- China

- /

- Auto Components

- /

- SHSE:603040

Hangzhou XZB Tech Co., Ltd (SHSE:603040) Surges 29% Yet Its Low P/E Is No Reason For Excitement

Those holding Hangzhou XZB Tech Co., Ltd (SHSE:603040) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 3.5% in the last twelve months.

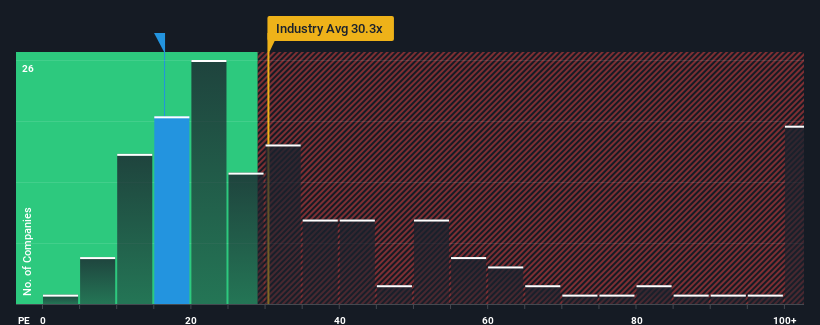

Even after such a large jump in price, Hangzhou XZB Tech's price-to-earnings (or "P/E") ratio of 16.3x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Hangzhou XZB Tech certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Hangzhou XZB Tech

How Is Hangzhou XZB Tech's Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Hangzhou XZB Tech's to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. EPS has also lifted 18% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been respectable for the company.

Turning to the outlook, the next year should generate growth of 28% as estimated by the three analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 41%, which is noticeably more attractive.

In light of this, it's understandable that Hangzhou XZB Tech's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Hangzhou XZB Tech's P/E close to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Hangzhou XZB Tech maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 1 warning sign for Hangzhou XZB Tech that you should be aware of.

If these risks are making you reconsider your opinion on Hangzhou XZB Tech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou XZB Tech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603040

Hangzhou XZB Tech

Engages in the research and development, production, and sale of precision parts in China and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026