- China

- /

- Auto Components

- /

- SHSE:600933

IKD Co., Ltd.'s (SHSE:600933) Share Price Is Matching Sentiment Around Its Earnings

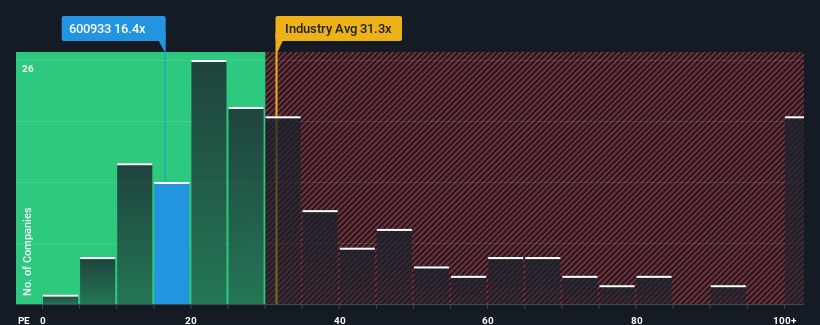

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 35x, you may consider IKD Co., Ltd. (SHSE:600933) as a highly attractive investment with its 16.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times have been pleasing for IKD as its earnings have risen in spite of the market's earnings going into reverse. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for IKD

Is There Any Growth For IKD?

IKD's P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 20%. The latest three year period has also seen an excellent 107% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 14% as estimated by the eight analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 38%, which is noticeably more attractive.

In light of this, it's understandable that IKD's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On IKD's P/E

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of IKD's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for IKD that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600933

IKD

Researches, develops, produces, and sells automotive aluminum alloy precision die castings parts in the United States, Europe, and Asia.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives