- China

- /

- Auto Components

- /

- SHSE:603286

Jiangsu Riying Electronics Co.,Ltd. (SHSE:603286) Stock Rockets 29% As Investors Are Less Pessimistic Than Expected

The Jiangsu Riying Electronics Co.,Ltd. (SHSE:603286) share price has done very well over the last month, posting an excellent gain of 29%. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

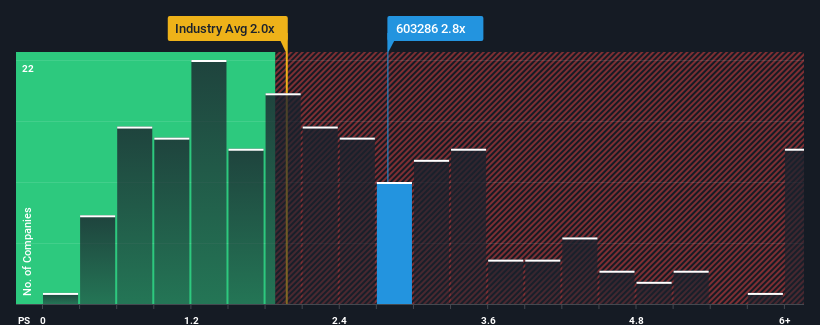

Following the firm bounce in price, when almost half of the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2x, you may consider Jiangsu Riying ElectronicsLtd as a stock probably not worth researching with its 2.8x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Jiangsu Riying ElectronicsLtd

What Does Jiangsu Riying ElectronicsLtd's P/S Mean For Shareholders?

Jiangsu Riying ElectronicsLtd has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Jiangsu Riying ElectronicsLtd's earnings, revenue and cash flow.How Is Jiangsu Riying ElectronicsLtd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Jiangsu Riying ElectronicsLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a decent 12% gain to the company's revenues. The latest three year period has also seen an excellent 50% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Comparing that to the industry, which is predicted to deliver 23% growth in the next 12 months, the company's momentum is weaker, based on recent medium-term annualised revenue results.

With this in mind, we find it worrying that Jiangsu Riying ElectronicsLtd's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Jiangsu Riying ElectronicsLtd's P/S is on the rise since its shares have risen strongly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

The fact that Jiangsu Riying ElectronicsLtd currently trades on a higher P/S relative to the industry is an oddity, since its recent three-year growth is lower than the wider industry forecast. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these the share price as being reasonable.

Plus, you should also learn about these 4 warning signs we've spotted with Jiangsu Riying ElectronicsLtd (including 1 which is concerning).

If you're unsure about the strength of Jiangsu Riying ElectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603286

Jiangsu Riying ElectronicsLtd

Engages in the research and development, production, and sale of auto parts products in China.

Low risk and overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026