- China

- /

- Auto Components

- /

- SHSE:603179

Asian Stocks Priced Below Estimated Intrinsic Value

Reviewed by Simply Wall St

As Asian markets navigate a landscape marked by mixed economic signals and ongoing geopolitical tensions, investors are increasingly focused on identifying opportunities within the region's diverse economies. In this context, stocks priced below their estimated intrinsic value present a compelling case for consideration, offering potential upside in an environment where careful analysis and strategic positioning can be key to capitalizing on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.58 | CN¥76.69 | 49.7% |

| Samyang Foods (KOSE:A003230) | ₩1509000.00 | ₩3006664.22 | 49.8% |

| Nan Juen International (TPEX:6584) | NT$233.00 | NT$452.60 | 48.5% |

| Meitu (SEHK:1357) | HK$9.33 | HK$18.35 | 49.2% |

| Kadokawa (TSE:9468) | ¥3623.00 | ¥7219.59 | 49.8% |

| Japan Eyewear Holdings (TSE:5889) | ¥2076.00 | ¥4034.84 | 48.5% |

| Essex Bio-Technology (SEHK:1061) | HK$4.81 | HK$9.49 | 49.3% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95693.43 | 49.6% |

| Cosmax (KOSE:A192820) | ₩212000.00 | ₩422997.50 | 49.9% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥48.60 | CN¥95.72 | 49.2% |

Let's dive into some prime choices out of the screener.

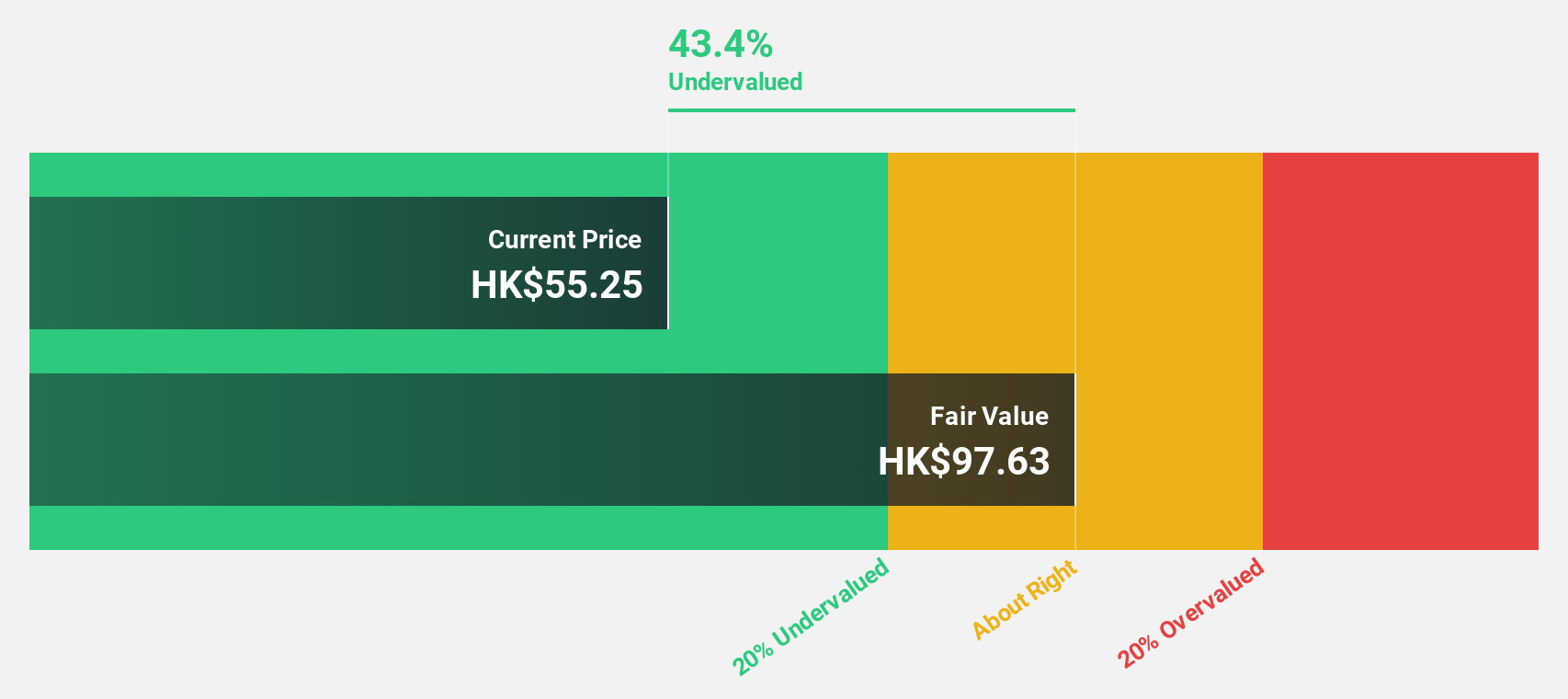

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in the design, manufacture, and marketing of machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of approximately HK$39.71 billion.

Operations: The company's revenue segments are comprised of Semiconductor Solutions, generating HK$7.77 billion, and Surface Mount Technology (SMT) Solutions, contributing HK$5.51 billion.

Estimated Discount To Fair Value: 25.6%

ASMPT is trading at 25.6% below its estimated fair value of HK$128.12, presenting a potential undervaluation based on cash flows. Despite recent downsizing in Shenzhen to optimize operations, the company's revenue and earnings are expected to grow faster than the Hong Kong market, with earnings projected to increase significantly over the next three years. However, profit margins have decreased from last year due to large one-off items impacting results.

- Insights from our recent growth report point to a promising forecast for ASMPT's business outlook.

- Delve into the full analysis health report here for a deeper understanding of ASMPT.

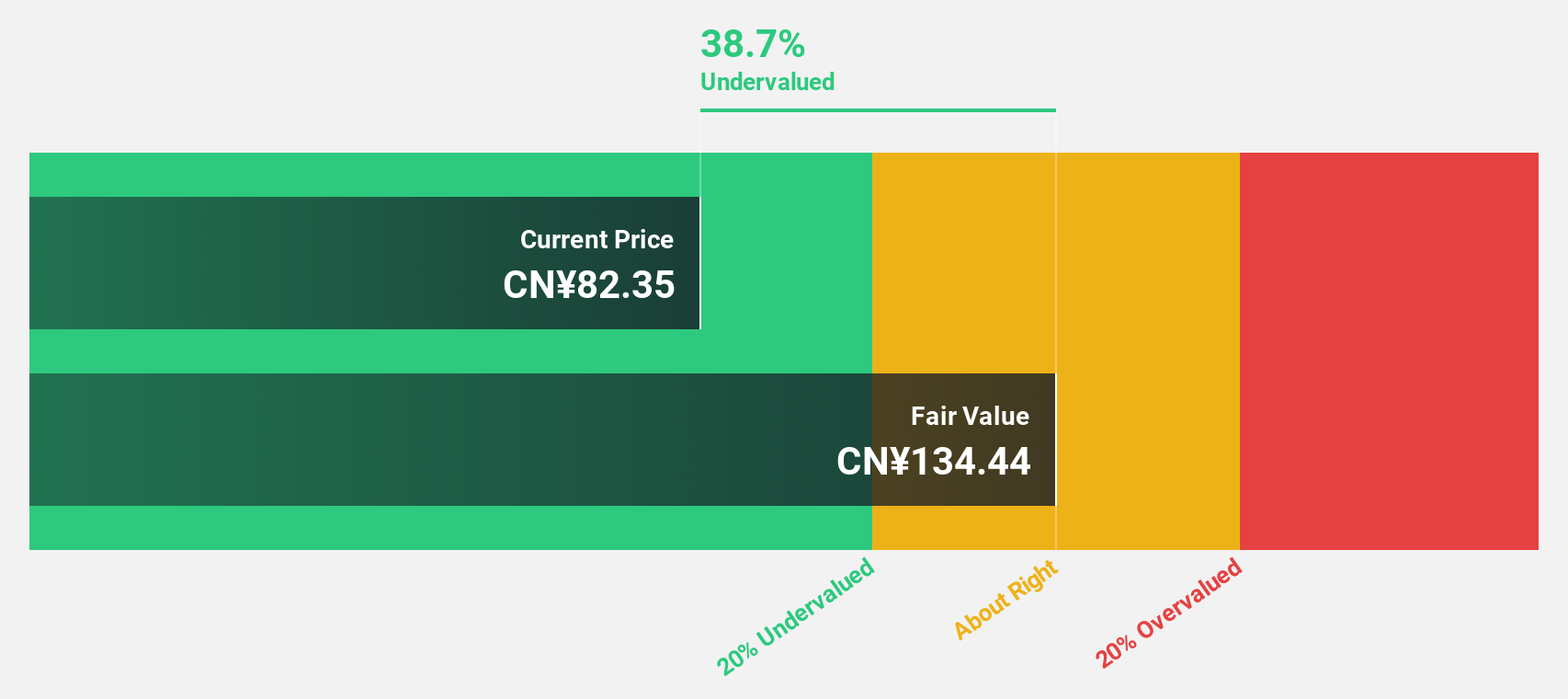

Jiangsu Xinquan Automotive TrimLtd (SHSE:603179)

Overview: Jiangsu Xinquan Automotive Trim Co., Ltd. designs, develops, manufactures, sells, and supplies auto parts in China with a market cap of CN¥41.22 billion.

Operations: The company generates its revenue primarily from the Auto Parts & Accessories segment, which amounts to CN¥14.56 billion.

Estimated Discount To Fair Value: 36.7%

Jiangsu Xinquan Automotive Trim Ltd. is trading 36.7% below its estimated fair value of CNY 133.57, indicating potential undervaluation based on cash flows. Despite high non-cash earnings, the company's revenue and earnings are forecast to grow significantly over the next three years, outpacing the Chinese market's revenue growth rate. However, recent results show only modest net income growth and a highly volatile share price in recent months could pose risks for investors seeking stability.

- Our comprehensive growth report raises the possibility that Jiangsu Xinquan Automotive TrimLtd is poised for substantial financial growth.

- Navigate through the intricacies of Jiangsu Xinquan Automotive TrimLtd with our comprehensive financial health report here.

Range Intelligent Computing Technology Group (SZSE:300442)

Overview: Range Intelligent Computing Technology Group Company Limited offers server hosting services to internet companies and large cloud vendors in China, with a market cap of CN¥88.71 billion.

Operations: The company's revenue from Software and Information Technology Services amounts to CN¥4.70 billion.

Estimated Discount To Fair Value: 44.5%

Range Intelligent Computing Technology Group is trading 44.5% below its estimated fair value of CNY 97.79, highlighting potential undervaluation based on cash flows. Despite a high debt level and a dividend not fully covered by free cash flows, the company shows significant revenue and earnings growth forecasts, surpassing market averages. Recent earnings reveal increased sales but declining net income compared to last year, which may concern investors focused on consistent profitability.

- Upon reviewing our latest growth report, Range Intelligent Computing Technology Group's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Range Intelligent Computing Technology Group stock in this financial health report.

Make It Happen

- Unlock our comprehensive list of 277 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603179

Jiangsu Xinquan Automotive TrimLtd

Designs, develops, manufactures, sells, and supplies auto parts in China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success