- China

- /

- Auto Components

- /

- SHSE:601163

Triangle TyreLtd's (SHSE:601163) Returns On Capital Are Heading Higher

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. So on that note, Triangle TyreLtd (SHSE:601163) looks quite promising in regards to its trends of return on capital.

What Is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Triangle TyreLtd, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.094 = CN¥1.2b ÷ (CN¥18b - CN¥5.1b) (Based on the trailing twelve months to September 2023).

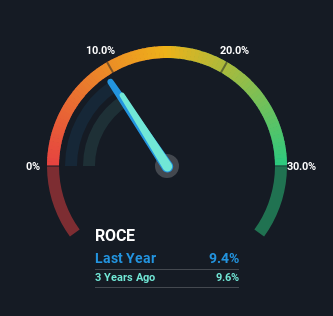

So, Triangle TyreLtd has an ROCE of 9.4%. In absolute terms, that's a low return, but it's much better than the Auto Components industry average of 5.9%.

Check out our latest analysis for Triangle TyreLtd

In the above chart we have measured Triangle TyreLtd's prior ROCE against its prior performance, but the future is arguably more important. If you'd like to see what analysts are forecasting going forward, you should check out our free analyst report for Triangle TyreLtd .

How Are Returns Trending?

While in absolute terms it isn't a high ROCE, it's promising to see that it has been moving in the right direction. The numbers show that in the last five years, the returns generated on capital employed have grown considerably to 9.4%. The amount of capital employed has increased too, by 31%. The increasing returns on a growing amount of capital is common amongst multi-baggers and that's why we're impressed.

In Conclusion...

All in all, it's terrific to see that Triangle TyreLtd is reaping the rewards from prior investments and is growing its capital base. Investors may not be impressed by the favorable underlying trends yet because over the last five years the stock has only returned 27% to shareholders. So exploring more about this stock could uncover a good opportunity, if the valuation and other metrics stack up.

One more thing to note, we've identified 1 warning sign with Triangle TyreLtd and understanding it should be part of your investment process.

While Triangle TyreLtd isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

Valuation is complex, but we're here to simplify it.

Discover if Triangle TyreLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:601163

Triangle TyreLtd

Engages in the research and development, design, manufacture, and marketing of tire products in China.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026