- China

- /

- Auto Components

- /

- SHSE:603179

Even With A 27% Surge, Cautious Investors Are Not Rewarding Jiangsu Xinquan Automotive Trim Co.,Ltd.'s (SHSE:603179) Performance Completely

Jiangsu Xinquan Automotive Trim Co.,Ltd. (SHSE:603179) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 14% in the last twelve months.

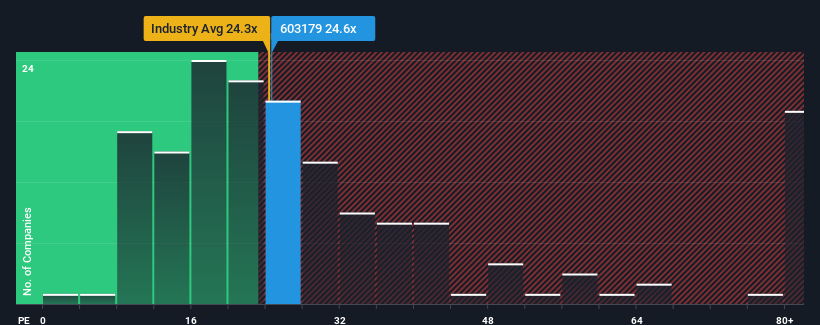

Even after such a large jump in price, given about half the companies in China have price-to-earnings ratios (or "P/E's") above 28x, you may still consider Jiangsu Xinquan Automotive TrimLtd as an attractive investment with its 24.6x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Jiangsu Xinquan Automotive TrimLtd has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Jiangsu Xinquan Automotive TrimLtd

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Jiangsu Xinquan Automotive TrimLtd's is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 23%. The strong recent performance means it was also able to grow EPS by 176% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 28% per annum during the coming three years according to the nine analysts following the company. With the market only predicted to deliver 19% each year, the company is positioned for a stronger earnings result.

In light of this, it's peculiar that Jiangsu Xinquan Automotive TrimLtd's P/E sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

The latest share price surge wasn't enough to lift Jiangsu Xinquan Automotive TrimLtd's P/E close to the market median. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Jiangsu Xinquan Automotive TrimLtd currently trades on a much lower than expected P/E since its forecast growth is higher than the wider market. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Jiangsu Xinquan Automotive TrimLtd that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603179

Jiangsu Xinquan Automotive TrimLtd

Designs, develops, manufactures, sells, and supplies auto parts in China.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives