- China

- /

- Auto Components

- /

- SHSE:600698

Optimistic Investors Push Hunan Tyen Machinery Co.,Ltd (SHSE:600698) Shares Up 28% But Growth Is Lacking

Those holding Hunan Tyen Machinery Co.,Ltd (SHSE:600698) shares would be relieved that the share price has rebounded 28% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

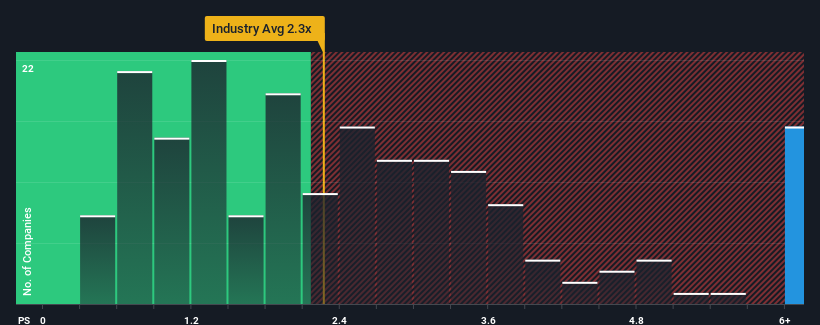

Following the firm bounce in price, given around half the companies in China's Auto Components industry have price-to-sales ratios (or "P/S") below 2.3x, you may consider Hunan Tyen MachineryLtd as a stock to avoid entirely with its 10.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

Check out our latest analysis for Hunan Tyen MachineryLtd

How Has Hunan Tyen MachineryLtd Performed Recently?

Revenue has risen firmly for Hunan Tyen MachineryLtd recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Hunan Tyen MachineryLtd will help you shine a light on its historical performance.Is There Enough Revenue Growth Forecasted For Hunan Tyen MachineryLtd?

The only time you'd be truly comfortable seeing a P/S as steep as Hunan Tyen MachineryLtd's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 25% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 27% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 25% shows it's an unpleasant look.

In light of this, it's alarming that Hunan Tyen MachineryLtd's P/S sits above the majority of other companies. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

The Bottom Line On Hunan Tyen MachineryLtd's P/S

Hunan Tyen MachineryLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Hunan Tyen MachineryLtd revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Hunan Tyen MachineryLtd with six simple checks.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Tyen MachineryLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600698

Hunan Tyen MachineryLtd

Engages in the development, design, production, and sales of engine parts in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives