- China

- /

- Auto Components

- /

- SHSE:603013

We Think YAPP Automotive Systems (SHSE:603013) Can Manage Its Debt With Ease

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, YAPP Automotive Systems Co., Ltd. (SHSE:603013) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for YAPP Automotive Systems

How Much Debt Does YAPP Automotive Systems Carry?

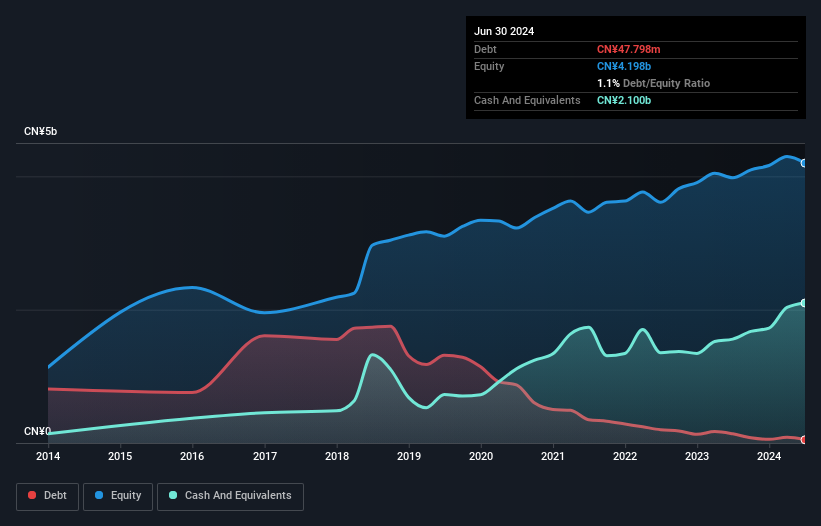

The image below, which you can click on for greater detail, shows that YAPP Automotive Systems had debt of CN¥47.8m at the end of June 2024, a reduction from CN¥138.4m over a year. However, it does have CN¥2.10b in cash offsetting this, leading to net cash of CN¥2.05b.

How Healthy Is YAPP Automotive Systems' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that YAPP Automotive Systems had liabilities of CN¥2.15b due within 12 months and liabilities of CN¥308.7m due beyond that. On the other hand, it had cash of CN¥2.10b and CN¥1.57b worth of receivables due within a year. So it actually has CN¥1.22b more liquid assets than total liabilities.

This surplus suggests that YAPP Automotive Systems is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Simply put, the fact that YAPP Automotive Systems has more cash than debt is arguably a good indication that it can manage its debt safely.

Fortunately, YAPP Automotive Systems grew its EBIT by 3.0% in the last year, making that debt load look even more manageable. There's no doubt that we learn most about debt from the balance sheet. But it is YAPP Automotive Systems's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. YAPP Automotive Systems may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, YAPP Automotive Systems actually produced more free cash flow than EBIT over the last three years. That sort of strong cash conversion gets us as excited as the crowd when the beat drops at a Daft Punk concert.

Summing Up

While we empathize with investors who find debt concerning, you should keep in mind that YAPP Automotive Systems has net cash of CN¥2.05b, as well as more liquid assets than liabilities. And it impressed us with free cash flow of CN¥909m, being 119% of its EBIT. So is YAPP Automotive Systems's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that YAPP Automotive Systems is showing 1 warning sign in our investment analysis , you should know about...

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603013

YAPP Automotive Systems

Engages in the research and development, manufacturing, and sale and service of energy storage system products and thermal management system products.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion