- China

- /

- Auto Components

- /

- SHSE:603190

Yantai Yatong Precision Mechanical's (SHSE:603190) Shareholders May Want To Dig Deeper Than Statutory Profit

Yantai Yatong Precision Mechanical Corporation's (SHSE:603190) robust recent earnings didn't do much to move the stock. We believe that shareholders have noticed some concerning factors beyond the statutory profit numbers.

See our latest analysis for Yantai Yatong Precision Mechanical

Examining Cashflow Against Yantai Yatong Precision Mechanical's Earnings

One key financial ratio used to measure how well a company converts its profit to free cash flow (FCF) is the accrual ratio. In plain english, this ratio subtracts FCF from net profit, and divides that number by the company's average operating assets over that period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. While having an accrual ratio above zero is of little concern, we do think it's worth noting when a company has a relatively high accrual ratio. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

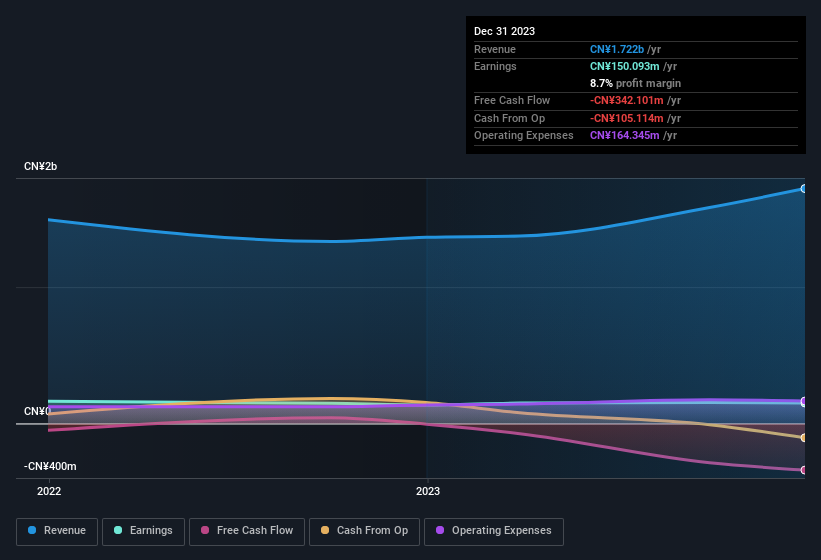

Over the twelve months to December 2023, Yantai Yatong Precision Mechanical recorded an accrual ratio of 0.28. We can therefore deduce that its free cash flow fell well short of covering its statutory profit. Over the last year it actually had negative free cash flow of CN¥342m, in contrast to the aforementioned profit of CN¥150.1m. We also note that Yantai Yatong Precision Mechanical's free cash flow was actually negative last year as well, so we could understand if shareholders were bothered by its outflow of CN¥342m.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Yantai Yatong Precision Mechanical.

Our Take On Yantai Yatong Precision Mechanical's Profit Performance

Yantai Yatong Precision Mechanical didn't convert much of its profit to free cash flow in the last year, which some investors may consider rather suboptimal. Because of this, we think that it may be that Yantai Yatong Precision Mechanical's statutory profits are better than its underlying earnings power. In further bad news, its earnings per share decreased in the last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you want to do dive deeper into Yantai Yatong Precision Mechanical, you'd also look into what risks it is currently facing. Our analysis shows 2 warning signs for Yantai Yatong Precision Mechanical (1 can't be ignored!) and we strongly recommend you look at them before investing.

This note has only looked at a single factor that sheds light on the nature of Yantai Yatong Precision Mechanical's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603190

Yantai Yatong Precision Mechanical

Engages in the research and development, production, sale, and service of auto parts and mining auxiliary transportation equipment in China.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives