David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Naturgy Chile Gas Natural S.A. (SNSE:NTGCLGAS) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. The first step when considering a company's debt levels is to consider its cash and debt together.

View our latest analysis for Naturgy Chile Gas Natural

What Is Naturgy Chile Gas Natural's Net Debt?

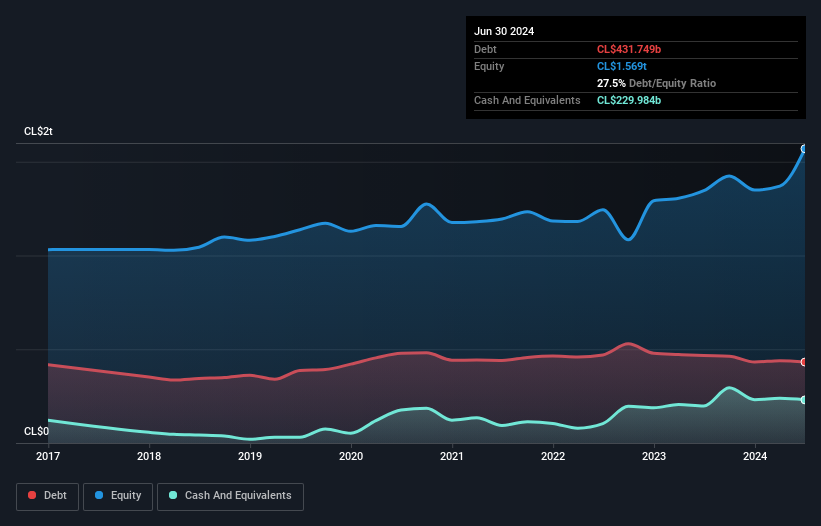

The image below, which you can click on for greater detail, shows that Naturgy Chile Gas Natural had debt of CL$431.7b at the end of June 2024, a reduction from CL$466.2b over a year. On the flip side, it has CL$230.0b in cash leading to net debt of about CL$201.8b.

A Look At Naturgy Chile Gas Natural's Liabilities

The latest balance sheet data shows that Naturgy Chile Gas Natural had liabilities of CL$194.0b due within a year, and liabilities of CL$914.4b falling due after that. Offsetting these obligations, it had cash of CL$230.0b as well as receivables valued at CL$194.2b due within 12 months. So it has liabilities totalling CL$684.2b more than its cash and near-term receivables, combined.

This deficit is considerable relative to its market capitalization of CL$785.7b, so it does suggest shareholders should keep an eye on Naturgy Chile Gas Natural's use of debt. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Naturgy Chile Gas Natural has a low net debt to EBITDA ratio of only 0.47. And its EBIT easily covers its interest expense, being 317 times the size. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that Naturgy Chile Gas Natural grew its EBIT by 243% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Naturgy Chile Gas Natural's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the most recent three years, Naturgy Chile Gas Natural recorded free cash flow worth 79% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Naturgy Chile Gas Natural's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its level of total liabilities does undermine this impression a bit. We would also note that Gas Utilities industry companies like Naturgy Chile Gas Natural commonly do use debt without problems. Zooming out, Naturgy Chile Gas Natural seems to use debt quite reasonably; and that gets the nod from us. After all, sensible leverage can boost returns on equity. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 3 warning signs for Naturgy Chile Gas Natural that you should be aware of before investing here.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Naturgy Chile Gas Natural might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:NTGCLGAS

Naturgy Chile Gas Natural

Engages in the distribution, supply, and transportation of natural gas in Chile and Argentina.

Excellent balance sheet and good value.

Market Insights

Community Narratives