- Chile

- /

- Electric Utilities

- /

- SNSE:ENELCHILE

The three-year decline in earnings for Enel Chile SNSE:ENELCHILE) isn't encouraging, but shareholders are still up 128% over that period

You can receive the average market return by buying a low-cost index fund. But you can make better returns by buying undervalued shares. For example, the Enel Chile S.A. (SNSE:ENELCHILE) share price is up 75% in the last three years, slightly above the market return. It's nice to see the stock price has more recent momentum, too, with a rise of 36% in the last year.

Since the long term performance has been good but there's been a recent pullback of 4.1%, let's check if the fundamentals match the share price.

While Enel Chile made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

In the last 3 years Enel Chile saw its revenue shrink by 9.4% per year. Despite the lack of revenue growth, the stock has returned 21%, compound, over three years. If the company is cutting costs profitability could be on the horizon, but the revenue decline is a prima facie concern.

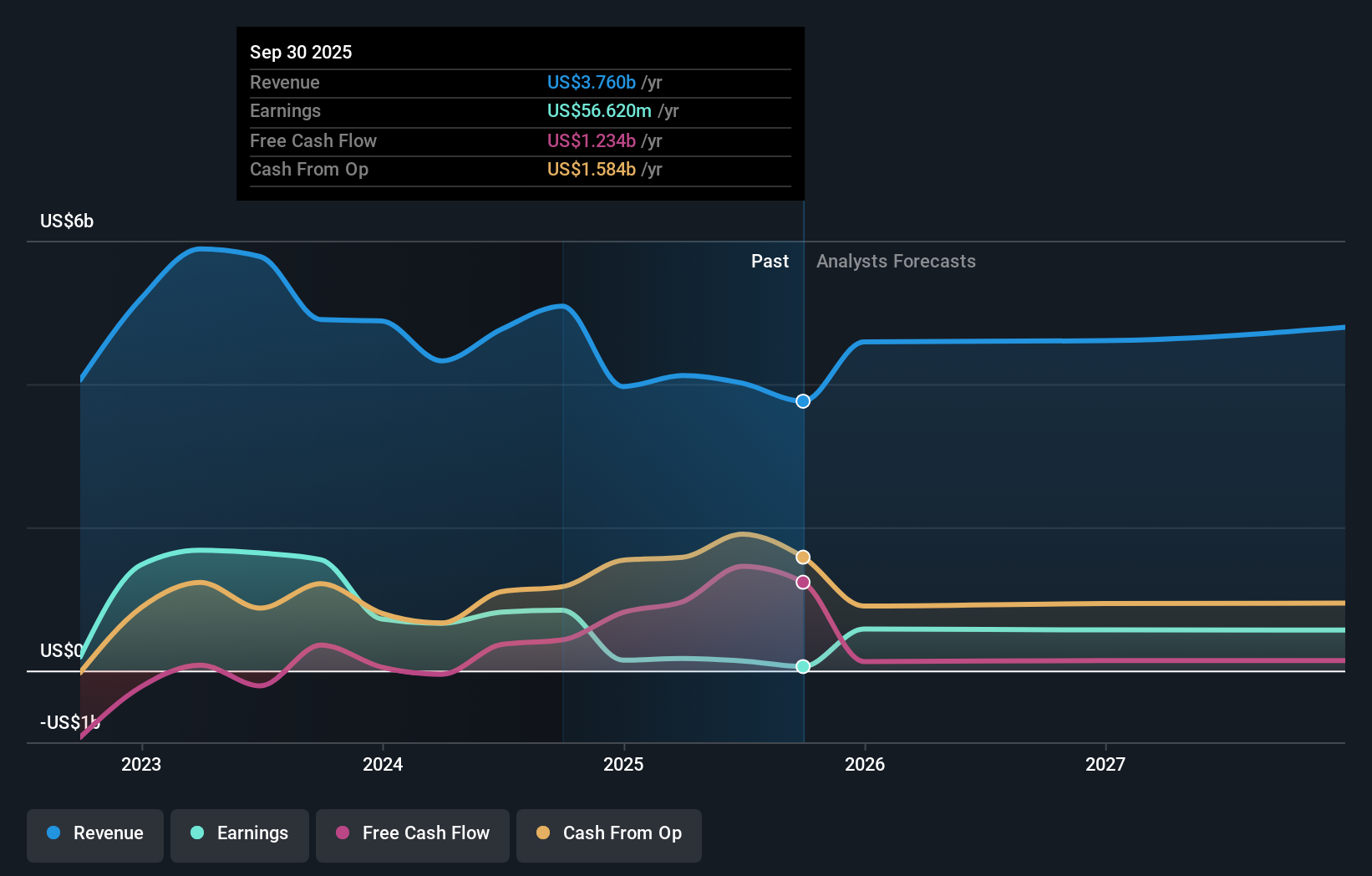

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

This free interactive report on Enel Chile's balance sheet strength is a great place to start, if you want to investigate the stock further.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Enel Chile, it has a TSR of 128% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Enel Chile provided a TSR of 45% over the year (including dividends). That's fairly close to the broader market return. That gain looks pretty satisfying, and it is even better than the five-year TSR of 13% per year. It is possible that management foresight will bring growth well into the future, even if the share price slows down. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Enel Chile is showing 2 warning signs in our investment analysis , and 1 of those is significant...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chilean exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Enel Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENELCHILE

Enel Chile

An electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success