- Chile

- /

- Electric Utilities

- /

- SNSE:ENELCHILE

Little Excitement Around Enel Chile S.A.'s (SNSE:ENELCHILE) Earnings

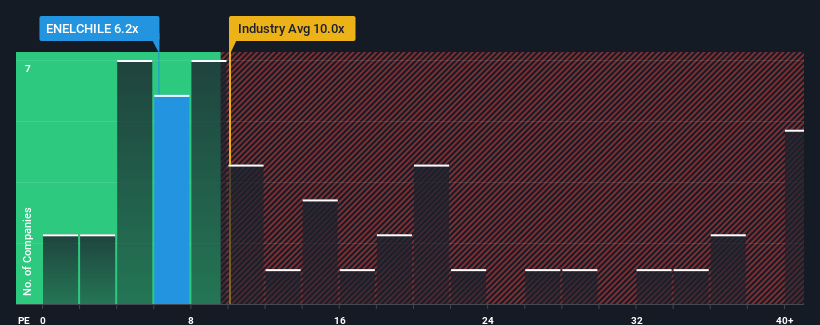

With a price-to-earnings (or "P/E") ratio of 6.2x Enel Chile S.A. (SNSE:ENELCHILE) may be sending bullish signals at the moment, given that almost half of all companies in Chile have P/E ratios greater than 9x and even P/E's higher than 14x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings that are retreating more than the market's of late, Enel Chile has been very sluggish. It seems that many are expecting the dismal earnings performance to persist, which has repressed the P/E. You'd much rather the company wasn't bleeding earnings if you still believe in the business. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

View our latest analysis for Enel Chile

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Enel Chile's to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 49%. At least EPS has managed not to go completely backwards from three years ago in aggregate, thanks to the earlier period of growth. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 1.1% per annum over the next three years. Meanwhile, the broader market is forecast to expand by 12% per year, which paints a poor picture.

With this information, we are not surprised that Enel Chile is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Enel Chile's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 5 warning signs for Enel Chile (2 are significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Enel Chile might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:ENELCHILE

Enel Chile

An electricity utility company, engages in the generation, transmission, and distribution of electricity in Chile.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives