- China

- /

- Auto Components

- /

- SHSE:603085

Fewer Investors Than Expected Jumping On Zhejiang Tiancheng Controls Co., Ltd. (SHSE:603085)

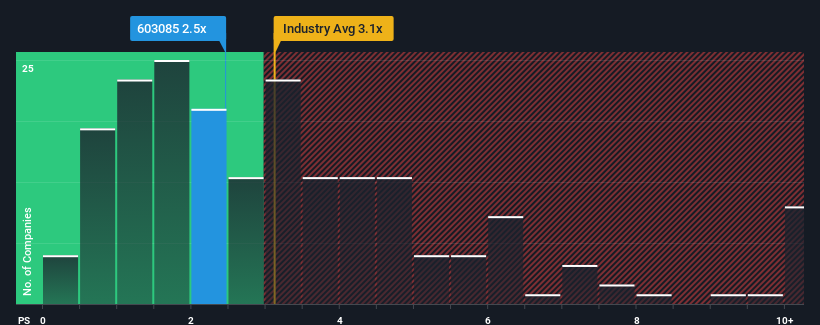

Zhejiang Tiancheng Controls Co., Ltd.'s (SHSE:603085) price-to-sales (or "P/S") ratio of 2.5x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Auto Components industry in China have P/S ratios greater than 3.1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Zhejiang Tiancheng Controls

How Has Zhejiang Tiancheng Controls Performed Recently?

Recent times have been advantageous for Zhejiang Tiancheng Controls as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Zhejiang Tiancheng Controls' future stacks up against the industry? In that case, our free report is a great place to start.How Is Zhejiang Tiancheng Controls' Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Zhejiang Tiancheng Controls' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. Revenue has also lifted 13% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 34% per year during the coming three years according to the only analyst following the company. That's shaping up to be materially higher than the 17% per year growth forecast for the broader industry.

In light of this, it's peculiar that Zhejiang Tiancheng Controls' P/S sits below the majority of other companies. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Zhejiang Tiancheng Controls' P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A look at Zhejiang Tiancheng Controls' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Before you settle on your opinion, we've discovered 2 warning signs for Zhejiang Tiancheng Controls (1 is concerning!) that you should be aware of.

If you're unsure about the strength of Zhejiang Tiancheng Controls' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Zhejiang Tenchen Controls might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603085

Zhejiang Tenchen Controls

Engages in the research, development, production, sale, and service of automobile seats in China, the United Kingdom, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion