- Chile

- /

- Infrastructure

- /

- SNSE:SMSAAM

It's A Story Of Risk Vs Reward With Sociedad Matriz SAAM S.A. (SNSE:SMSAAM)

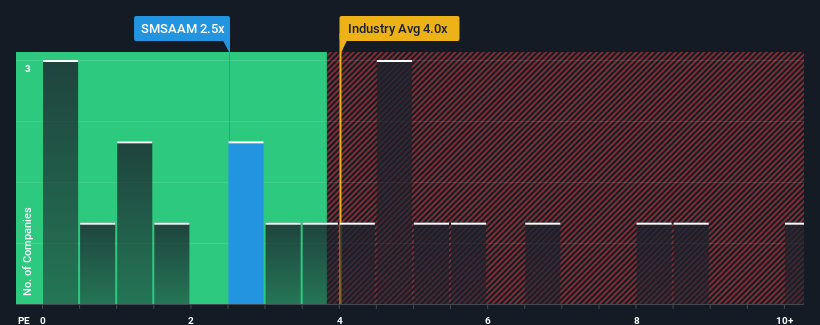

You may think that with a price-to-sales (or "P/S") ratio of 2.5x Sociedad Matriz SAAM S.A. (SNSE:SMSAAM) is a stock worth checking out, seeing as almost half of all the Infrastructure companies in Chile have P/S ratios greater than 4x and even P/S higher than 6x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Sociedad Matriz SAAM

What Does Sociedad Matriz SAAM's Recent Performance Look Like?

Recent times have been advantageous for Sociedad Matriz SAAM as its revenues have been rising faster than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Sociedad Matriz SAAM's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Sociedad Matriz SAAM would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 17% gain to the company's top line. However, this wasn't enough as the latest three year period has seen the company endure a nasty 8.8% drop in revenue in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 6.2% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 1.7%, which is noticeably less attractive.

In light of this, it's peculiar that Sociedad Matriz SAAM's P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Sociedad Matriz SAAM's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Sociedad Matriz SAAM's analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Sociedad Matriz SAAM (2 shouldn't be ignored) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SNSE:SMSAAM

Sociedad Matriz SAAM

Through its subsidiaries, provides tugboat services, air cargo logistics, and real estate rentals in South America, Central America, and North America.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success