Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Empresas Gasco S.A. (SNSE:GASCO) does carry debt. But the real question is whether this debt is making the company risky.

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Empresas Gasco

What Is Empresas Gasco's Debt?

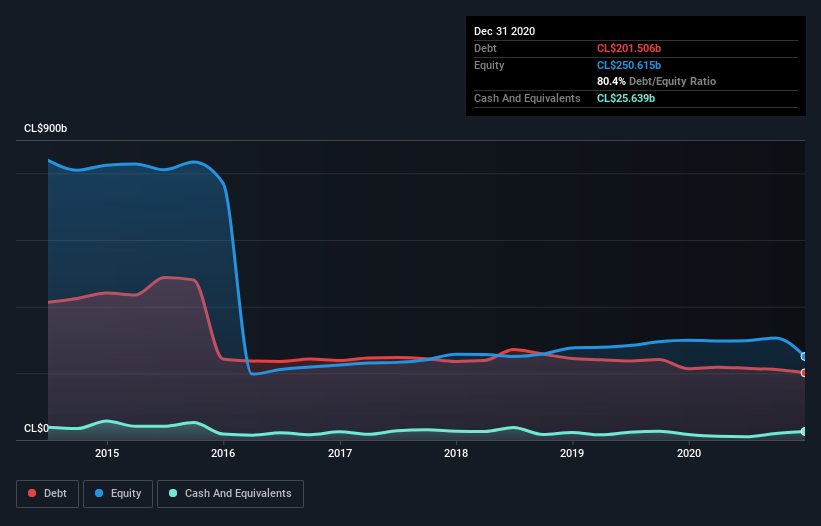

The image below, which you can click on for greater detail, shows that Empresas Gasco had debt of CL$201.5b at the end of December 2020, a reduction from CL$213.7b over a year. However, it does have CL$25.6b in cash offsetting this, leading to net debt of about CL$175.9b.

How Strong Is Empresas Gasco's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Empresas Gasco had liabilities of CL$170.1b due within 12 months and liabilities of CL$288.5b due beyond that. Offsetting these obligations, it had cash of CL$25.6b as well as receivables valued at CL$40.6b due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CL$392.3b.

When you consider that this deficiency exceeds the company's CL$331.0b market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Empresas Gasco has a debt to EBITDA ratio of 3.0 and its EBIT covered its interest expense 3.3 times. This suggests that while the debt levels are significant, we'd stop short of calling them problematic. Worse, Empresas Gasco's EBIT was down 25% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Empresas Gasco's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Empresas Gasco produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

We'd go so far as to say Empresas Gasco's EBIT growth rate was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. It's also worth noting that Empresas Gasco is in the Gas Utilities industry, which is often considered to be quite defensive. Overall, we think it's fair to say that Empresas Gasco has enough debt that there are some real risks around the balance sheet. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Empresas Gasco is showing 2 warning signs in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Empresas Gasco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SNSE:GASCO

Empresas Gasco

Provides energy solutions based primarily based on gas in Chile and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives