- China

- /

- Auto Components

- /

- SHSE:603305

Some Ningbo Xusheng Group Co., Ltd. (SHSE:603305) Analysts Just Made A Major Cut To Next Year's Estimates

Today is shaping up negative for Ningbo Xusheng Group Co., Ltd. (SHSE:603305) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

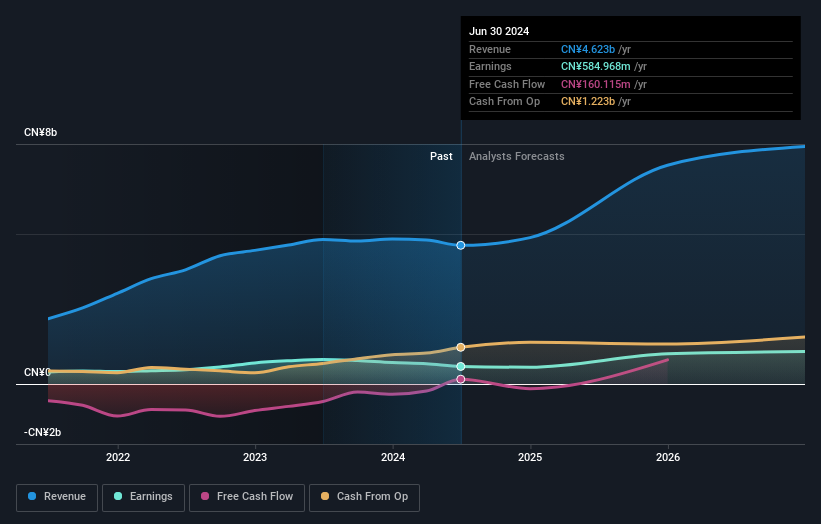

After the downgrade, the eleven analysts covering Ningbo Xusheng Group are now predicting revenues of CN¥4.9b in 2024. If met, this would reflect a credible 5.6% improvement in sales compared to the last 12 months. Statutory earnings per share are anticipated to dip 4.5% to CN¥0.60 in the same period. Prior to this update, the analysts had been forecasting revenues of CN¥5.8b and earnings per share (EPS) of CN¥0.88 in 2024. Indeed, we can see that the analysts are a lot more bearish about Ningbo Xusheng Group's prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Ningbo Xusheng Group

The consensus price target fell 5.9% to CN¥16.90, with the weaker earnings outlook clearly leading analyst valuation estimates.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Ningbo Xusheng Group's revenue growth is expected to slow, with the forecast 11% annualised growth rate until the end of 2024 being well below the historical 32% p.a. growth over the last five years. Compare this against other companies (with analyst forecasts) in the industry, which are in aggregate expected to see revenue growth of 18% annually. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Ningbo Xusheng Group.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for Ningbo Xusheng Group. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Ningbo Xusheng Group's revenues are expected to grow slower than the wider market. Given the scope of the downgrades, it would not be a surprise to see the market become more wary of the business.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Ningbo Xusheng Group analysts - going out to 2026, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Xusheng Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603305

Ningbo Xusheng Group

Engages in the research and development, production, and sales of precision aluminum alloy parts in China and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026