- China

- /

- Electronic Equipment and Components

- /

- SHSE:603583

Ling Yun Industrial Leads These 3 Undiscovered Gems in Asia With Strong Metrics

Reviewed by Simply Wall St

Amidst escalating trade tensions and fluctuating consumer sentiment, Asian markets have been navigating a complex landscape shaped by global economic shifts. While broader indices like the Russell 2000 have shown resilience, small-cap stocks in Asia present intriguing opportunities for investors seeking robust metrics amidst uncertainty. In this environment, identifying stocks with strong fundamentals and growth potential becomes crucial, as these factors can provide stability and promise even when market conditions are volatile.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Saha-Union | 0.99% | 0.02% | 12.48% | ★★★★★★ |

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Zhejiang Hengwei Battery | NA | 9.07% | 10.81% | ★★★★★★ |

| Champion Building MaterialsLtd | 26.79% | -6.38% | 19.21% | ★★★★★★ |

| Kangping Technology (Suzhou) | 28.70% | 2.21% | 3.71% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.86% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| Wison Engineering Services | 41.36% | -3.70% | -15.32% | ★★★★★☆ |

| ASTERASYSLtd | 5.09% | 20.42% | 29.09% | ★★★★★☆ |

| Yuan Cheng CableLtd | 106.99% | 8.34% | 40.95% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Ling Yun Industrial (SHSE:600480)

Simply Wall St Value Rating: ★★★★★★

Overview: Ling Yun Industrial Corporation Limited focuses on the production and sale of metal, automotive plastic, and plastic piping systems in China, with a market cap of CN¥14.57 billion.

Operations: Ling Yun Industrial generates revenue primarily from the sale of metal, automotive plastic, and plastic piping systems. The company's net profit margin has shown notable trends over recent periods.

In the bustling world of Asian industrials, Ling Yun Industrial stands out with a notable earnings growth of 21.9% over the past year, surpassing the Auto Components industry average of 10.1%. This growth is underpinned by a significant reduction in its debt to equity ratio from 57.4% to 22.2% over five years, reflecting prudent financial management. Trading at nearly 30% below its estimated fair value, Ling Yun seems attractively priced for potential investors. Despite recent share price volatility, the company remains profitable with high-quality earnings and more cash than total debt, suggesting robust financial health and resilience in challenging markets.

- Click to explore a detailed breakdown of our findings in Ling Yun Industrial's health report.

Explore historical data to track Ling Yun Industrial's performance over time in our Past section.

Zhejiang Jiecang Linear Motion TechnologyLtd (SHSE:603583)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Jiecang Linear Motion Technology Co., Ltd. specializes in the development and manufacturing of linear motion systems, with a market capitalization of CN¥14.04 billion.

Operations: Jiecang generates revenue primarily from the Linear Drive Industry, totaling CN¥3.50 billion. The company's net profit margin is 12.5%, reflecting its efficiency in converting revenue into profit.

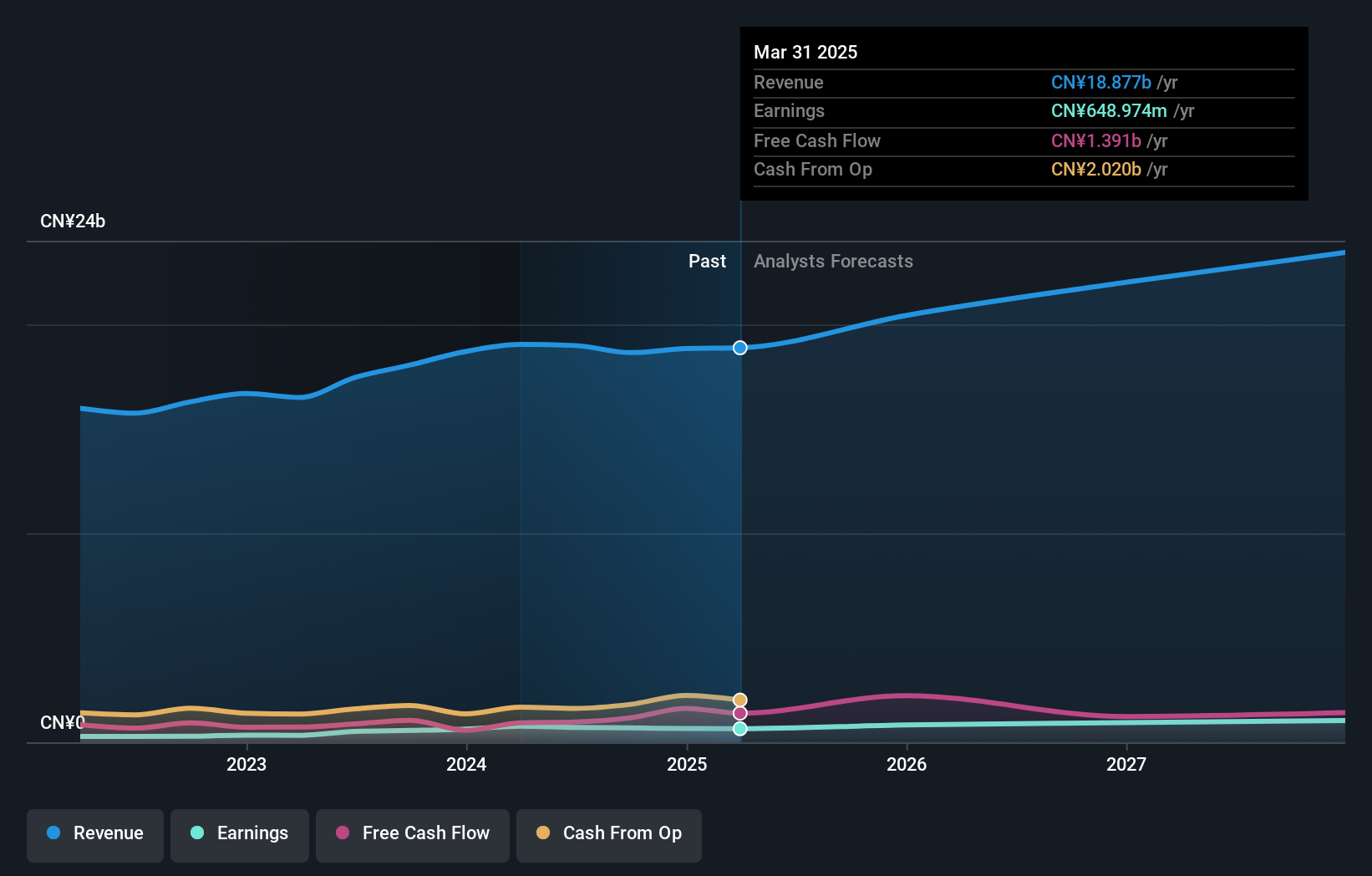

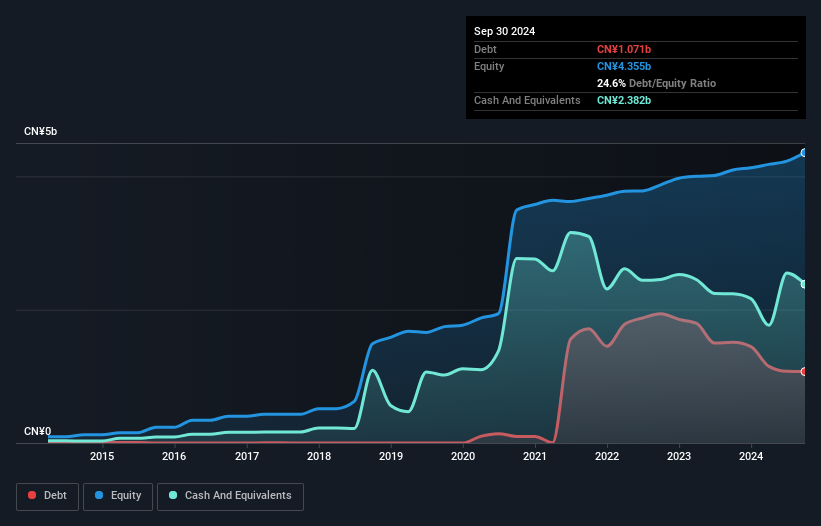

Zhejiang Jiecang Linear Motion Technology, a nimble player in the electronic industry, has shown impressive earnings growth of 35% over the past year, outpacing the industry's 5%. With its debt to equity ratio climbing from 0% to 24.6% in five years, it still maintains more cash than total debt. Trading at a significant discount of 65% below estimated fair value, Jiecang's high-quality earnings and positive free cash flow signal robust financial health. Despite recent share price volatility, its forecasted annual earnings growth of over 25% hints at promising future potential for investors.

- Dive into the specifics of Zhejiang Jiecang Linear Motion TechnologyLtd here with our thorough health report.

Learn about Zhejiang Jiecang Linear Motion TechnologyLtd's historical performance.

MPI (TPEX:6223)

Simply Wall St Value Rating: ★★★★★★

Overview: MPI Corporation, along with its subsidiaries, is engaged in the manufacturing, processing, maintenance, import/export, and trading of semiconductor production process and testing equipment across Taiwan, China, Singapore, Korea, the United States, and other international markets with a market cap of NT$60.87 billion.

Operations: MPI Corporation generates revenue primarily from its semiconductor equipment and services segment, amounting to NT$10.17 billion. The company's financial performance is characterized by a notable net profit margin trend, which provides insight into its profitability relative to its revenue streams.

MPI Corporation, a nimble player in the semiconductor space, has seen its earnings surge by 74.6% over the past year, outpacing industry growth of 24.9%. The company reported net income of TWD 2.3 billion for 2024, up from TWD 1.31 billion the previous year, showcasing robust financial health with basic earnings per share rising to TWD 24.42 from TWD 13.92. Despite recent share price volatility, MPI's debt-to-equity ratio improved significantly over five years from 35% to just over 23%, and it remains free cash flow positive at TWD1.52 billion as of June last year.

- Navigate through the intricacies of MPI with our comprehensive health report here.

Gain insights into MPI's past trends and performance with our Past report.

Key Takeaways

- Embark on your investment journey to our 2625 Asian Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Jiecang Linear Motion TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603583

Zhejiang Jiecang Linear Motion TechnologyLtd

Zhejiang Jiecang Linear Motion Technology Co.,Ltd.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives