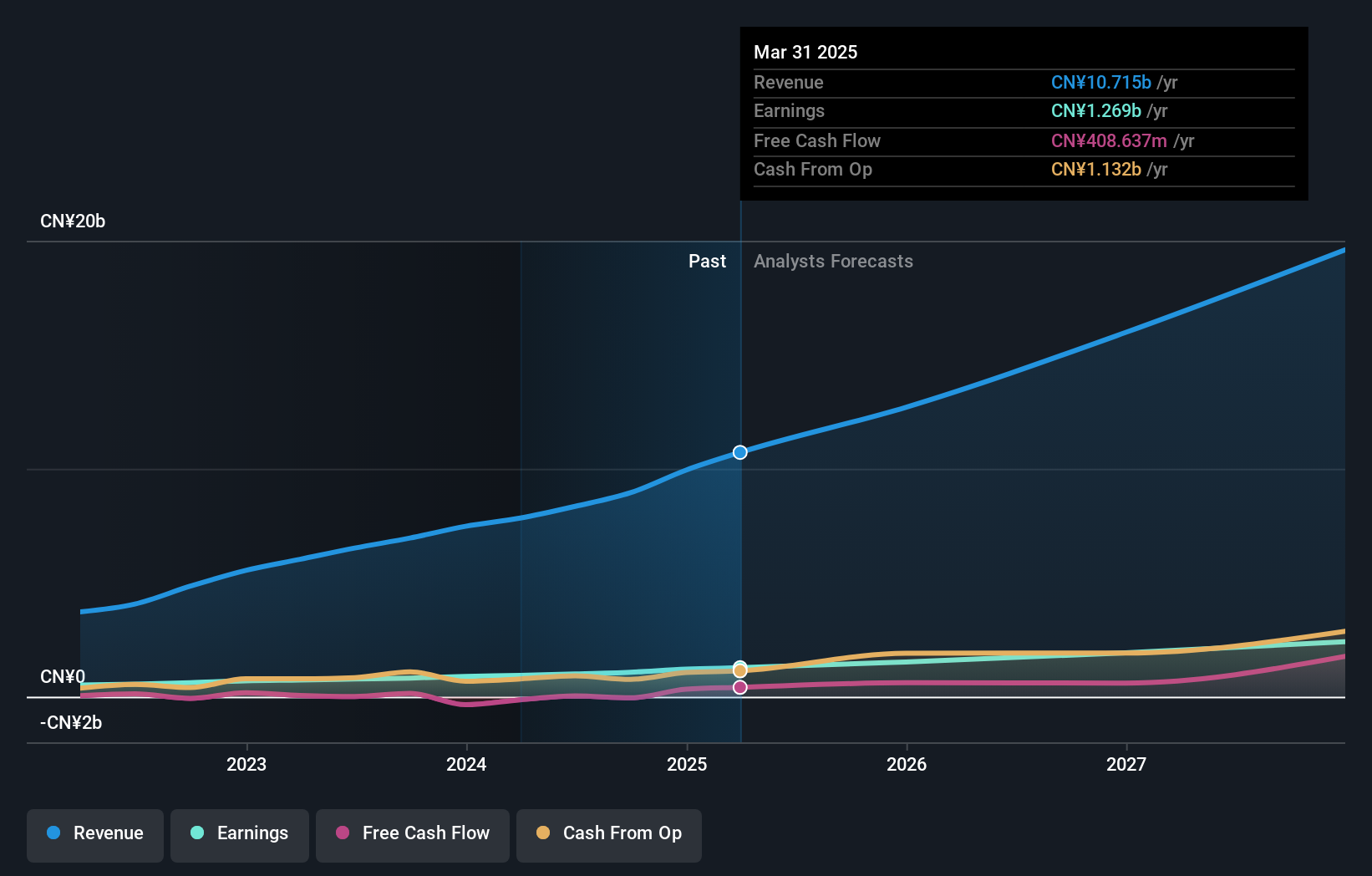

Overview: Bethel Automotive Safety Systems Co., Ltd, with a market cap of CN¥29.47 billion, develops, manufactures, and sells automotive safety systems and advanced driver assistance systems in China.

Operations: The company's revenue primarily comes from the manufacturing and selling of automobile and related accessories, amounting to CN¥11.72 billion.

Insider Ownership: 20.2%

Revenue Growth Forecast: 22.3% p.a.

Bethel Automotive Safety Systems demonstrates strong growth potential, with earnings expected to increase significantly at 24.8% annually, though slightly below the Chinese market's 27%. Revenue is forecasted to grow at 22.3% per year, outpacing the market's 14.3%. Recent earnings show an increase in net income to CNY 891.49 million for nine months ending September 2025 from CNY 778.03 million a year ago, indicating robust financial health and high-quality earnings despite trading below fair value estimates.

- Click to explore a detailed breakdown of our findings in Bethel Automotive Safety Systems' earnings growth report.

- In light of our recent valuation report, it seems possible that Bethel Automotive Safety Systems is trading behind its estimated value.

Shenzhen Noposion Crop Science (SZSE:002215)

Simply Wall St Growth Rating: ★★★★★☆

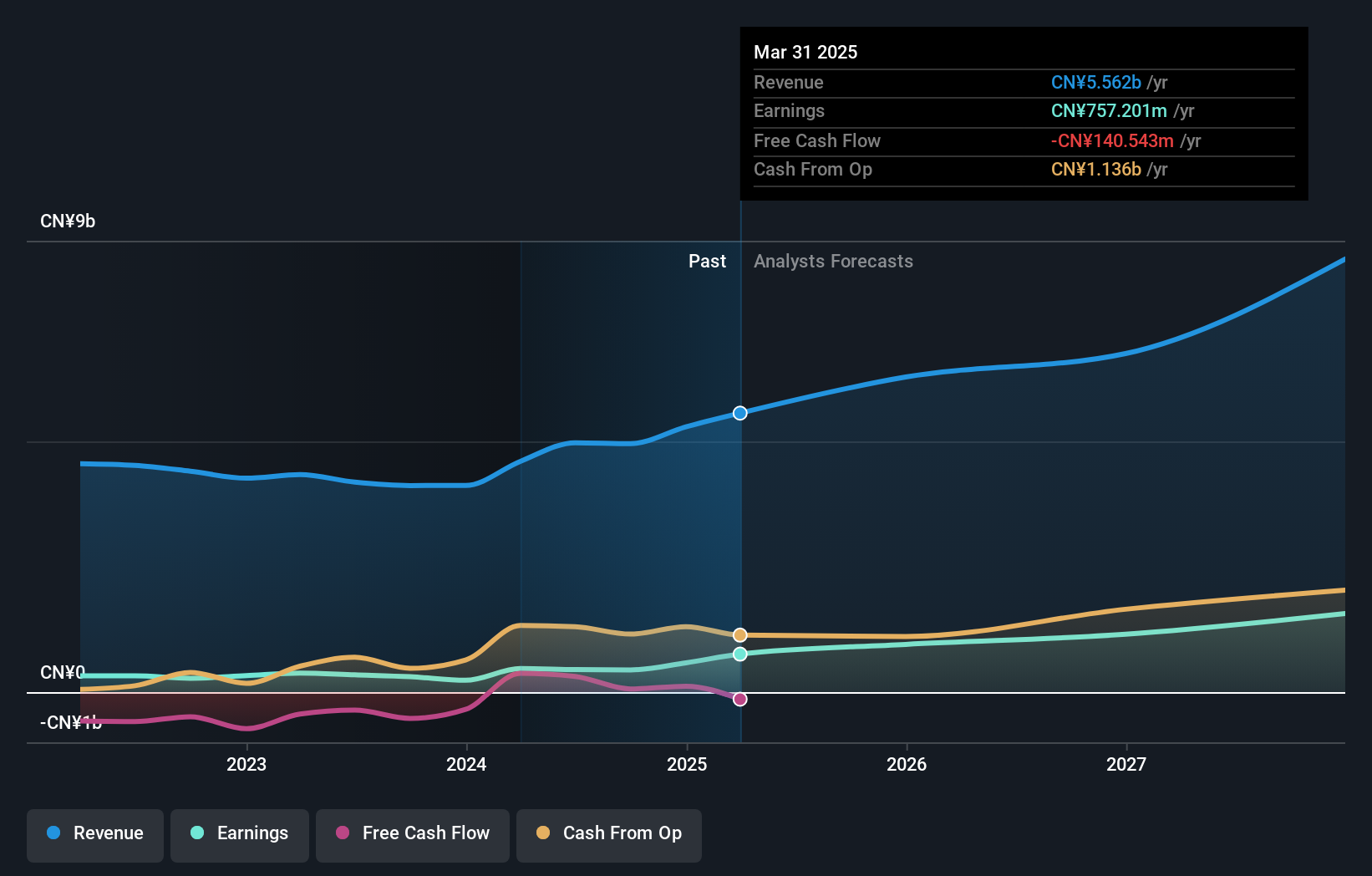

Overview: Shenzhen Noposion Crop Science Co., Ltd. is involved in the research, development, manufacturing, distribution, and technical servicing of pesticides and fertilizers both in China and internationally, with a market cap of CN¥12.68 billion.

Operations: Shenzhen Noposion Crop Science Co., Ltd. generates revenue through its core activities of researching, developing, manufacturing, distributing, and providing technical services for pesticides and fertilizers in both domestic and international markets.

Insider Ownership: 29.4%

Revenue Growth Forecast: 19% p.a.

Shenzhen Noposion Crop Science exhibits strong growth prospects, with earnings projected to rise significantly at 34.7% annually, surpassing the Chinese market's average. Despite high debt levels, its revenue is expected to grow faster than the market at 19% per year. Recent results show net income increased to CNY 575.53 million for nine months ending September 2025 from CNY 487.61 million a year prior, reflecting solid financial performance while trading slightly below estimated fair value.

- Dive into the specifics of Shenzhen Noposion Crop Science here with our thorough growth forecast report.

- Our valuation report unveils the possibility Shenzhen Noposion Crop Science's shares may be trading at a discount.

Where To Now?

- Reveal the 618 hidden gems among our Fast Growing Asian Companies With High Insider Ownership screener with a single click here.

- Looking For Alternative Opportunities? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A218410

RFHIC

Designs and manufactures radio frequency (RF) and microwave components for wireless infrastructure, commercial and military radar, and RF energy applications in South Korea and internationally.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives