- China

- /

- Communications

- /

- SZSE:300353

3 Asian Growth Companies With Insider Ownership Up To 39%

Reviewed by Simply Wall St

As Asian markets continue to navigate a complex landscape of economic challenges and geopolitical tensions, investors are keenly observing growth opportunities within the region. In this context, companies with substantial insider ownership can be particularly appealing, as they often signal strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 56.0% |

| Techwing (KOSDAQ:A089030) | 19.1% | 64.4% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 84.7% |

| Samyang Foods (KOSE:A003230) | 11.7% | 28.3% |

| Novoray (SHSE:688300) | 23.6% | 28.4% |

| M31 Technology (TPEX:6643) | 30.7% | 96.8% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 48.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 91.9% |

Below we spotlight a couple of our favorites from our exclusive screener.

Jiangsu Xinquan Automotive TrimLtd (SHSE:603179)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Xinquan Automotive Trim Co., Ltd. designs, develops, manufactures, sells, and supplies auto parts in China with a market cap of CN¥26.96 billion.

Operations: The company's revenue is primarily derived from its Auto Parts & Accessories segment, which generated CN¥13.74 billion.

Insider Ownership: 39.4%

Jiangsu Xinquan Automotive Trim Ltd. is positioned for growth with earnings expected to rise significantly over the next three years, though slightly below the broader CN market's pace. The company's revenue growth forecast of 20.5% per year outpaces the industry average, reflecting strong potential despite a dividend not well covered by free cash flows. Recent earnings showed sales of CNY 7.46 billion, up from CNY 6.16 billion, indicating solid performance momentum without substantial insider trading activity recently noted.

- Click here and access our complete growth analysis report to understand the dynamics of Jiangsu Xinquan Automotive TrimLtd.

- The valuation report we've compiled suggests that Jiangsu Xinquan Automotive TrimLtd's current price could be quite moderate.

Kyland Technology (SZSE:300353)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kyland Technology Co., Ltd. specializes in industrial Ethernet technology both in China and internationally, with a market cap of CN¥15.75 billion.

Operations: Kyland Technology Co., Ltd. generates revenue from its expertise in industrial Ethernet technology, serving both domestic and international markets.

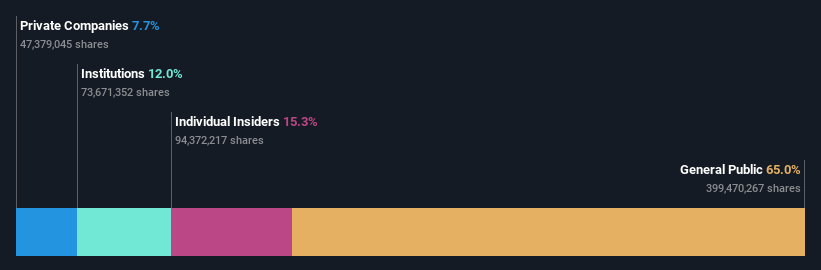

Insider Ownership: 15.3%

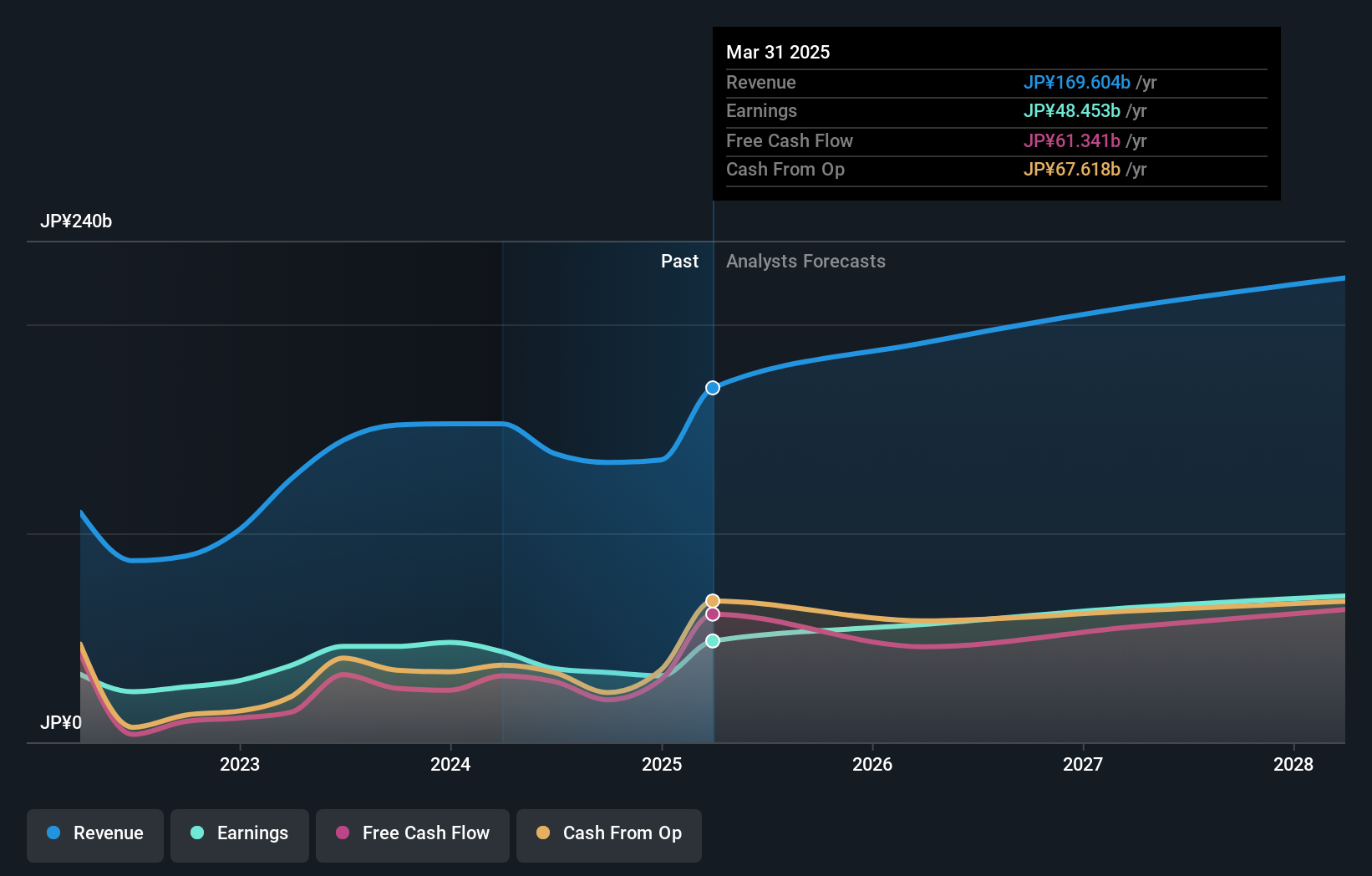

Kyland Technology's earnings are expected to grow significantly at 57.2% annually, outpacing the CN market, though recent results showed a net loss of CNY 88.8 million for the first half of 2025. Revenue is projected to increase by 19.8% per year, surpassing the market average but below high-growth benchmarks. Despite stable insider ownership, profit margins have declined from last year and share price volatility has been observed recently.

- Dive into the specifics of Kyland Technology here with our thorough growth forecast report.

- The analysis detailed in our Kyland Technology valuation report hints at an inflated share price compared to its estimated value.

Capcom (TSE:9697)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Capcom Co., Ltd. is engaged in the planning, development, manufacturing, sale, and distribution of home video games, online games, mobile games, and arcade games both in Japan and internationally with a market cap of approximately ¥1.70 billion.

Operations: The company's revenue segments include Digital Content at ¥133.57 billion, Arcade Operations at ¥23.49 billion, and Amusement Equipment at ¥21.21 billion.

Insider Ownership: 10.5%

Capcom's earnings are projected to grow at 8.6% annually, outpacing the Japanese market, with revenue growth expected at 7% per year. The company maintains a high return on equity forecast of 20.4%. Recent announcements include new titles like Resident Evil Requiem and PRAGMATA, signaling continued investment in both established franchises and new IPs. Despite no recent insider trading activity, Capcom's strategic releases aim to sustain its growth trajectory in the gaming industry.

- Click here to discover the nuances of Capcom with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Capcom is priced higher than what may be justified by its financials.

Next Steps

- Click here to access our complete index of 598 Fast Growing Asian Companies With High Insider Ownership.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kyland Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300353

Kyland Technology

Provides industrial Ethernet technology in China and internationally.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives